SUMMARY

FFP, Peugeot Group’s holding company and EDBI also participated in this round

Livspace is looking to expand into dozens Indian cities and internationally

The company is planning to be operationally profitable in India by 2021

Bengaluru-based home design and decor service provider Livspace has raised $90 Mn in Series D funding round led by Switzerland-based investment firm Kharis Capital and consumer space-focused Venturi Partners. FFP, Peugeot Group’s holding company and EDBI also participated in this round, along with existing investors Ingka Investments, TPG Growth, Goldman Sachs, UC-RNT and Bessemer Ventures.

Livspace will use this funding to expand its supply chain and presence across new markets, create fresh offerings and private labels in the Asia Pacific (APAC) regions. In a conversation with Inc42, Livspace’s cofounder and COO Ramakant Sharma said that the company started expanding its services beyond metropolitan cities in 2019. The company is now aiming to expand into 30 smart cities, starting its services from Lucknow, Kolkata and Ahmedabad.

The company is also evaluating other countries such as Australia, Malaysia and Indonesia in the APAC region and the Middle East as its next markets, where the interior and renovation industry is equally fragmented and presents a ripe opportunity for Livspace’s platform-based market entry.

Founded in 2014 by Anuj Srivastava and Ramakant Sharma, Livspace is a curated marketplace for homeowners and home designers that provides an end-to-end home design experience. The company offers an online marketplace for home interior solutions and also offers software tools for designers to streamline their workflow. It currently has its presence across nine metro cities and designed over 20K homes. It has marked its entry in Singapore last year.

Livspace Plans To Be Operationally Profitable In India

Prior to this, the company had raised more than $70 Mn in Series from TPG Growth, Goldman Sachs, Jungle Ventures, Bessemer Venture Partners, Helion Ventures, IKEA group franchisee, and Ingka Group. In June 2020, the company had further raised $2.4 Mn from Fevicol maker Pidilite to meet its “growth objectives and to strengthen its financial position.” So far, the company has raised $200 Mn.

Since its last funding round by Ingka Capital, TPG Growth and Goldman Sachs, Livspace claims to have quadrupled its revenue and doubled its margin. The company also claims to have hit a gross revenue run rate of over $200 million in February 2020 and is projecting to grow into a $500 Mn business in the next 24-30 months. “Its India operations are expected to be profitable in 2021,” the company highlighted in its press note.

Elaborating on its plans to profitability, Sharma highlighted that the home interior and renovation business is anyway a profitable business as there is almost an 80% profit margin on each sale. But prior to this, the company was infusing that profits back into the business. He emphaised that Livespace won’t have to change much in its business or revenue structure to attain profitability.

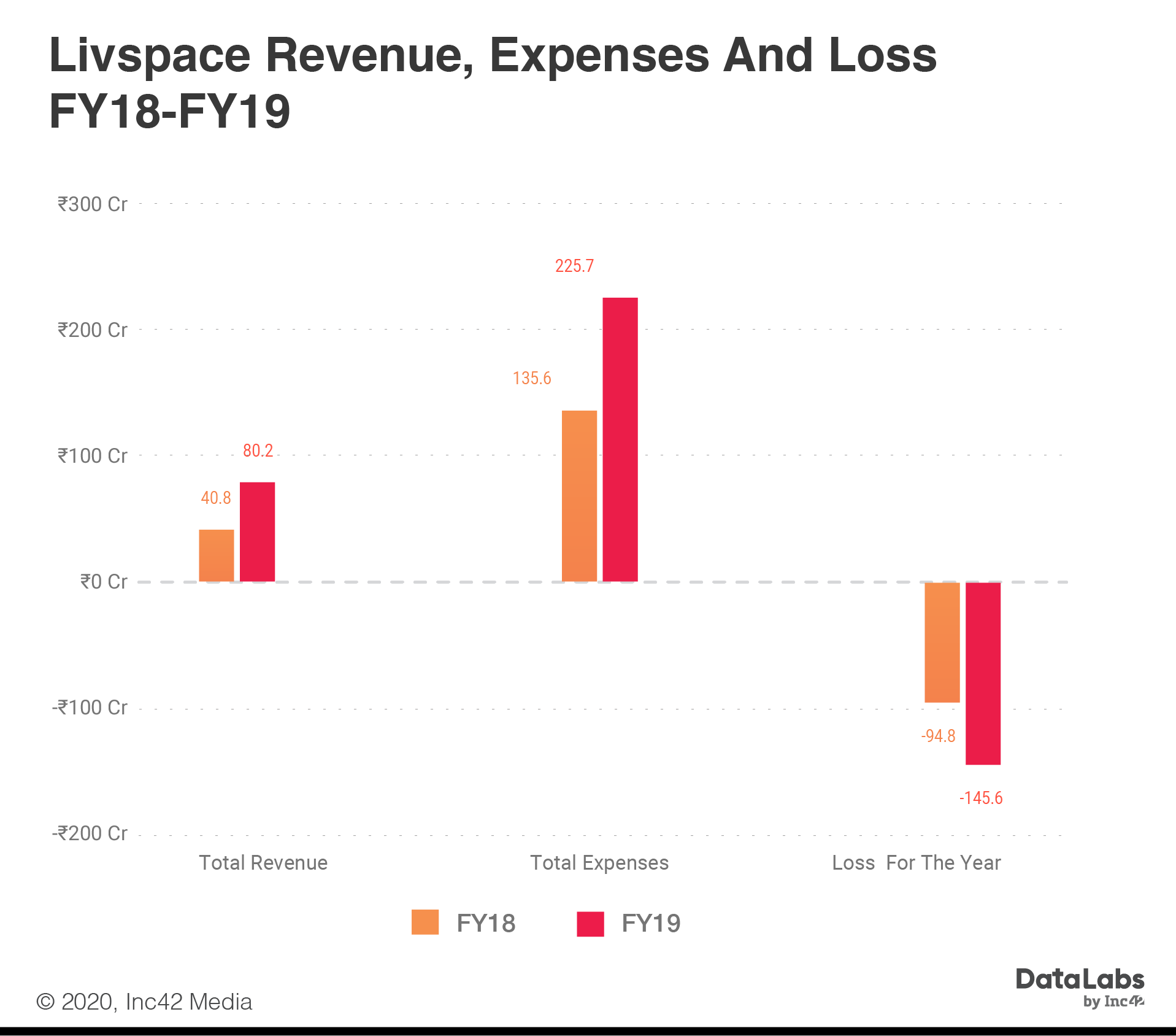

In the financial year 2019, the company’s revenue had grown by 96.3% to INR 80.17 Cr and expenses jumped by 66% to INR 225.73 Cr, leading up to a loss of INR 145.5 Cr. The company had burned INR 49.58 Cr on marketing expenses, a 1.35X Y-o-Y increase. Notably, the marketing expenses were 61.8% of the total revenue of the company.

Livspace Off Ventilator Support, Path To Covid Recovery

Sharma also discussed the impact that Covid-19 had on its business. Like other startups in the furniture ecommerce segment, Livspace too faced an impact. The

on-site renovation for all homes had to be paused but all design consultations and new project bookings moved online. Nearly, 70% of the bookings during the period were done remotely. Since the unlock phase has started, over 1500 homes have been completed .

Besides this, the company has also noticed a change in the customer’s behavior. The customer now focuses on the standard of living enhancing products that allow the home to be converted into a place to live, work, unwind, work out, educate the kids, meet up with friends, and everything in between. The company had also laid off 15% of its total workforce i.e over 450 employees out of a total of 2,800 due to capital crunch.

He emphasised that the company has already regained 70-75% of its business ever since the Covid-19 resultant lockdown was lifted in May, and will be making a full recovery by September. He also noted that almost all the sales on the platform are virtual.

Keeping that in mind, the company has laid a special focus on safety, quick and 100% refund policy, and other standard operating procedures that reduce the spread of virus and make customers feel safe about their platform.

Livspace’s top competitors include At Home Group, Pepperfry, Stokers, HomeLane and American Furniture Warehouse. HomeLane too is looking to expand its services to new markets and had raised over $8.1 Mn ( INR 60 Cr) recently. Stride Ventures, Accel Partners, Sequoia Capital, Evolvence India and JSW Ventures participated in this round.