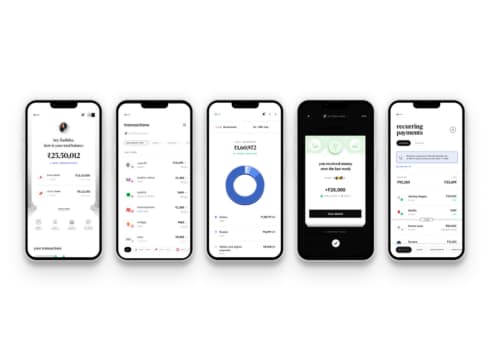

CRED has rolled out a new offering for its users that enables them to have a unified view of all their bank account balances and a tool to analyse spends called CRED Money

For recurring payments such as SIPs, EMIs, rent, staff salaries, or insurance premiums, CRED Money would send users reminders and updates

This new development comes at a time after CRED secured an in-principle approval from the Reserve Bank of India (RBI) for its payment aggregator licence application in April

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Fintech unicorn CRED has rolled out a new offering for its users that enables them to have a unified view of all their bank account balances, reminders for recurring payments beyond credit card transactions and a tool to analyse spends.

“For the affluent, managing finances often means more complexities leading to anxiety. We have built a product that improves every affluent person’s relationship with money and makes them less anxious about it through a trusted, insightful experience. CRED Money is for those who wish to have greater control over money without the pain of doing it,” said CRED’s founder and chief executive Kunal Shah.

For recurring payments such as SIPs, EMIs, rent, staff salaries, or insurance premiums, CRED Money would send users reminders and updates.

The product enables users to analyse spending patterns across multiple bank accounts and search spends by merchant category.

CRED Money is built on the account aggregator (AA) framework that enables users to share their data with banks or financial institutions between authorised organisations.

This new development comes at a time after CRED secured an in-principle approval from the Reserve Bank of India (RBI) for its payment aggregator licence application in April.

Meanwhile, the unicorn also acquired investech platform Kuvera to enter the fast-growing wealth management space and take on the likes of Zerodha, Groww, and PhonePe.

The Bengaluru-based fintech company has been on the track for new launches, and previously, it rolled out its Unified Payments Interface (UPI)-based peer-to-peer (P2P) payments system, a year ago.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.