Snapdeal cofounders Bahl and Bansal will anchor the fund as its largest investors and continue supporting entrepreneurs in follow-on rounds as they build their ventures

Titan Capital Winners Fund is backed by LPs including prominent family offices, CEOs and founders of leading companies, and key figures from the VC ecosystem

Titan Capital’s seed investment portfolio includes the likes of Urban Company, OfBusiness, Razorpay, Ola Cabs, Mamaearth, and recently listed startup Unicommerce

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

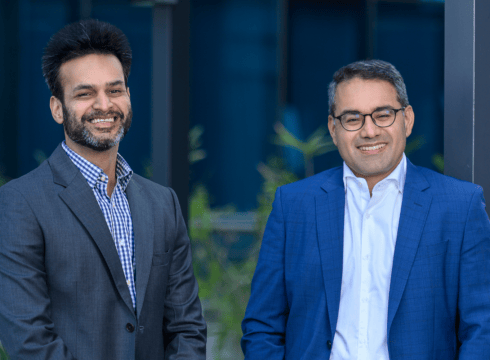

Titan Capital Winners Fund, backed by Kunal Bahl and Rohit Bansal, has raised a target corpus of INR 200 Cr to exclusively invest in follow-on rounds of breakout startups from its seed portfolio.

Snapdeal cofounders Bahl and Bansal will anchor the fund as its largest investors and continue supporting entrepreneurs as they build their ventures.

It is worth noting that Titan Capital’s seed investment portfolio includes the likes of Urban Company, OfBusiness, Razorpay, Ola Cabs, Mamaearth, and recently listed startup Unicommerce.

“With the Titan Capital Winners Fund, we can more significantly support the founders of our portfolio companies in subsequent rounds of capital raises, further strengthening Titan Capital’s partnership with them,” Bahl and Bansal said in a statement on Wednesday (August 21).

The Category-II alternative investment fund (AIF) is focussed on backing tech-enabled businesses led by “stellar founders and management teams building category creators”. It said that despite a challenging market for the VC ecosystem, it could complete the fundraise in less than six months and the fund is backed by LPs including prominent family offices, CEOs and founders of leading companies, and key figures from the VC ecosystem.

In addition to the Snapdeal cofounders, Titan Capital Winners Fund’s team includes CFO Chetan Rana and its VP Shiv Kapoor.

Titan Capital’s portfolio includes over 200 companies worldwide across consumer internet, D2C, fintech, SaaS, and Web3 sectors. It recently led an INR 8.93 Cr seed funding in Karban, a manufacturer of energy-efficient electronic appliances.

While the traces of funding winter continued to remain in the Indian startup ecosystem till the first half of 2024, a turnaround is expected in the second half by over 90% of the startup investors surveyed by Inc42 recently.

Recently, VC firm Ankur Capital also floated its fund III, which aims to raise a target corpus of INR 1,200 Cr (about $150 Mn).

Earlier this month, consumer-focused VC firm Sauce.vc reportedly marked the final close of its third fund at INR 365 Cr (nearly $43.6 Mn).

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.