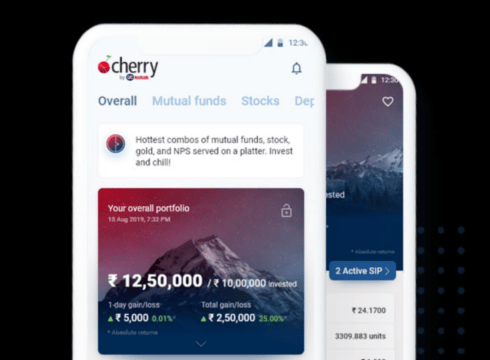

The new investment tech platform will offer holistic investing solutions to users through an app

Kotak Cherry will offer a range of solutions for investing in stocks, bonds, mutual funds, fixed deposits, NPS and ETFs

Kotak Cherry aims to onboard 10 Lakh customers within a year

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Kotak Investment Advisors Ltd, a subsidiary of Kotak Mahindra Bank, has launched a curated tech-led investment management platform, Kotak Cherry. The platform will offer complete investing solutions to users through an app.

Kotak Cherry currently offers a range of solutions for investing in stocks, bonds, mutual funds, fixed deposits, National Pension Scheme (NPS) and Exchange Traded Funds.

The platform also plans to add other financial solutions like stock baskets, Robo advisory, life, medical, and general insurance, and enable international investing.

According to Srikanth Subramanian, CEO-Designate of Kotak Cherry, the platform wants to declutter investment options for its customers by offering curated solutions

“Led by a solid team of credible and experienced professionals, we believe deep domain experience will matter when it comes to investing. It is a one stop platform that will help people invest like experts,” he said.

In addition, Kotak Cherry will soon have a complete open architecture, where app users will be able to maintain their banking and broking relationships with providers of their choice, he added.

Kotak Cherry aims to onboard 10 Lakh customers in a year. While it can leverage the reach of Kotak Investment Advisors to acquire customers, it will face stiff competition from investment tech startups like Zerodha, Groww, and Upstox.

Thanks to robust digital infrastructure and the increasing awareness and interest among young Indians to earn through other income channels, the overall investment tech segment in India is growing at a compound annual growth rate of 44%, according to an Inc42 report.

The investment tech market is currently valued at $9.2 Bn and is expected to reach $27.5 Bn by 2025, as per the report.

The investment tech startups have raised $1.2 Bn in funding till date. Of this, $1 Bn has been raised since January 2020.

Join us and navigate the downturn with India’s top 1% fintech and BFSI leaders at Fintech Summit 2022 by Inc42.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.