The new product will be launched in partnership with NBFC-P2P LenDenClub and has initially been rolled out for select users

Jar will help source customers while the NBFC-P2P will connect the lenders to evaluated borrowers

Jar’s loss jumped 77% YoY to INR 122.8 Cr in FY23 even as operating revenue jumped to INR 8.7 Cr from INR 73.8 Lakh in FY22

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Investment tech platform Jar is reportedly set to foray into the peer-to-peer (P2P) lending space with its new offering ‘Jar Plus’.

As per Moneycontrol, the new product will be launched in partnership with Mumbai-based non-banking financial company (NBFC) – P2P LenDenClub. It has already been rolled out for select users.

For the uninitiated, P2P lending involves connecting lenders with potential borrowers. In this case, Jar will help source customers while LenDenClub will connect individual borrowers with lenders.

.

“Jar Plus is in the testing phase and is being rolled out to a handful of customers within the Jar platform. The firm is mostly receiving feedback and implementing it right now. Rollout will take some more time,” the report cited a source as saying.

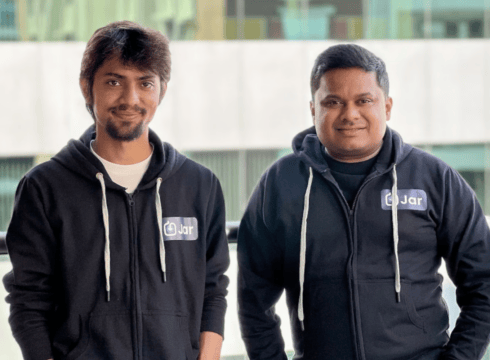

Founded in 2021 by Nischay AG and Misbah Ashraf, Jar operates a platform which allows users to make investments as low as INR 1. It last secured $22.6 Mn in its Series B round at a valuation of about $300 Mn from Tiger Global, Eximius Ventures, among others, in 2022.

The new offering is expected to help the startup spruce up its top line and cut down losses. The startup’s loss jumped 77% year-on-year (YoY) to INR 122.8 Cr in FY23 even as operating revenue jumped to INR 8.7 Cr from INR 73.8 Lakh in FY22.

Interestingly, this is not the first fintech startup that LenDenClub has tied up with to bolster its P2P lending play. The NBFC also counts names such as BharatPe, Google Pay, PhonePe, and Karza among its partners in the segment.

With this, Jar has joined a growing list of Indian startups that have rolled out P2P lending offerings to create alternate revenue streams. While fintech unicorn CRED launched P2P lending product Mint for its members in 2021, BharatPe also forayed into the P2P lending space with 12% Club the same year.

Last year, fintech startup Uni Cards acquired RBI-licenced OHMY Technologies to offer P2P lending products.

The development comes at a time when the central bank has cracked its whip on the fintech sector. While the central bank has tightened rules for the digital lending sector, the P2P lending space has also come under its radar over issues such as lax KYC processes and non-compliance with guidelines.

Recently, the RBI also engaged with licensed P2P platforms. It has even been conducting supervisory visits at the offices of these since September, as per Moneycontrol.

The startups were reportedly directed to incorporate certain undisclosed measures post the review process.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.