Elevation Capital (erstwhile SAIF Partners India) is the largest shareholder of the company with 8.83 Cr shares, followed by Peak XV capital with 15.68% stake

Founder duo, Rajnish Kumar and Aloke Bajpai, hold the fourth and fifth most number of shares in the company

The startup’s initial public offering (IPO) will comprise a fresh issue of INR 120 Cr and an OFS component of 6.66 Cr equity shares

Le Travenues Technology, the parent entity of travel tech major ixigo, has refiled its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for its potential initial public offering (IPO).

The IPO comprises fresh issue of shares valued at INR 120 Cr and an offer for sale (OFS) component of 6.66 Cr equity shares, according to the draft papers filed on Wednesday (February 14).

It plans to allocate INR 45 Cr of the net proceeds from the fresh issue for its working capital requirements, while INR 26 Cr will be set aside for investments in technology and cloud infrastructure enhancements.

The DRHP sheds light on the online travel aggregator’s (OTA) second attempt at a public listing. However, this time around the company has settled for a much lower figure compared to the previous bid when it was eyeing an IPO size of INR 1,600 Cr, back in 2021.

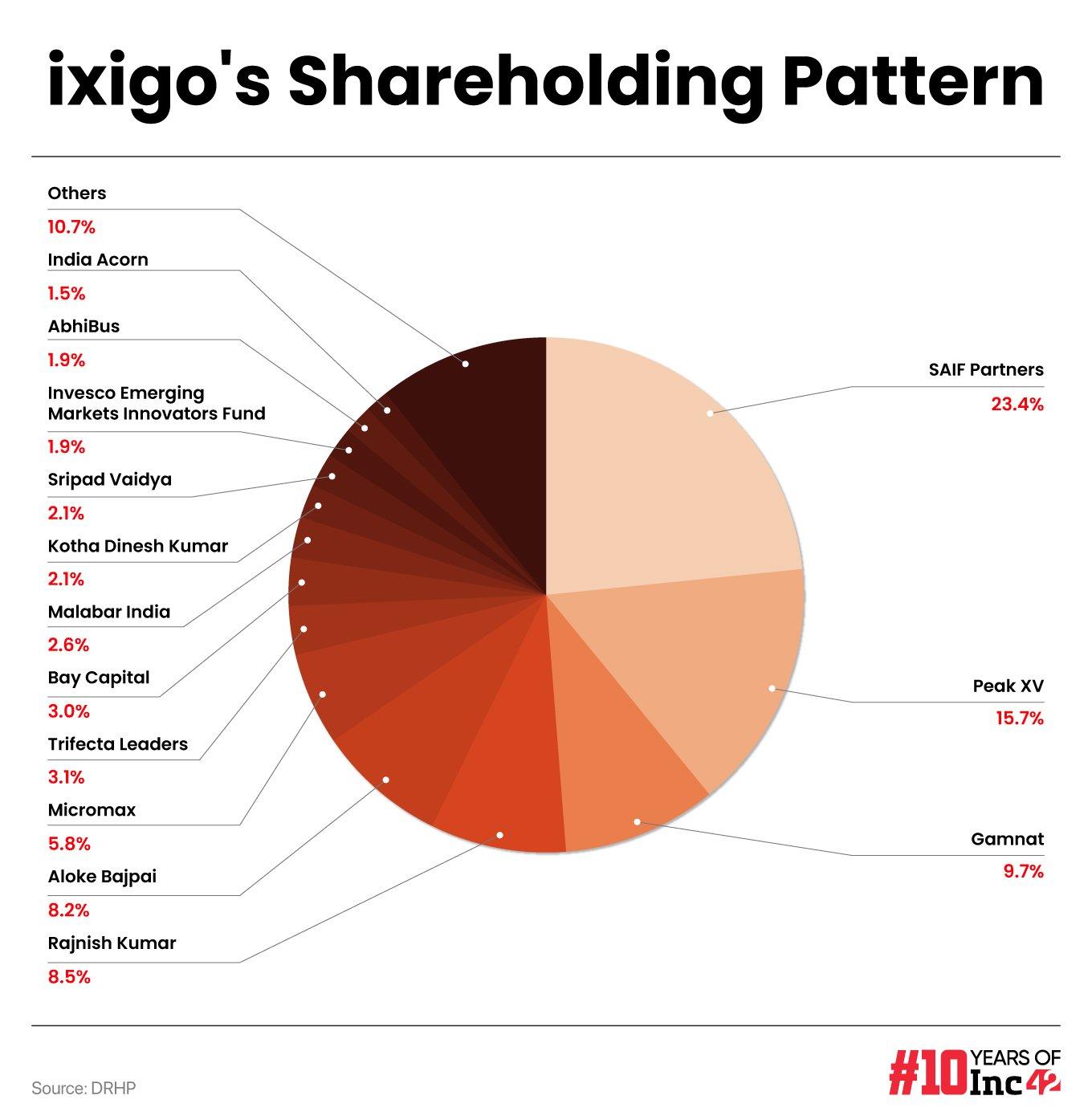

The IPO papers also give a sneak-peek into ixigo’s organisational structure and its shareholding pattern.

A Look At ixigo’s Cap Table

Ixigo

Ixigo

Elevation Capital (erstwhile SAIF Partners India), one of the oldest backers of the startup, is the largest shareholder with 8.83 Cr shares. It holds a 23.40% stake in the company on a fully diluted basis.

Peak XV Partners, which led the OTA’s $15 Mn Series B funding round in 2017, is the second biggest shareholder in ixigo with 5.92 Cr shares, translating to a 15.68% stake.

The two VC firms are the only principal shareholders of the company, holding equity share capital in excess of 15% in the company.

Coming in next is Gamnat, the investment arm of Singaporean sovereign wealth fund GIC, with 3.65 Cr equity shares or 9.68% stake in the company.

The founder duo, Rajnish Kumar and Aloke Bajpai, are the fourth and fifth biggest shareholders of the company. While Kumar holds 3.22 Cr shares for 8.52% stake in the company, Bajpai accounts for 3.08 Cr shares or 8.15%.

Further to this, the CEO and cofounder of ConfirmTkt, which ixigo acquired in 2021, Kotha Dinesh Kumar also holds 7.98 Cr shares in the company, translating to a 2.12% stake. The ixigo-owned online train discovery platform’s second cofounder Sripad Vaidya also owns 2.12% stake in the IPO-bound company.

ixigo’s Top Guns

It is pertinent to note that the ixigo does not have an identifiable promoter in terms of SEBI’s Issue of Capital and Disclosure Requirements Regulations, 2018, and the Companies Act, 2013.

However, the startup’s cofounder and INSEAD alumni Bajpai helms its director’s board and is the chairman, managing director and group CEO. ixigo’s other cofounder Rajnish Kumar is the director and group co-CEO of the travel tech startup.

Peak XV’s Shailesh Lakhani and Canada-based OTA Hopper’s Frederic Lalonde are the two non-executive directors in the company’s board. The board also comprises independent directors Shuba Rao Mayya, Mahendra Pratap Mall, Arun Seth, Rahul Pandit and Rajesh Sawhney.

While IIT-Delhi alumni Saurabh Devendra Singh is the company’s group chief financial officer (CFO), ixigo’s corporate governance, legal and compliance functions are helmed by Suresh Kumar Bhutani, who is the OTA’s group general counsel, company secretary and compliance officer.

Just before filing its DRHP, Kotha Dinesh Kumar assumed the role of CEO for ixigo trains and ConfirmTkt in January 2024. ConfirmTkt’s other co-founder Sripad Vaidya was also appointed as the COO of ixigo trains and ConfirmTkt earlier this year.

Alongside, Lenin Koduru serves as the CEO for ixigo’s bus business, AbhiBus while the startup’s flight and hotel business is helmed by senior VP Nitin Gurha.

Besides this, the company employs a total of 368 employees, according to its LinkedIn profile.

ixigo’s bid for an IPO comes at a time when the startup has bounced back strongly from its pandemic-era woes. After reporting a net profit of INR 7.5 Cr in FY21, the startup slipped into the red with a net loss of INR 21.1 Cr in FY22. However, its fortunes reversed in FY23 with a net profit of INR 23.4 Cr and an operating revenue north of INR 500 Cr.

For now, the company has reignited its IPO ambitions and the ball is now in SEBI’s court as to whether it greenlights ixigo’s proposal or not.

Ad-lite browsing experience

Ad-lite browsing experience