SUMMARY

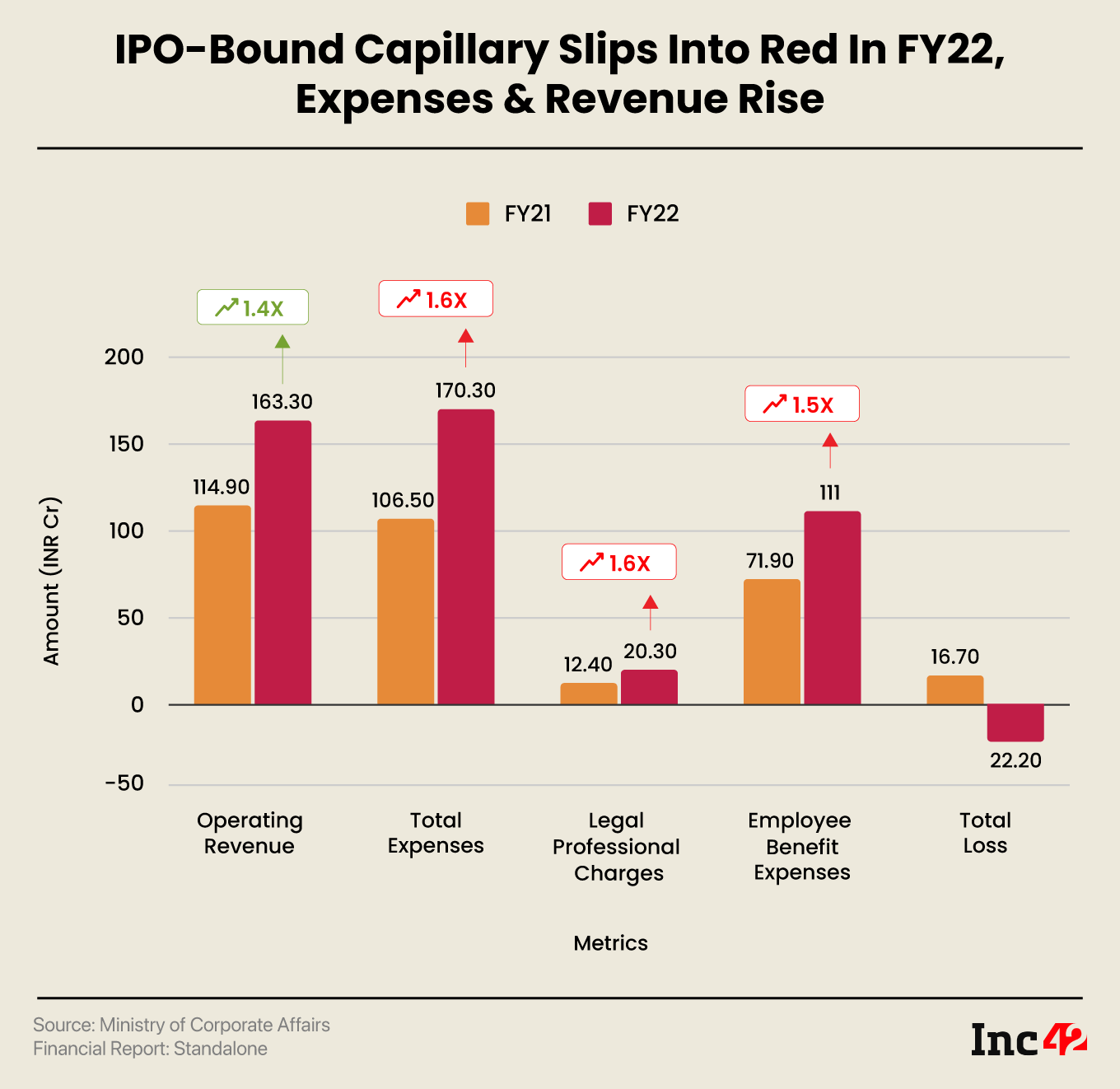

Capillary, which reported a net profit of INR 16.7 Cr in FY21, reported a net loss in FY22 as its employee benefit expenses surged in the year

Operating revenue grew 42% to INR 163.3 Cr in FY22 from INR 114.9 Cr in FY21

Total expenses jumped 60% YoY to INR 170.3 Cr in FY22, with employee benefit expenses accounting over 65% of it

IPO-bound SaaS startup Capillary Technologies slipped into the red in the financial year 2021-22 (FY22), reporting a standalone net loss of INR 22.2 Cr as its expenditure towards employee benefits surged.

Capillary reported a net profit of INR 16.7 Cr in FY21.

It must be noted that the startup filed its draft red herring prospectus (DRHP) for an INR 850 Cr initial public offering (IPO) with market regulator SEBI in December 2021.

The startup’s bottom line took a hit despite an over 42% jump in operating revenue to INR 163.3 Cr from INR 114.9 Cr in the prior fiscal year.

In FY21, Capillary reported a 30.8% year-on-year (YoY) fall in operating revenue from INR 166.12 Cr in FY20. However, the startup managed to remain profitable by cutting down on expenses.

As an AI-based solutions provider that helps businesses develop customer and partner loyalty, Capillary earns a majority of its revenue from sale of services.

Including interest income and other non-operating income, Capillary’s total revenue stood at INR 164.2 Cr in FY22 as against INR 123.2 Cr in the previous year.

Founded in 2008 by Aneesh Reddy and Krishna Mehra, Capillary claims to have served over 250 brands and more than 875 Mn customers. Capillary has over 100 loyalty programs deployed across 124K stores.

Capillary’s total expenses jumped 60% to INR 170.3 Cr in FY22 from INR 106.5 Cr in the prior fiscal year, with employee benefit expenses accounting over 65% of it.

The startup’s expenditure towards employee benefits surged 54.5% to INR 111 Cr in FY22 from INR 71.9 Cr in FY21.

While Capillary spent INR 73.4 Cr towards salaries and wages during the year, up from INR 65.1 Cr in the prior year, its spending towards ESOPs jumped 831% YoY to INR 33.2 Cr in the year under review.

In FY22, the startup also spent INR 20.3 Cr towards legal professional charges, a rise of 63.7% YoY.

Besides, Capillary’s miscellaneous expenses, including software and server charges and advances/ deposits written off, stood at INR 30.4 Cr in FY22 as against INR 16.4 Cr in the prior fiscal year.

Meanwhile, the startup’s consolidated net loss more than quadrupled to INR 100.8 Cr in FY22 from INR 22.8 Cr in FY21. Consolidated operating revenue grew 30.5% YoY to INR 223.1 Cr during the reported year.

In September last year, the IPO-bound startup appointed Sameer Garde as its CEO. Earlier, Garde was an independent director and board member at the startup.

Backed by Warburg Pincus, Sequoia Capital, Avataar Capital, and Filter Capital, among others, Capillary has raised $100 Mn in funding so far. Its IPO offer includes fresh issue of shares worth INR 200 Cr and an offer for sale (OFS) worth INR 650 Cr.

The startup is reportedly expected to come out with its IPO in the next 4-6 weeks.

Update | February 28, 16:06 PM

The story has been updated to add Capillary’s consolidated numbers on the company’s request.

Ad-lite browsing experience

Ad-lite browsing experience