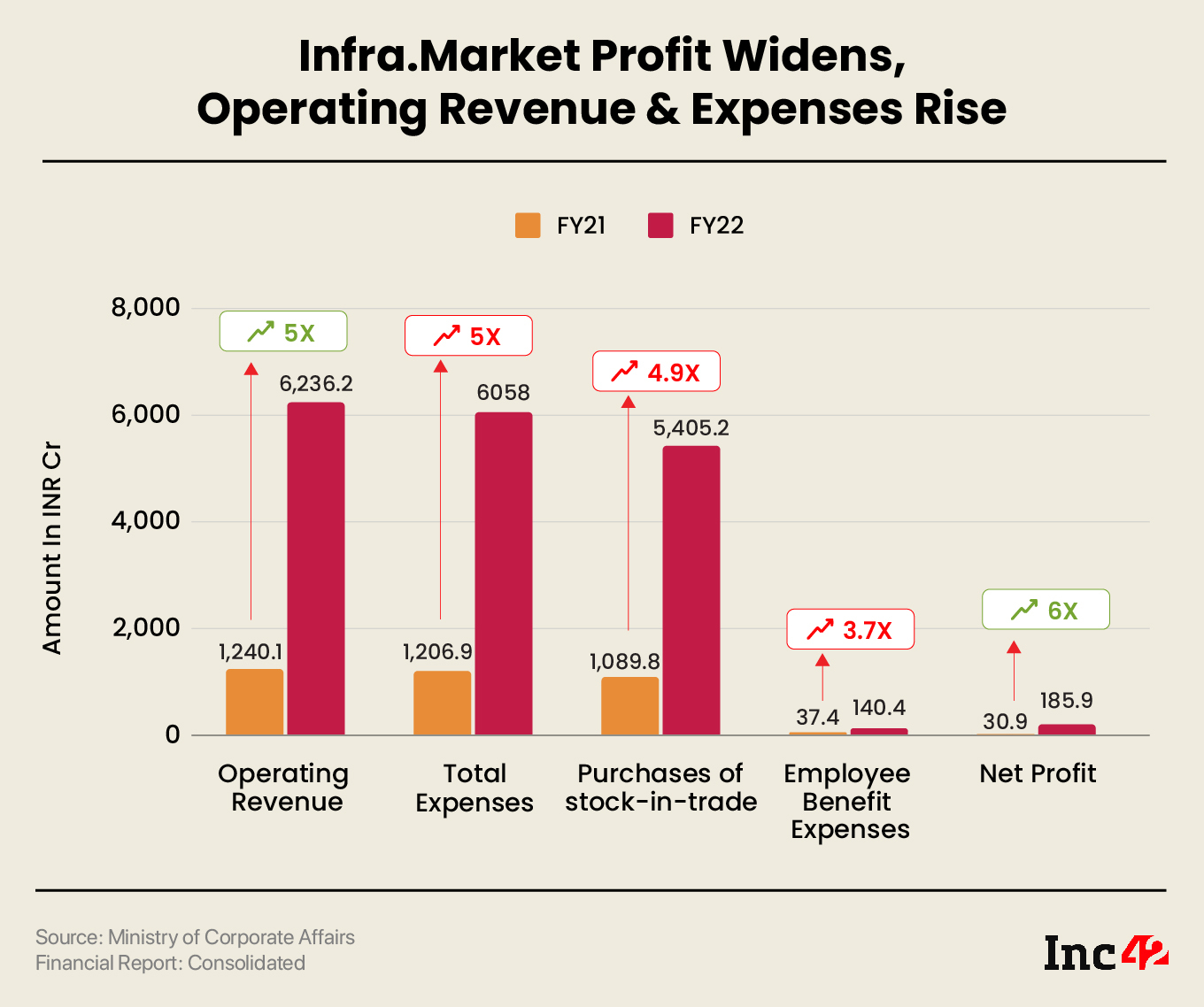

The construction marketplace unicorn’s total revenue surged 404% to INR 6,285 Cr in FY22 from INR 1,244.9 Cr in FY21

Infra.Market’s expenses rose 5X to INR 6,058 Cr from INR 1,206.9 Cr in FY21

Earlier this year, Infra.Market acquired a strategic stake in Shalimar Paints for INR 270 Cr

Maharashtra-based construction marketplace unicorn Infra.Market’s net profit surged 6X to INR 185.9 Cr in the financial year 2021-22 (FY22) from INR 30.9 Cr in FY21 on the back of a sharp increase in its operating revenue.

The startup’s total revenue jumped 404% to INR 6,285 Cr in FY22 from INR 1,244.9 Cr in FY21. Revenue from operations surged 5X to INR 6,236.2 Cr from INR 1,240.1 Cr in the previous fiscal year.

One of the primary reasons for the sharp jump in sales was the startup’s decision to diversify its business. The startup launched its private labels in 2021 for the construction industry. Currently, Infra.Market has private label brands in segments like concrete, walling products, chemicals, paint, electricals, and tiles. Private label brands constituted almost 60% of the overall operating revenue in FY22.

In an attempt to build its House of Brands, Infra.Market made two major investments. It first acquired concrete manufacturing company RDC Concrete for INR 700 Cr in 2021. Earlier this year, it made a strategic investment of INR 270 Cr in listed paint company Shalimar Paints for a 24% stake.

Apart from this, Infra.Market is also focusing on the B2C space now with its retail stores. Customers can get products ranging from concrete to modular furniture from these retail stores. As per the startup, retail stores now contribute around 10% of the total revenue. Apart from this, the startup also started a new vertical, Chemical.Market, last year which further added a new revenue stream.

On the expenses front, Infra.Market saw a 400% rise in total expenses to INR 6,058 Cr in FY22 from INR 1,206.9 Cr in FY21. Of this, purchase of stock-in-trade accounted for INR 5,405.2 Cr, a 395% jump from INR 1,089.8 Cr in FY21.

Employee benefit expenses rose 275% to INR 140.4 Cr from INR 37.4 Cr in FY21. Employee benefit expenses comprise employee salaries, PF contribution, gratuity, and other employee welfare benefits.

Earlier this year, Infra.Market raised $50 Mn in growth capital from Liquidity Group’s MARS Unicorn Fund. Liquidity Group, a global capital market fund, is backed by financial institutions such as the US-listed Apollo and Mitsubishi UFJ Financial Group. In December 2021, the startup raised $53 Mn in debt from over 100 investors, which Inc42 exclusively reported.

Founded in 2016 by Aaditya Sharda and Souvik Sengupta, Infra.Market is an online construction solutions company backed by marquee investors such as Tiger Global, Accel Partners, Nexus Venture Partners, and Sistema Asia Fund.

Ad-lite browsing experience

Ad-lite browsing experience