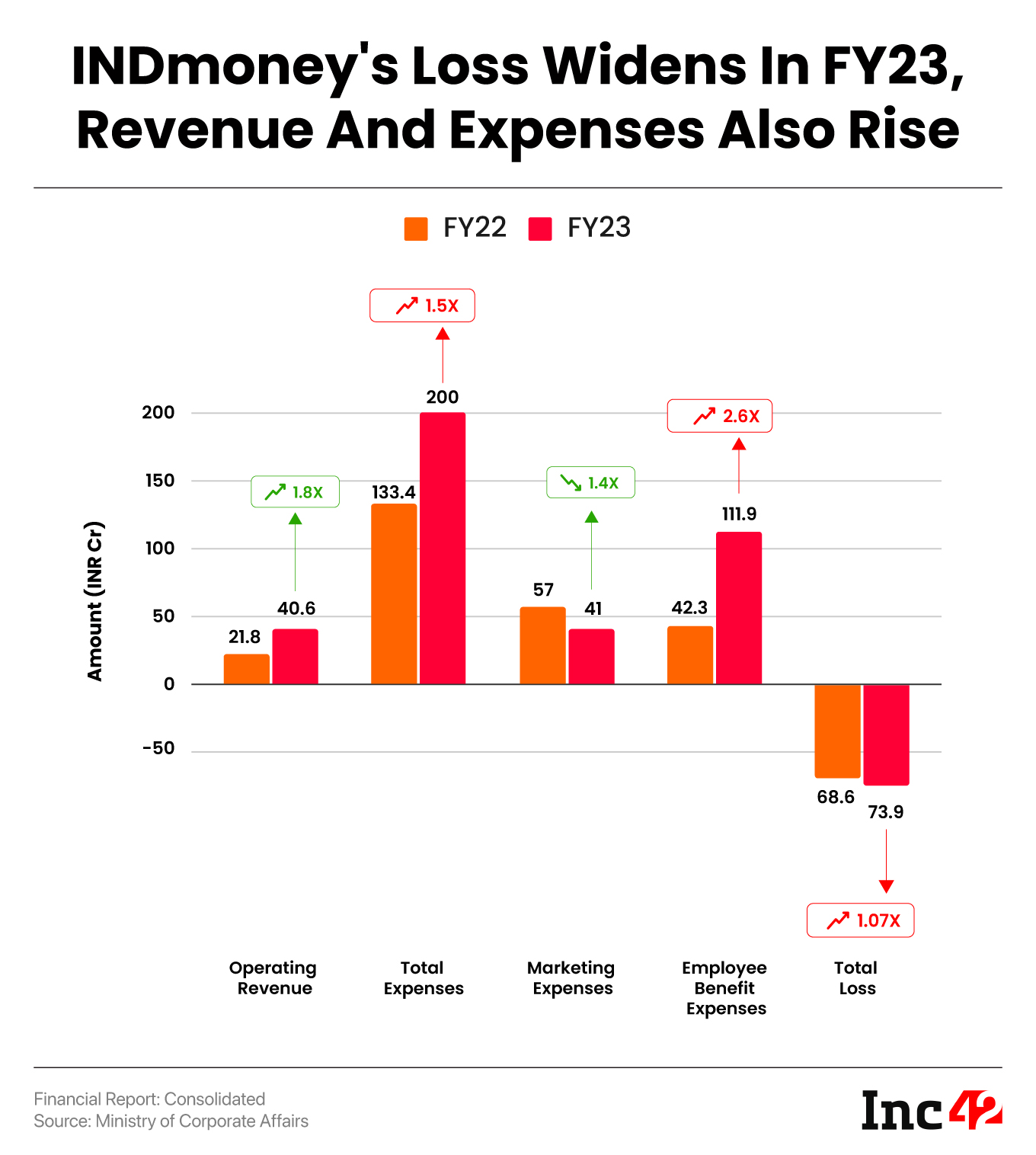

The investment tech startup’s bottom line took a hit in FY23 despite operating revenue almost doubling to INR 40.6 Cr

Total expenses grew 1.5X to INR 200 Cr in FY23, with employee costs accounting for 56% of it

INDmoney’s marketing costs declined over 25%, while ESOP expenses surged 11X YoY to INR 47.6 Cr

Investech startup indmoney

The bottom line was hurt despite INDmoney’s operating revenue almost doubling to INR 40.6 Cr during the year from INR 21.8 Cr in FY22.

Founded by Ashish Kashyap in 2019, INDmoney claims to be a one-stop super finance app for saving and investing. The startup allows users to invest in stocks, mutual funds, IPOs, and fixed deposits. Users can also invest in US stocks through the INDmoney app.

As such, the startup earns operating revenue from the sale of services, which includes income from advisory and distribution services and income from broking activities.

In FY23, INDmoney earned a majority of its revenue from other income, including gain from sale of investments and other non-operating income.

INDMoney’s other income stood at INR 46.7 Cr in FY23 as against INR 19.7 Cr in the previous year.

Overall, the startup’s total revenue jumped 111% year-on-year (YoY) to INR 87.4 Cr in FY23.

INDmoney is backed by marquee investors like Tiger Global, Steadview Capital, Sixteenth Street Capital, and angels like Lenskart founder Peyush Bansal and influencer and founder of Nearbuy.com, Ankur Warikoo.

The startup competes with the likes of Upstox, Groww, and Zerodha.

Zooming Into The Expenses

INDmoney’s overall spending grew 1.5X to INR 200 Cr in FY23 from INR 133.4 Cr in the prior fiscal year.

Employee Costs The Biggest Expense: At INR 111.9 Cr, employee benefit expenses accounted for 56% of the startup’s total expenditure.

Employee benefit expenses jumped 2.6X YoY from INR 42.3 Cr due to a sharp increase in ESOP costs.

While INDMoney spent INR 58.9 Cr towards salaries and wages, its employee share-based payment (equity settled) jumped over 11X YoY to INR 47.6 Cr in FY23.

Marketing Expenses Decline: INDmoney managed to cut its marketing costs by over one-fourth to INR 41 Cr in the reported year from INR 57 Cr in FY22.

Among other expenses, the startup’s total depreciation, depletion, and amortisation expense grew to INR 5.4 Cr in the reported period from INR 3.7 Cr a year ago. Meanwhile, software, cloud storage, and server charges grew 1.3X YoY to INR 32.1 Cr in FY23.

INDmoney last raised $11 Mn in its Series D funding round in March last year.

Ad-lite browsing experience

Ad-lite browsing experience