Recently-listed DroneAcharya was the biggest gainer this week, followed by shares of EaseMyTrip which rose 15%

MapmyIndia was the only loser among the new-age tech stocks this week, falling 4%

The recovery in the tech stocks was in line with the broader market, as Nifty50 and Sensex rose 1.7% and 1.6%, respectively, this week

After last week’s slump, new-age tech stocks rallied this week to end the year’s final week in the green as the Indian stock market also recovered slightly. Except for MapmyIndia, which ended the week 4% lower, all other tech stocks ended the week up in a range of about 2% to 27%.

The recently-listed tech startup DroneAcharya Aerial Innovations emerged as the biggest winner this week. The drone startup listed on the BSE SME platform last week at INR 102, a premium of almost 90% to its issue price of INR 54 apiece. This week, the stock rallied further by 27.5%, ending the week at INR 136.6.

After taking the biggest hit among its peers last week, traveltech startup EaseMyTrip emerged as the second-biggest winner by gaining over 15% this week.

Besides, Zomato, one of the worst-performing new-age tech stocks of the year, rose 10.7%, while Paytm was up over 11%, ending Friday’s session at INR 530.8 on the BSE. Meanwhile, Nykaa rose 7% on a weekly basis, ending the year’s last session at INR 154.8.

Paytm, Zomato, Nykaa, PB Fintech, and Nazara are among the top 20 biggest losers on Nifty 500 this year.

RateGain Travel Technologies, which got listed in December last year, also ended the week up over 7%. It closed at INR 284.6 on the BSE on Friday.

Benchmark indices Nifty50 and Sensex rose 1.7% and 1.6%, respectively, this week. However, Nifty50 and Sensex ended the year’s last session marginally lower at 18,105.3 and 60,840.74, respectively, which also impacted most of the tech stocks’ performance on Friday.

“Domestic equities ended the last day of the year on a sombre note with profit booking pulling down the index in the last 30 minutes,” said Siddhartha Khemka, head of retail research at Motilal Oswal.

“As we start the new year 2023, we expect markets to remain sideways in a range in the near term. While fears of recession and spread of Covid outside China is capping the upside, we are witnessing strong buying at lower levels which is supporting the markets on the downside,” he said.

The third quarter results of FY23 and the upcoming Union Budget could provide fresh positive triggers to Indian equities, Khemka added.

Now, let’s take a detailed look at the weekly performance of some of the listed new-age tech stocks from the Indian startup ecosystem.

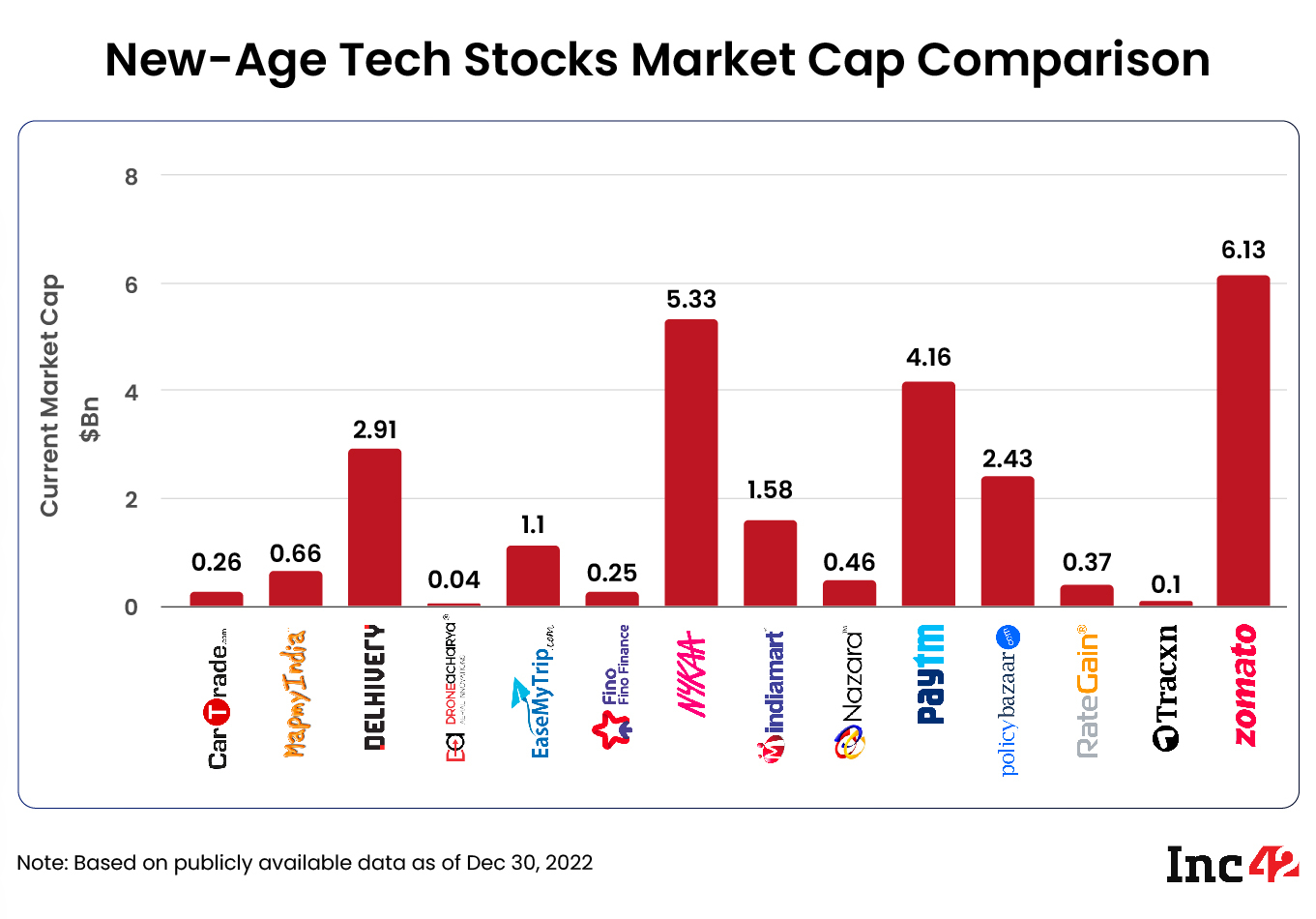

The 14 new-age tech stocks under our coverage, with recently listed DroneAcharya and RateGain as the newest additions, ended this week with a total market capitalisation of $25.78 Bn.

EaseMyTrip Makes Strong Comeback

Traveltech startup EaseMyTrip emerged from the 18% fall of last week to become the second-biggest winner as its shares hit the upper circuit earlier this week.

EaseMyTrip announced a special programme called EMTFAMILY for its shareholders on Monday under which its shareholders would be enrolled on a ‘Refer Now & Earn Forever’ programme. On the day, its shares jumped 19.9%. For the next two sessions, the stock was able to hold on to its gains. However, in the last two sessions of the week, EaseMyTrip shed some of its gains to end Friday’s session 1.5% lower at INR 52.7 on the BSE.

Currently, EaseMyTrip is trading on “buy on dips” and is showing a bullish engulfing pattern, opined Jigar S Patel, senior manager, technical research analyst at Anand Rathi.

“We can see support at around INR 49-INR 50 level, and from there we can see a rally till INR 60 in the coming few weeks,” said Patel.

It must be noted that EaseMyTrip is the only listed tech stock under our coverage which has seen an increase in its valuation year-to-date. Its market capitalisation has increased 39% year to date (YTD) to INR 9,160.95 Cr (approx $1.1 Bn).

Besides EaseMyTrip, Paytm can also see a rally in the next few weeks, said Patel.

Paytm Initiates Share Buyback

The year 2022 has been a difficult one for fintech giant Paytm. From regulatory hurdles to criticism for its various strategic decisions, numerous issues have hurt its stock market performance.

In the latest, its share buyback proposal sparked debates on whether the startup was just trying to compensate and reward its pre-IPO shareholders following a poor stock market performance.

However, eventually, the proposal received Paytm board’s approval and the startup has also started notifying about the initiation of the share buyback on the exchanges this week.

On Thursday it bought back 1,85,000 shares for INR 527.4946 per unit. On Friday, it bought back 1,75,000 shares for INR 534.0034 per unit.

Paytm’s shares gained in three straight sessions earlier this week and ended the year’s last day in the green zone. Overall, the shares rose over 11% this week, ending Friday’s session at INR 530.8. The shares are down 60.2% YTD.

Anand Rathi’s Patel said that Paytm has currently stabilised at around INR 480-INR 490 levels. The immediate support is at around INR 510-INR 520 and the resistance is at around INR 560.

“If in the coming weeks and months it breaks INR 560-INR 570 levels, then we may see INR 600 level,” Patel added.

Zomato To Bring Back Zomato Gold

After months of suspension, foodtech unicorn Zomato is planning to bring back its customer loyalty programme ‘Zomato Gold’.

Zomato’s founder and CEO Deepinder Goyal shared a teaser of Zomato Gold on Thursday saying, “Back soon.”

Zomato introduced Zomato Gold in 2017, which was later rebranded as Zomato Pro in 2020 and was discontinued earlier this year.

However, the absence of a loyalty program had raised concerns among Zomato investors as its rival Swiggy has such a program. Zomato hinted about a new loyalty programme during its Q2 FY23 earnings call.

While there was not much immediate impact of the announcement on Zomato stock, the shares recovered from last week’s significant slump in line with the overall market.

Zomato shares jumped 10.7% this week, ending the year’s last trading session at INR 59.35, down 2.5% compared to Thursday’s close. The shares have declined 56.8% YTD.

Zomato is currently trading in a tight range of INR 60-INR 70 and it is in consolidation mode. If it manages to trade above INR 70, there can be a higher side till INR 75-INR 80, said Patel.

Ad-lite browsing experience

Ad-lite browsing experience