SUMMARY

The UPI-PayNow linkage would enable Indian and Singaporean users to make cross-border payments using their respective mobile apps

The launch of UPI-PayNow linkage was a much-awaited gift to the people of India and Singapore: PM Narendra Modi

Cross-border retail payments and remittances between India and Singapore amount to over $1 Bn annually: Singapore PM Lee Hsien Loong

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

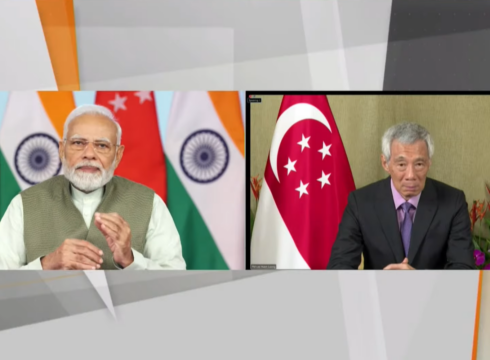

The cross-border linkage between India’s Unified Payments Interface (UPI) and Singapore’s PayNow has been completed on Tuesday (February 21), with the Prime Minister of India Narendra Modi and the Prime Minister of Singapore Lee Hsien Loong in attendance.

The facility was launched through token transactions by the Reserve Bank of India (RBI) governor Shaktikanta Das and the managing director of the Monetary Authority of Singapore (MAS), Ravi Menon using the UPI-PayNow linkage.

According to a statement by the RBI, the UPI-PayNow linkage would enable Indian and Singaporean users to make cross-border payments using their respective mobile apps.

“Funds held in bank accounts or e-wallets can be transferred to/from India using just the UPI ID, mobile number, or Virtual Payment Address (VPA),” RBI said.

To begin with, the State Bank of India, Indian Overseas Bank, Indian Bank and ICICI Bank will facilitate both inward and outward remittances while Axis Bank and DBS India will facilitate inward remittances. For Singapore users, the service will be made available through DBS-Singapore and Liquid Group (a non-bank financial institution).

Both countries plan to include more banks in the linkage for facilitating cross-border payments eventually.

Speaking at the launch event, PM Modi said, “The launch of UPI-PayNow linkage was a much-awaited gift to the people of India and Singapore. These days, technology is connecting people in more than one way; fintech is also such a sector. However, fintech is usually limited to the borders of a single country. Today’s launch marks the beginning of a new chapter in cross-border fintech connectivity.”

PM Modi added that this would also help NRIs, Indian professionals and students living in Singapore.

Talking about India’s fintech startups, the PM said thousands of fintech startups in the country have allowed India to become the leading nation in digital payments in the world.

Highlighting 2022’s UPI statistics, PM Modi added, “Experts estimate that digital transactions in India would soon cross the number of cash transactions in the country.”

Speaking at the event, Singapore PM Lee Hsien Loong, said, “The idea of linking PayNow and UPI was first conceived in 2018 when PM Modi visited Singapore. Since then, the two central banks have been working on this in earnest.”

“So I’m very glad that the PayNow-UPI linkage has become a reality. Cross-border retail payments and remittances between India and Singapore amount to over $1 Bn annually,” PM Loong added.

The Singapore premier also added that the Southeast Asian country has been working with NPCI International to facilitate cross-border remittances between itself and India.

PM Loong also added that the UPI-PayNow linkage was the first such linkage to include cloud-based infrastructure and participation from non-banking financial companies (NBFCs) in the world.

To begin with, an Indian user can remit up to INR 60,000 in a day (equivalent to around SGD 1,000). At the time of making the transaction, the system shall dynamically calculate and display the amount in both currencies for the convenience of the user.

The UPI-PayNow linkage is the product of collaboration between RBI, MAS, and payment system operators of both countries, NPCI International Payments Limited (NIPL) and Banking Computer Services Pte Ltd. (BCS).

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.