Nandan Nilekani also said that India’s DPIs have so far been deployed in 15 countries across the globe

Nilekani also reiterated that startups and companies leveraging India’s DPIs were valued north of $100 Bn

As per Inc42 data, Indian startups have raised more than $150 Mn in funding between 2014 and H1 2024, with the country currently being home to 118 unicorns

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

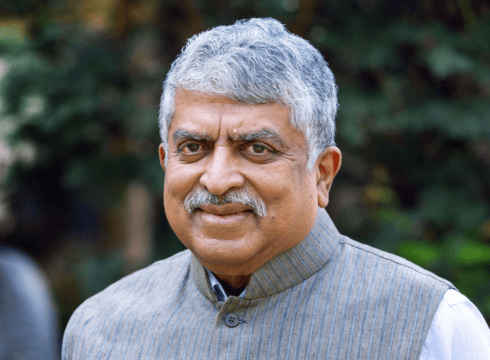

Infosys cofounder and Aadhaar architect Nandan Nilekani has reportedly said that India is planning to take its digital public infrastructure (DPI) to 50 countries in the next five years.

As per Economic Times, Nilekani, while shedding light on the global deployment of India’s DPI, said that the infrastructure was currently being used in 15 countries across the globe.

“This (DPI) can be applied anywhere… There is a project to take this to 50 countries in five years. We’re at least in 15 countries today. Not the whole stack as it’s a bit complex but a lot of pieces of this are getting rolled out,” said Nilekani at an event in Bengaluru.

On being asked a question about whether such DPIs would need “government push” to succeed, Nilekani said some of it indeed needed a regulatory push.

“The ID (Aadhaar) was government-backed. They spent about $1 per person and gave 1.3 Bn people an ID. But UPI came from NPCI, which is a non-profit owned by banks. It became valuable to the government because of demonetisation, which gave a push to digital payments, and Covid-19 forced people to make payments with social distancing. Government needs to define the rules of the game,” Nilekani reportedly added.

Speaking about unified payments interface (UPI), Nilekani said that the digital payments infrastructure was built on the philosophy of “public rails and private innovation”, adding that UPI today clocked 14.4 Bn transactions a month with 500 Mn users and 50 Mn merchants.

He further reiterated that startups leveraging India’s DPIs were valued north of $100 Bn. “We estimate that on this infrastructure, there are more than $100 billion worth of companies that have been created on top of this, leveraging this technology,” added Nilekani.

At the heart of all this is India’s burgeoning startup ecosystem that has raised more than $150 Bn in funding between 2014 and H1 2024. India is also home to more than 118 unicorns and 112 soonicorns that have raised billions of dollars and clocked hundreds of crores in revenues.

The growth of Indian startups has largely been attributed to the growing number of internet users in India, increasing penetration of smartphones and affordable internet tariffs. Additionally, state-backed platforms such as UPI, ONDC and account aggregator framework have created multiple use cases and spawned the rise of giants in the fintech ecosystem.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.