CarTrade filed its Draft Red Herring prospectus with SEBI, last week, for its INR 2K Cr IPO

Five of the largest stakeholders of CarTrade will be offloading their stake in the proposed IPO

CEO Vinay Sanghi has been appointed as the MD of CarTrade for the next five years

Mumbai-based online auto classifieds startup CarTrade filed its Draft Red Herring Prospectus (DRHP) with the Indian market regulator Securities and Exchange Board of India (SEBI) last week, for its INR 2K Cr initial public offering (IPO). According to the DRHP shared by Axis Capital, lead book running manager for the IPO, CarTrade will be making a pure offer for sale (OFS) for 1,23,54,811 equity shares of the company. These shares will have a face value of INR 10 each.

Among the shareholders offloading stake in the IPO are CarTrade investors Warburg Pincus (Highdell Investment), Temasek (MacRitchie Investments), JP Morgan (CMDB II) and March Capital (Springfield Venture International). According to the document, JP Morgan will sell 16,08,324 equity shares, Warburg Pincus and Temasek will offload 35,68,217 shares, while March Capital will sell 11,24,700 shares. Among the promoters, Bina Vinod Sanghi will sell 1,83,333 shares. The offer constitutes nearly 27% of the company’s post-offer paid-up equity share capital.

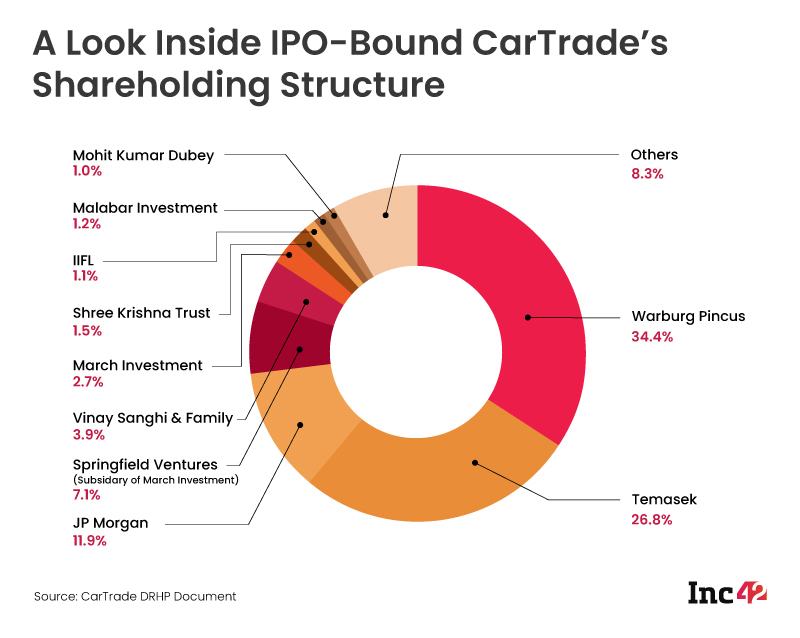

How CarTrade’s Shareholding Pattern Looked Like Pre-IPO?

The above-mentioned shareholders, who are going to be offloading in CarTrade’s upcoming IPO, are currently the top five shareholders of the online auto classifieds business. Only Warburg Pincus and Temasek hold more than 25% stake in the company, but their shareholding will be reduced to below 25% mark as they offload their shares in CarTrade’s upcoming IPO.

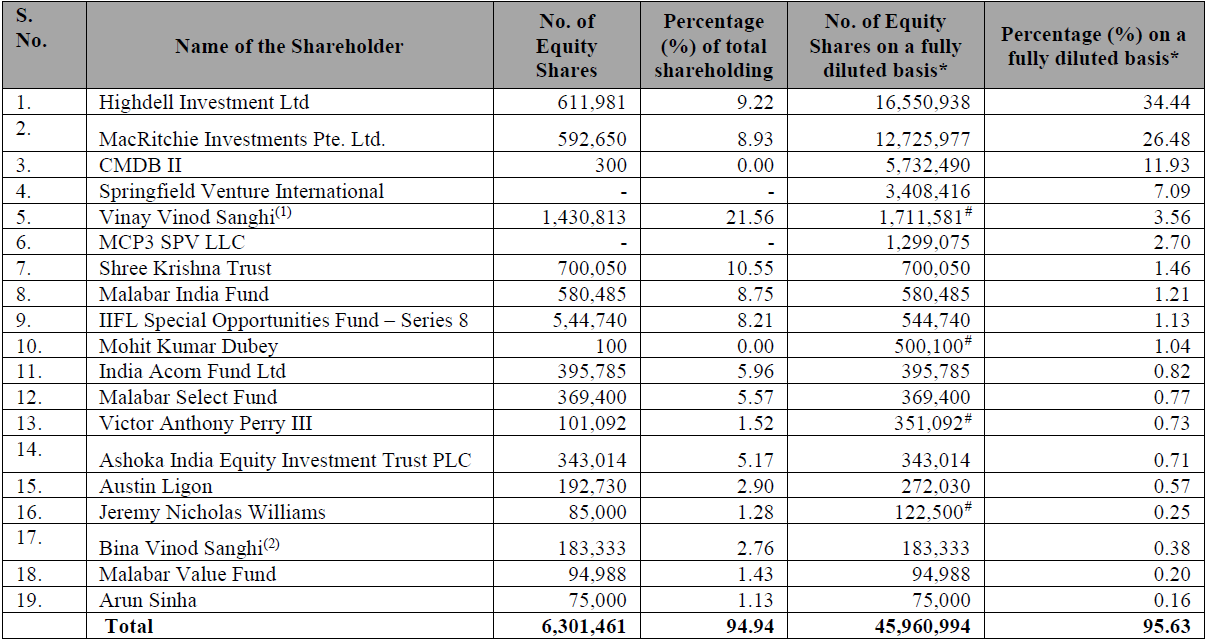

Warburg Pincus is the largest stakeholder in CarTrade, with a shareholding of 34.44%, followed by Temasek’s 26.48% shareholding. JP Morgan holds about 11.93%, whereas March Capital owns about 9.79 shares through Springfield Venture (7.09%) and MCP3 SPV LLC (2.7%). Founder Sanghi and family has a shareholding of 3.56% in CarTrade.

About 19 of the total 26 shareholders of the company account for 95.63% of CarTrade’s shareholding. The remaining 7 investors account for 4.37% stake in the cap table.

CarTrade, founded in 2009 by Vinay Sanghi, is an online automotive market for buyers and sellers of new and used vehicles. The company’s online car auction platform has a presence in over 80 Indian cities. As of last year, it claimed to be selling 1 Mn vehicles a year. More than 40 OEMs and 15,000 plus dealers work with the CarTrade Group and it has over 180 owned or franchise stores.

The company has raised $307 Mn to date, with INR 321 Cr coming through its Series H round last June. CarTrade converted itself from a private limited company to a public company last week, ahead of its planned IPO. The company’s registered name is now CarTrade Tech Limited. The company also approved the appointment of its founder and CEO Vinay Sanghi as managing director (MD) of CarTrade for the next five years.

Ad-lite browsing experience

Ad-lite browsing experience