SUMMARY

Zomato stocks surged nearly 15% while Nazara Tech soared 13% in the week ended October 9, 2022

Nykaa, Fino Payments Bank and CarTrade were the only three losers among new-age tech stocks this week

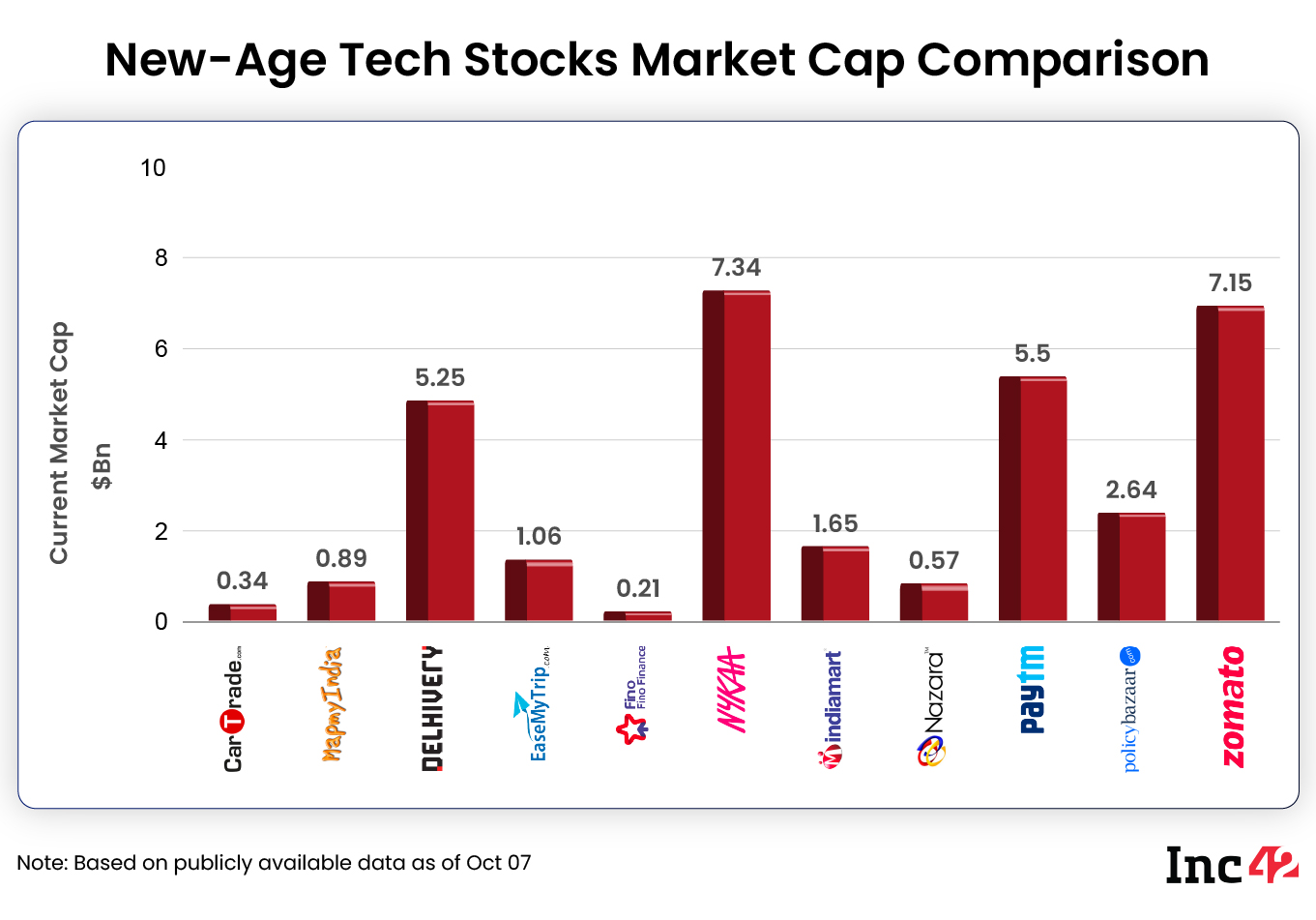

The combined market capitalisation of the 11 new-age tech stocks stood at $32.6 Bn this week , up from $32.25 Bn last week

Indian new-age tech stock rebounded back somewhat strongly despite volatile market sentiment, weak global cues and a depreciating rupee.

While the Rupee continued to be in a freefall and even as the World Bank lowered India’s FY23 GDP estimates to 6.5%, what cushioned the markets this week was fresh foreign capital inflows and mixed trends in Asian markets. As a result, the new-age tech stocks also somewhat gained and brought respite to the markets.

Continuing its strong momentum for the second consecutive week, Zomato shares closed 15% higher on October 7 compared to the previous week.

PB Fintech, the parent company of Policybazaar, broke the downward spiral as the stock rallied 3% over the course of the entire week.

Recouping its losses, gaming unicorn Nazara Technologies emerged as the second biggest winner this week as stocks surged 13.04%. The stocks had plummeted last week after the Tamil Nadu government passed an ordinance to ban online games.

Fintech major Paytm also regained its lost ground, surging 11.27% in the week, emerging as the third best performer among new-age tech companies. This came largely on the back of global financial advisory majors JP Morgan and Goldman Sachs reiterating their bullish outlook on One97 Communications.

While Goldman Sachs termed Paytm as one of the ‘most compelling growth stories’ at an attractive price, JP Morgan noted that the fintech giant was undergoing a model shift from chasing ‘growth at any loss’ to ‘profitability at scale.’

This also came at a time when Paytm Mall went live on the ONDC network’s beta testing launch in Bengaluru late last month.

Stocks of neobank Fino Payments Bank continued to drag its feet as the stocks fell close to 7% in the period under review. While the shares tanked more than 8% last week, it continued its losing streak well into this week as well.

The startup has been witnessing massive headwinds especially with regards to questions over maintaining profitability and rising costs to fuel its offline foray.

Besides Fino, the week saw just two other stocks namely CarTrade (for the fourth consecutive week) and Nykaa in the red. The negative market sentiment weighed heavily on CarTrade as shares fell yet again by 1.51% in the week.

B2B ecommerce giant IndiaMART continued its growth trajectory as share prices grew 2.4% to INR 4,473.20 over the previous week. On similar lines, CE Info Systems, the parent company of MapMyIndia, also surged 1.01% to INR 1,384 compared to the week ended September 30.

Logistics giant Delhivery, which was in the red last week, also rebounded strongly and surged nearly 3.17% over the previous week to settle at INR 600 on the NSE.

“Ever since news broke of the Russia-Ukraine war, FIIs have been selling all the hyped stocks and, as a result, new-age tech companies such as Paytm and CarTrade have been hit. Going forward, it would be difficult to take a call on these new-age businesses because, of the 15-20 new-age tech startups currently, only 1-2 may sustain itself in the next 20 years”, Research Analyst and Senior VP (Research) at Mehta Equities, Prashanth Tapse, told Inc42.

The total market capitalisation of the 11 new-age tech stocks stood at $32.6 Bn, compared to $32.25 Bn last week.

Even as the markets closed on a sombre note on Friday, benchmark index Sensex gained 3.15% over the last week to settle at 58,191.29 points at the end of intraday trading.

Following suit, Nifty50 also surged 3.16% to 17,314.65 points compared to last week. Going forward, independent market expert Kush Ghodasara believes that Nifty could likely remain negative to range bound next week.

Nykaa: Spurned Investors Reject Peace Offering

While the overall market sentiment largely favoured new age tech stocks this week, beauty ecommerce platform Nykaa stood out as a glaring contrast.

Shares fell 0.43% over the course of this week to INR 1,281.90 while total market capitalisation fell by 0.9% to $7.34 Bn at the end of this week.

In the past one month, Nykaa shares have plummeted by close to 5% while its stock prices have tanked by more than 31% in the last six months.

“Stock has been technically weak since its listing which means that it is creating new lows every week. Stock has not been able to break the resistance line above INR 1,510 level since the last few months…So, I would recommend to exit this stock at current levels and reconsider entering around INR 1,100 levels,” warned independent market expert Kush Ghodasara.

In The News For:

-

- Nykaa announced a strategic alliance with the UAE-based Apparel Group to expand its operations in the Middle-East region.

- The board of FSN Ecommerce also approved the formulation and implementation of the employee stock option plan 2022 to grant stock options to eligible employees of the company. Under the scheme, Nykaa is slated to grant a maximum of 16 Lakh options to eligible employees. `

- Nykaa’s board also approved the issuance of 5 equity shares for every 1 fully paid-up equity share held by the shareholders. As a result, the stock spiked by more than 10%, but, subsequently, returned to pre-announcement levels.

“The markets did not like the way they managed bonus shares and how they are managing corporate governance. Nykaa is not a good stock for investors to trade in right now”, said Mehta Equities’ Prashanth Tapse. He, however, added that the startup could see good Q2 FY23 numbers on the back of festive season which may help stock prices surge slightly higher.

Zomato Continues Winning Streak

The Gurugram-based foodtech giant bagged the biggest gains this week as share prices jumped 14.55% to close at INR 69.30. The total market cap of the startup also surged to $7.15 Bn, from $6.88 Bn last week.

“Stock is technically approaching a strong resistance of 200 day average at INR 77. However, on the downside, it operates heavy volumes in the range of INR 54 to INR 57. Now, the stock is poised to have a good short term rally with targets around INR 77 and could achieve targets in the range of INR 100+ in the next 2-3 years,” added Ghodasara.

This is the second consecutive week of positive growth for Zomato, which has been battered by market volatility in the recent past. The food delivery major’s stock prices are still a far cry from the record high of INR 169 it posted back in November last year. The ensuing volatility has cost Zomato’s investors dearly, losing close to 59% of their wealth to the tumble.

In The News For:

-

- Zomato announced the relaunch of its carnival-style food event, Zomaland. The event aims to bring together more than 400 restaurants, spanning over four months and seven cities

- The National Restaurants Association of India has asked its members to log out of Swiggy’s Dineout app. The fallout of the row, which bears striking resemblance with the Zomato Gold controversy, could likely deal collateral damage to the Gurugram-based foodtech giant.

Tapse said that the startup has been witnessing a good volume growth in terms of business in the past two months, adding that the performance was being discounted in the stock prices.

While the week brought some relief for retail investors, it remains to be seen whether it will sustain the growth momentum.

EaseMyTrip: Out Of The Woods?

After two consecutive weeks of being in the red, traveltech platform EaseMyTrip finally rebounded back strongly. The listed startup’s shares shot up 7.48% to close at INR 404.65 at the end of intraday trading on October 7.

Market capitalisation surged to $1.06 Bn this week, compared to $1 Bn last week.

Before we delve deeper, let’s take a look at why EaseMyTrip grabbed headlines this week:

In The News For:

-

- The OTA also jumped onto the festive sale bandwagon, announcing its Travel Utsav sale, offering heavy discounts to woo customers.Easy Trip Planners, the parent company of EaseMyTrip, announced that its board will convene on October 10 to consider issues of bonus and stock split of shares.

- Easy Trip Planners, the parent company of EaseMyTrip, announced that its board will convene on October 10 to consider issues of bonus and stock split of shares.

Since the announcement of the board meeting, EMT shares have hogged the interest of investors and have rallied to 15-day high. In comparison to other new-age tech stocks, EaseMytrip has offered better returns.

From an IPO valuation of $255.9 Mn, EMT has nearly quadrupled in market capitalisation since then.

Competition Watch:

-

- OTA major Booking Holdings, the parent company of travel platforms such as Booking.com and Agoda, announced the opening of its new centre of excellence in Bengaluru.

- The startup is yet to catch up with its peers such as SOTC, Thomas Cook India and MakeMyTrip in the Travel Now Pay Later domain as the new format catches up among youngsters in India.

Ad-lite browsing experience

Ad-lite browsing experience