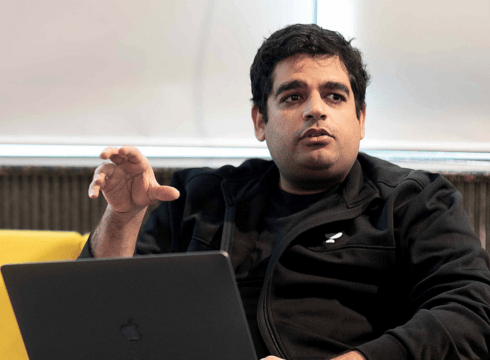

Sharing his learnings of 2023, founder Gaurav Munjal said Unacademy turned down a tempting $500 Mn debt offer and a host of merger and acquisition opportunities in the last two years

On the edtech sector, Munjal said the blitzscaling approach does not work. Expressing his optimism, he said online learning is here to stay

Earlier this month, Munjal claimed that Unacademy managed to reduce its cash burn by 60% in 2023

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Edtech unicorn Unacademy turned down a tempting $500 Mn debt offer and a host of merger and acquisition (M&A) opportunities, according to its cofounder and chief executive officer Gaurav Munjal, who took to X (formerly Twitter) to share his learnings over the last two years.

Munjal said that the startup faced a lot of flak for these decisions, but after two years, it looks like those choices were correct.

It is pertinent to note that the last two years have been difficult for the Indian startup ecosystem due to the ongoing funding winter, which has resulted in many shutdowns and layoffs. The edtech sector has been among the hardest hit, with the troubles of BYJU’S, once the poster boy of Indian edtech and Unacademy’s rival, stealing the limelight.

“Taking decision from first principles might make you look dumb in the short term but it’s still the right way to take decisions,” Munjal said in a series of posts.

Munjal delved into the nuances of business leadership, emphasising the delicate transition from growth to profitability. Highlighting the difficulties in this transition, the CEO said that growth stage leaders thrive on not being constrained, hence they may not always survive this transition.

“It’s just that Growth Leaders thrive on not being constrained. And the Leaders who work with constrains have a different DNA,” he said.

Munjal said that brand-building as a formidable moat in the absence of deeptech and startups need to build great brands and protect them at all costs.

Munjal suggested that many companies are disproportionately allocating resources, cautioning against overemphasis on performance marketing at the expense of brand and content investment.

“Replace your traditional social media team with influencers who have themselves built content and amassed huge following. They know more about social media that your current team ever will,” he said.

He also said that while great distribution and marketing can initially compensate for a subpar product, sustained success requires a focus on both aspects.

On the edtech sector, Munjal said the blitzscaling approach does not work and suggested a more measured strategy where each transaction generates profit. He also expressed optimism about the sector, adding that online learning is here to stay.

“Online Learning is here to stay. Duolingo is generating $100M of Cash Annually and is now valued at $10B. Honestly, this is just the start for Online Learning,” he added.

Giving an example of Graphy, which Munjal claimed is “growing well” now, he said any zero to one project takes at least 3-4 years to show tangible results.

Graphy is a SaaS platform owned by Unacademy which offers learning management system services to creators in the edtech space.

Meanwhile, the founder also expressed his optimism on tech companies and India’s role in it. “Yes, suddenly everyone is excited about Consumer Goods. But I am extremely optimistic about Tech in the long run even if everyone is bearish about Tech right now. It’s a fallacy that India won’t have great Tech Companies so it’s better to build Consumer Goods Companies.”

He also said that the period before 2022 was an anomaly and startup founders need to adapt to the new reality.

A Sneak Peek Into Unacademy’s 2023

However, earlier this month, Munjal claimed that the edtech unicorn managed to reduce its cash burn by 60% in 2023. He said the company’s current cash reserves extend to more than four years.

He also said that the startup turned cash flow positive in the first quarter of FY24, driven by a reduction in cash burn. Noting that the startup’s online business degrew 30% in 2023, Munjal said that EBITDA improved by 87%. He added that its offline business, Unacademy Centres, saw its learners grow to 32,000 in 2023 from 6,000 in 2022.

In October, Graphy fired around 20-30% of its workforce to focus on its offline business. However, the startup claimed that the job cuts happened on the basis of performance and had nothing to do with layoffs or revenue growth plan.

It is pertinent to note that like all other edtech startups, Unacademy was also hit hard by the funding winter and has laid off 2040 employees since 2022.

Meanwhile, Inc42 reported this month that Unacademy has now decided to stop putting non-performing employees on performance improvement plans (PIPs) and will instead provide a direct exit to such employees.

The edtech major also saw several top exits, including those of CFO Subramanian Ramachandran and COO Vivek Sinha, in 2023.

While Unacademy is yet to file its financial statements for FY23, the startup reported a 85% jump in its consolidated net loss to INR 2,848 Cr in FY22 from INR 1,537 Cr in FY21. Revenue from operations jumped more than 80% year-on-year to INR 719 Cr during the year ended March 2022.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.