The Fintech Convergence Council represents the members of the IAMAI and advocates for the fintech sector with a special focus on areas like digital lending and P2P lending

The FCC also appointed new chairs and co-chairs of its six other committees, including digital lending, investment and more, through the recent elections

The elected members’ role becomes important as the RBI has taken a series of steps over the last year or so which have impacted fintech startups

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

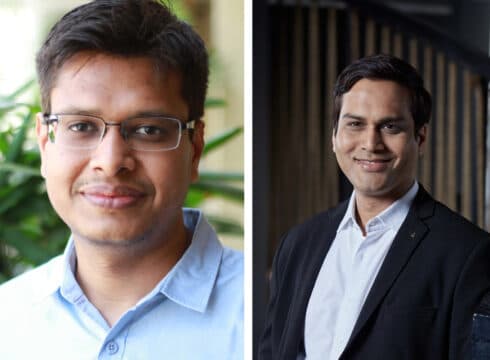

Lendingkart cofounder and CEO Harshvardhan Lunia and Jupiter founder and CEO Jitendra Gupta have been appointed as the new chairman and co-chair, respectively, of the Internet and Mobile Association of India’s (IAMAI’s) Fintech Convergence Council (FCC) following an election.

The duo would be succeeding the erstwhile officeholders Naveen Surya, chairman emeritus of PCI, and executive director of SBI Funds Management, Srinivas Jain, respectively.

Established in 2018, the FCC acts as an advocate for the fintech sector with a special focus on areas including digital lending, P2P lending, insurance, investments, and regtech. It represents the members of the IAMAI and facilitates collaboration and convergence among diverse stakeholders in the financial services landscape by creating a self-regulatory mechanism.

Lunia is a chartered accountant and Indian School of Business graduate and comes with an experience of over 10 years. He started his career with large private sector and multinational banks, including HDFC bank and Standard Chartered Bank, in their small loan divisions.

“I am thrilled to join the Fintech Convergence Council (FCC) as its new Chair. The FCC is a leading voice for the fintech industry, and I am committed to working with the Council’s members to shape the future of finance…. I am positive that my experience will be useful while collaborating with leading lights of the industry,” Lunia said.

With an experience of over 16 years, Jitendra has cofounded several startups in his entrepreneurial journey. His founder portfolio includes Jupiter, Lazypay, and Citrus Pay. Moreover, he briefly served as MD of PayU and chief manager of investment banking at ICICI bank.

“I am thankful to the industry for providing the opportunity to serve as Co-Chair of the Fintech Convergence Council… We will continue to progress on the FCC’s work in the areas of digital lending, DFSP, Insurtech, investment, Regtech, and P2P lending. We will work with respective regulators to drive independent SROs in areas of lending or fintech in general,” Jitendra said.

Besides these appointments, the FCC said new chairs and co-chairs of its six other committees, including digital lending, investment and more, were also appointed through the recent elections.

The elected members’ role becomes important considering the Reserve Bank of India (RBI) has taken a series of steps over the last year or so which has impacted fintech startups. The latest such measure was the RBI’s decision to increase the risk weight for unsecured consumer credit exposure for banks and NBFCs, which is expected to push up the cost of capital for fintechs.

With a massive influx of fintech startups and digitisation of banking and financial services, the homegrown fintech ecosystem has seen robust growth and funding over the last few years.

The Indian fintech industry is estimated to reach a size of $2.1 Tn by 2030, growing at a compound annual growth rate (CAGR) of 18% from 2022, according to Inc42’s State Of Indian Fintech Report Q2 2023.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.