GST Rollout 101: Impact Of Becoming 'One Nation, One Tax' On Indian Startups

On July 1, 2017, the Goods and Services Tax (GST) will be rolled out. And the motto of ‘one country, one tax’ will finally become a reality. The new tax will shift the focus from a tax on production to a tax on consumption and, thereby, entail to create a single national market or, as an expert would say, a single commercial union.

The GST has been billed as the biggest tax reform (in the indirect taxation) since Independence and seeks to have uniform taxation for various goods and services across the country. It will unite India as a single market by folding a plethora of state and central levies into itself.

Announced by the presiding government in 2000, the GST is finally becoming a reality after 17 years. Under the new regime, taxpayers will pay one consolidated tax instead of a variety of taxes. These include State Value-Added Tax (VAT), Central Excise, Service Tax, Entry Tax or Octroi, Customs Duty, Central Surcharge & Cess, Luxury Tax, Entertainment Tax, and Purchase Tax along with a few other indirect taxes.

Mostly, GST will be applied to all goods and services, barring alcohol. Eventually, even petrol and petroleum products will be subject to it.

Thus, in the new regime, GST would be payable on the price actually paid or payable, termed as a “transaction value.” The transaction value or actual paid price will include packing cost, commission, and all other expenses incurred for sales. This tax will be payable at the final point of consumption.

What Happens Under A Goods and Services Tax Regime

The GST doesn’t discriminate between goods and the services and will, therefore, tax both of them at a flat rate. This will remove the multiplicity of taxes and hassles of computation. Indian SMBs will now have to ensure that their processes, including accounting and data management, are efficiently organised so as to be able to file a compliance report three times a month.

In GST filing, only two buckets will have to be created to get input tax credit — one for State-GST and another for Central-GST. Currently, if companies are selling in, say, seven states, they have to make seven buckets for taking input tax credit in value added tax (VAT) paid by them. Similarly, for calculating excise duty in manufacturing units, they have to make as many buckets as there are manufacturing units. For services, only one bucket is required.

In GST, companies will have to file a statement of outward supplies by the 10th of the next month of sale, statement of inward supplies or inputs by the 15th of the next month and returns by the 20th of the next month. The filings have to match inward and outward supplies and claims on input tax credit.

Finance Minister Arun Jaitley has stated, “As I said, we made sure that consumers don’t have to pay more. The net effect of goods and services is not going to be inflationary because once the system of input credits starts the actual incidence is going to be positively impacted.”

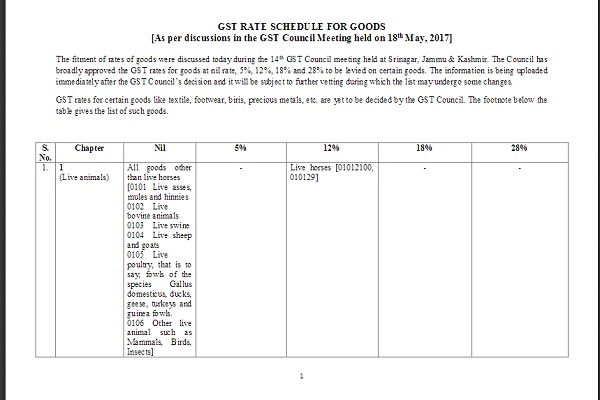

Let’s take a look at the GST rate chart to understand better what item/service will be taxed in what manner.

The GST Rate Card

To start with, the GST Council has finalised tax rates of 0%, 5%, 12%, 18% and 28% for goods and services.

The government has kept a large number of items under the 18% tax slab. The government categorised 1,211 items under various tax slabs. Exceptions are education and healthcare, which will continue to be exempted from tax in the upcoming GST regime. Similarly, gold and rough diamonds do not fall under the current rate slabs and will be taxed at 3% and 0.25% respectively.

The entire list can be accessed here.

The following table gives a broad idea of how common goods and services would be taxed.

- Broadly speaking, transport services will be taxed at 5%, leading to a small drop in economy class air travel which currently attracts 6%. The 5% rate will also apply to cab aggregators like Ola and Uber, which currently pay 6% tax.

- Healthcare and education services will continue to be exempted from tax under the GST.

- Hotels and lodges charging INR 1,000 as per day tariff will be exempt from GST. Rate for hotels with a tariff of INR 1,000-INR 2,000 per day would be 12%, while those with INR 2,500-INR 5,000 would be 18%. The GST for hotels with tariff above INR 5,000 will be 28%.

- Ecommerce players like Flipkart, Snapdeal will have to deduct 1% TCS (tax collected at source) while making payments to suppliers. The Ministry of Finance has however delayed provisions related to TDS (Tax deducted at source) and TCS for ecommerce players yesterday in order to ensure the smooth rollout of the GST.

- Under the GST regime, businesses with a turnover exceeding INR 20 Lakhs will have to pay duty. Earlier this limit was INR 1.5 Cr. For the North Eastern States, the exemption limit has been set up at INR 10 Lakhs. This increase in the GST threshold limits will mean a sigh of relief for traders and service providers. This is because, currently, the threshold of VAT is INR 5 Lakhs in most states and INR 10 Lakhs for service tax, which will mean more taxpayers will be exempt from the GST. However, it also creates bad news for manufacturers because the previous excise threshold was INR 1.5 Cr. Hence, small manufacturers with a threshold more than INR 20 Lakhs will have to register under the GST.

Sector-Wise Impact Of GST On Startups

At the outset, the GST aims to simplify the tax regime by reducing the multiplicity of taxes. This would not only bring compliance costs down but also make taxation transparent with digital tax processes. Startups lack the resources to hire tax experts or a dedicated team for handling compliance. Hence the DIY model makes it easy to do taxpayer registration, return submission, tax payments, and claim refunds online. These will be advantageous for all sorts of startups irrespective of sectors.

In India, ease of doing business is not easy. Entrepreneurs have to undergo several steps in order to start doing business. This includes company registration, service tax registration, VAT registration they intend to operate in among others. business expansion will become seamless as GST will enable entrepreneurs to get just one license for their company and then do business in as many states. Also, with the GST, all states in India will have the same tax rate and this will bring down the logistics costs for many businesses.

Also, under the GST exemption limits, startups that are at a nascent stage with turnover below INR 20 Lakhs need not worry about compliance and can continue operations without registration. However, this limit does not apply to startups in the ecommerce sector.

However, let’s take a look at specific sectors to assess GST’s impact.

Impact On Ecommerce

Currently, ecommerce websites do not collect tax in any form. However, under the GST structure, they will collect TCS at a fixed 1% rate (tax collected at source) while paying to the sellers listed on their websites. This is likely to impact prices and make online shopping more expensive. Though the latest notification issued by the government stated that the provisions of “TDS (Section 51 of the CGST/SGST Act 2017) and TCS (Section 52 of the CGST/SGST Act, 2017) will be brought into force from a date which will be communicated later.”

The government said that the step was taken after taking stakeholder feedback into consideration. The step will provide more time for entities liable to deduct tax at source/ecommerce companies and their suppliers to prepare for the GST. The notification further said that the “Persons who will be liable to deduct or collect tax at source will be required to take registration, but the liability to deduct or collect tax will arise from the date the respective sections are brought in force.”

Currently, triggered by the impending GST levy, ecommerce platforms such as Flipkart and Amazon India are offering upto 80% discount on apparels and furniture.

However, as per an ET report, these discounts might become scarcer in the future as they will attract an additional tax. Additionally, since an ecommerce player will have to pay tax on the price they have purchased the goods from the supplier, they might be forced to consider offering further discounts, leading to some sort of market stabilisation with respect to user acquisition.

Similarly, returns and cancellations will become trickier. As per the report, ecommerce companies have a return or cancellation rate of nearly 18%. While collecting TCS, ecommerce players have to bear the tax amount on their own and will only get refunds only from the government in case of returns and cancellations. More so, more than two-thirds of the transactions are on COD, reconciliation for which happens about 7-15 days later. This would pose a burden on the operators seeking refund, in case of cancelled or returned orders on which tax has already been deducted. This puts them at a major cash-flow disadvantage, which might make them reconsider the terms and conditions around these policies

Also, ecommerce players will have to initiate stock-transfer of goods from vendor to warehouse or one warehouse to another under the GST. Currently, stock transfers are not liable to any tax, with the exception of entry tax. But under GST, interstate stock transfers will be liable to IGST. This could have a major impact on the Micro Small and Medium Enterprises (MSMEs).

Samar Singla, CEO and founder of hyperlocal startup Jugnoo explains some of the conundrums which ecommerce startups are facing. He says, “As an aggregator in the on-demand space, we have the majority of our customers with a lesser turnover than the threshold defined in GST. But, by explicitly defining the ecommerce operator in the act, the government has indirectly covered these small merchants to register for the GST if they sell or purchase using an ecommerce operator. However, this has been deferred temporarily now.

He further adds that in the hyperlocal space such as where Jugnoo operates in, onboard merchants are small shop owners who have not yet understood the GST registration process. “Most of them have been taking “free consultancy” to get registered. The consultants in the market are charging them a very high fee. Further, they do not know what rates to be charged and how they will be penalised if they fail to register. Overall for an aggregator, this is not going to be easy.”

Samar further added that they might need a minimum of 6 months to make a smooth transition else it will lead to business disruption. He explains, “The biggest issue is multiple instances of return filing. Then we may have return mismatch which may lead to further disputes and instances of reconciliation. Furthermore, as an aggregator, we have to register in each state simply because the state government does not want revenue leakage but it adds to multiple levels of complexity for us. The other way it impacts is that we have to register in all states that we operate. This one regulation negates the whole benefit of GST in the case of the ecommerce operator.”

Impact On Logistics

The one sector which will benefit under the GST is logistics, as retailers will not have to file a separate paperwork for each state. This means deliveries will become faster as the extra paperwork imposed by states will no longer be imposed, making deliveries seamless. The usual turf wars between the Centre and State governments due to the current differential tax regime will also decrease leading to reduced logistic inefficiencies, slow transit times, red tape and disruption in the overall business climate. Thus, movement of goods will be seamless leading to faster turnaround times, lower costs, and overall faster business growth. This will enable India to become one single market.

Interestingly, the unified regime also affords businesses a higher flexibility in determining where to set up their business and which markets to serve considering the transit of goods would be a more painless process, henceforth. Businesses can, therefore, base themselves where they can gain long-term competitive advantage in terms of resources and won’t be driven solely by short-term benefits of tax breaks provided by states.

Archit Gupta, founder of ClearTax points out how GST will enable India to become a single market. He says, “According to research done by TCIL, a truck in India typically covers between 250-400 kms a day, compared to 700-800 kms in the US and Europe. This is mainly due to the check posts and entry tax collection points on state borders. However, once GST sees the light of day, India will become one single market, free from state entry levies wherein goods and services can flow freely.”

Also, the logistics industries in India have to maintain multiple warehouses across states to avoid the current CST and state entry taxes on inter-state movement. As the GST unites India by removing restrictions on inter-state movement of goods, this will lead to a warehouse consolidation across the country.

Archit also points out that, currently, states have different VAT laws. For example, online websites (like Flipkart, Amazon) delivering to Uttar Pradesh, have to file a VAT declaration and the registration number of the delivery truck. Tax authorities sometimes seize goods when there is a failure to produce documents. Again, they are treated as facilitators or mediators by states like Kerala, Rajasthan, West Bengal not requiring them to register for VAT. Under the GST, differential treatment and confusing compliances will be eradicated.

Similar sentiments are expressed by Pushkar Singh, co-founder of Bengaluru-based techno-logistics startup LetsTransport. He states, “The logistics industry, today, contributes about 13%-14 % of India’s GDP, whereas the global average is 8%-9% in a developed economy. As an important link of the national economy, logistics usually changes accordingly with the developing economy and reversibly puts its influence on the economy developing. The higher the trade and movement of goods across the market, higher will be the GDP. There are a lot of flaws in the current framework of the logistics sector and with the GST coming in, a percentage of these logistic flaws will end up spending as GDP.”

He adds that the hub and spoke model is a very efficient and proven framework to build data warehousing for a company. Right now, the primary component taken into consideration while designing the warehousing model is the taxation involved in commuting across the borders and in each state.

“Once GST comes in, the hub and spoke model could be developed based on the demand pattern that a manufacturer or a brand would see. Based on these demand patterns, you would see more warehouses coming up and generating a demand-centric area or the hub which could optimise transportation costs therein. . So, the entire snag of taxation being the main focal point in the planning of your supply chain changes to being more optimum and being more efficient as a supply chain.” he explains.

Impact On Manufacturing Startups

Initially, startups in the manufacturing sector will bear the brunt of the GST regime. Under the existing excise laws, only manufacturing business with a turnover exceeding INR 1.5 Cr has to pay excise. But in the new GST regime, the turnover limit has been reduced to INR 20 Lakhs. This increases the tax burden for many manufacturing startups, but at the same time also bring a large number of SMEs under the tax net.

However, it is hoped that post-implementation, most of the current challenges will be sorted, as India becomes a single market where goods can move freely and with lesser compliances for startups.

Abhijeet Vijayvergiya, VP & Business Head-APAC, Capillary Technologies explains the effects on the apparel sector. He says, “One of the key contributors to the Indian economy is the apparel sector. The contribution to the country’s GDP and exports sums to a whopping 6% and 13% respectively. With the indirect taxes being replaced by the fixed tax structure, each product category will vary from 5% to 28%.”

He gives a few examples to explain the structure. “For example, apparels costing less than INR 1,000 will bear a tax of 5%, while a 12% tax will be levied on the ones costing above INR 1,000. The textile manufacturing industry, which is at the bottom of the value chain, is welcoming the 5% GST rate. So, the non-premium brands will benefit from the GST which generate 80%-90% sales from products worth less than INR 1,000. But premium brands might take a hit. Having said that, the loyalty of the customers to the brands will be a defining factor for both premium and non-premium brands alike.”

Impact On Ride-Hailing Startups

Broadly, transport services will be taxed at 5%. This will lead to a small drop in economy class air travel. The 5% tax rate will also apply to cab aggregators like Ola and Uber. Thus, GST will bring down the tax rate for ride-hailing services marginally.

Ride-hailing startup Uber India believes that the new rate structure at 5% as compared to the previous service tax rate of 6% is a step in the right direction by the GST council. An Uber spokesperson stated, “The government has not only reaffirmed its pro-consumer, pro-business stance by keeping transport services in the lowest tax bracket but also put to rest any apprehensions among drivers and riders around GST rates being inflationary. Harmonising a large number of central and state taxes into a single simplified tax regime, the move is expected to convert the entire country into a seamless market.”

But while the 1% fall may bring some cheer to consumers, driver partners of both Ola and Uber will be affected. This is due to leases becoming costlier, post-GST. Shalabh Seth, CEO, Ola Fleet Technologies Ltd, a wholly-owned subsidiary of Ola explains,

“At Ola Fleet Technologies, we run a leasing programme for tens of thousands of driver partners who may not be able to afford buying a car of their own. Presently, these driver-partners pay 14.5% VAT. In the proposed GST regime, they will have to bear GST rates of 29% to 43% on the cars already leased, as an outcome of double taxation on existing leases. This will have an adverse impact on their livelihoods, setting them back over INR 1,00,000 for the remaining period of the lease, making it unviable to sustain their business.”

Consequently, as per an ET report, an industry grouping that includes LeasePlan, Arval, TranzLease, Orix, Magma, AVIS, Clix Capital, Tata Capital, Ola, Uber, Sundaram Finance as well as the Tractor Manufacturers Association have petitioned the government seeking exemption from central goods and services tax on existing leases to prevent double taxation as central excise duty has already been paid on the vehicles.

Online Event Ticketing

Overall GST, would have little impact on multiplexes and large single screen theatres, even though the Government relaxed the GST rate from the originally announced 28% to 18% for cinema tickets priced below INR 100.

Mitesh Shah, VP Finance, BookMyShow explains, “At the macro level, GST is definitely a positive move towards a much-needed, unified tax regime. This will be critical in plugging the existing tax leakages existing within the entertainment industry and thereby helping bring in more economic balance for companies associated with this sector. Though the Government relaxed the GST rate from the originally announced 28% to 18% for cinema tickets priced below INR 100. In effect, the impact of this may not be as widespread- especially among the multiplexes and large single screen theatres. This is largely because the overall share of this category in the total ticket sales is estimated to be a low number.”

However, he points out that regional cinema, which earlier benefitted from the exemption of entertainment tax, will also now fall under this tax regime. Even for the events industry, the exemption limit for GST is prescribed for tickets priced below INR 250 which compares unfavourably with the earlier limit of INR 500 under the Service Tax regime.

“A major area of concern also remains that certain states have been empowered to levy Entertainment Tax. If exercised, this will neutralise the positive impact of lower GST rates in many regions. Having said that, the recent decision of the government to defer the TCS provision has come in as a big relief. At BookMyShow, we are fully geared up to embrace this new tax regime and are hopeful that the GST, while benefitting all, will bring in much-needed economy and efficiency in the industry,” he added.

Technology And Services Startups

Currently, any business providing products and services is subjected to both VAT and Service Tax. This adds to the burden of tax compliance and increases the cost of doing business in the form of higher taxes. As the GST does away with the distinction between products and services, tax calculation for such businesses will become simpler.

For instance, startups in the service industry have to pay service tax. Under GST, such startups will be able to set off the VAT paid on their purchases (say, on office supplies), with the service tax on their sales, which is not possible under the current regime. So basically startups can enjoy tax credit on their purchases as the tax paid on buying supplies can be subtracted from the total tax to be paid on service it provides. This means, in many cases, it will lead to lowering of taxes.

Archit astutely adds, “There is a race for all fintech companies to develop GST software. The GST will impact these companies positively by opening a huge market pan India. Demand for GST software by all companies will mean a huge boost to these software developers.”

Online Travel Industry

As mentioned earlier, hotels and lodges charging INR 1,000 as per day tariff will be exempt from GST while more than those will be subject to 12%-28% tax, depending on their price slabs.

Indroneel Dutt, Chief Financial Officer, Cleartrip, feels that GST brings a mixed bag of offerings for the tourism industry. It is anticipated to be a great leveller not just for the rate rationalisation but for the predictability it brings to tourism.

He says, “For air travel, the council’s decision to pull down the tax rate for economy class tickets should incrementally earn and help sustain growth in the sector. However, with its tiered tax structure for hotels, mid-market hotels which are an integral part of such travel are being subject to an overall 8 to 10% cost increase and philosophically being bracketed as a ‘sin tax.’”

He does believe that coupled with the broader aviation strategy of promoting regional travel, the new tax amendment will help usher in a new era in Indian domestic aviation. However, it might fall short of giving similar velocity to the overall tourism industry if viewed in isolation.

Archit further clarifies, “Budget travellers have a reason to cheer and plan for the upcoming holidays. On the other hand, business class fares are going to cost higher. However, it is only a marginal increase from 9% to 12%. This slight increase in travel prices is probably not enough to deter business travellers from their travel plans.”

He believes that, on the whole, domestic tourism will get a huge boost. For luxury travellers, there will be some increase in prices but the ease of travel will also increase with efficient check-ins and check-outs and lesser waiting time for billing and invoicing. Restaurant prices will go up, for sure, but once again this will mostly affect gourmet diners.

This sentiment is further seconded by Sidharth Gupta, co-founder, Treebo Hotels. He says, “Tax rates on budget accommodation will go down with GST which is a great news for us. 75%-80% of Treebo’s inventory lies in the Rs 1,000-INR 2,500 price band. The GST applicable in this band is 12% as opposed to 17%-20% applicable earlier. This means that our rooms will now be even more affordably priced, and many more customers will be able to benefit from the highest quality accommodation services we offer.”

Ritesh Agarwal, founder and CEO, OYO concurs that the lower tax rate for budget hotels sector will ensure that the industry’s quality upgrade continues while delivering standardised accommodation to millions of middle-class travellers.

He says, “This will also save and create thousands of new jobs which could have been impacted by higher tax rates. Hotels are the single biggest contributor to tourism industry which accounts for 7.5 percent of the GDP. The move will boost revenue from the travel & tourism sector for the next many years. The industry is expected to contribute $280 Bn dollars to the GDP by 2026 and will pass on benefits of uniform taxation across the country to travellers.”

At the same time, he agrees that with the GST being a large-scale reform, there may be some initial teething issues. In that regard, he welcomes the government’s decision to allow companies to file late returns during the first two months.

Ritesh says, “This is a practical solution permitting flexibility in the early period as all stakeholders come to grips with the nationwide tax system. Of course, there may be challenges in compliance and implementation. But, over time, there will be more clarity and familiarity, enabling all stakeholders to adjust, adapt, and adhere. Already we have seen the GST slab for mid-market hotels be revised in response to an industry-wide request for relief. This is a progressive step and will ensure that more businesses come under the tax-net and deliver more revenue to the exchequer.”

Deepak Gulati, COO Zomato also believes that the GST rollout will smoothen out a lot of chinks, though it will be a bit painful in the beginning. He says, “The vision behind the GST roll out to create a standardised and uniform marketplace across the country is both ambitious as well as progressive. It’s a step in the right direction. While the GST roll out and adoption will be painful in the beginning, it will help smoothen out a lot of chinks in the longer term. We also hope that the interests of SMBs and smaller restaurants are taken into consideration as the policy evolves and gains wider adoption.”

A GST–ised India: What Does The Way Forward Look Like?

There is no doubt that there will be many teething issues as the GST rolls in on July 1. This could range from a few months to possibly a year for manufacturing companies. Both in manufacturing and FMCG companies, the pain could cause short-term disruption of increased working capital and a partial hit on profitability. An inflationary effect on certain items could also be created.

However, with a single tax regime subsuming VAT and other taxes, no confusing laws, startups will only have to comply with a single nationwide tax. This would result in enhancing India’s ranking on the World Bank’s ‘Ease of Doing Business Index’ where it stands at 130 at present.

As the GST doesn’t discriminate between the goods and the services and taxes them at a flat rate, it will remove the multiplicity of taxes and hassles of computation. This will result in improved collections and participation in tax net and improve the overall ease-of-doing-business. With businesses and enterprises saving on taxes as well as complexities, companies ultimately stand to gain. The new tax law will also remove the root cause for the temptation for tax evasion. Additionally, it will help in streamlining supply chains.

More so, the design of GST is such that it makes it necessary for businesses to employ technology to run their business and accounting processes. This augurs well for the government’s digitisation drive. As more businesses come online, they will create more opportunities as well as be able to leverage more avenues of growth. Hence, this also benefits technology-based product and service companies as demand for their solutions will increase in the post-GST regime.

Also, as compliance requirements under GST are well-defined, businesses will have to learn to adjust better. This, in turn, implies they will move to increased automation of their accounting processes which will ultimately result in increased operational efficiencies.

Overcoming Initial Hiccups

Of course, initial hiccups could persist for longer periods. One of them is learning the compliances to new procedures. There is likely to be some increase in compliance costs. Exempt enterprises may have an increased sales tax burden. Uncertainty and confusion with respect to getting tax refunds are another hiccup.

As the GST rolls out, lack of clarity is one unsettling factor as it hampers business decisions, for instance, on pricing. Initially, working capital requirements may increase substantially and then settle down once the process is established. Since many SMEs do not even have an online presence, getting them all smoothly onboard the digital bandwagon, and expecting them to learn digitally file GST filings seamlessly is a big ask.

For this, the GST Council has extended the deadline for filing a GST return for the first two months and allowed a simpler format for the same, citing lack of preparedness on part of the ERP providers and other businesses. The relaxation is meant for the first two months whereby the assessees can file returns for July by August 20, and for August by September 20. However, they will have to file the return with invoice-wise details for both August and September in September itself.

In all, the GST regime change is huge and won’t be smooth sailing. Hence, the startup ecosystem too should be prepared for a bumpy ride for the next few months as the GST juggernaut rolls out slowly in the country.

Ad-lite browsing experience

Ad-lite browsing experience