Revenue secretary Sanjay Malhotra said online betting has always attracted 28% GST and as such, the tax notices are not retrospective in nature

Chhattisgarh minister TS Singh Deo said many states flagged during the GST Council meeting that the dues being demanded from some online gaming platforms are more than their turnover

This comes close on the heels of tax authorities issuing exorbitant GST notices to online gaming companies, demanding dues in excess of INR 50,000 Cr

Amid the tax authorities issuing a flurry of show cause notices to online gaming startups, the union government has clarified to the states that the 28% goods and services tax (GST) is not being levied retrospectively on these platforms.

The Centre said online betting has always attracted 28% GST and as such the tax notices are not retrospective in nature.

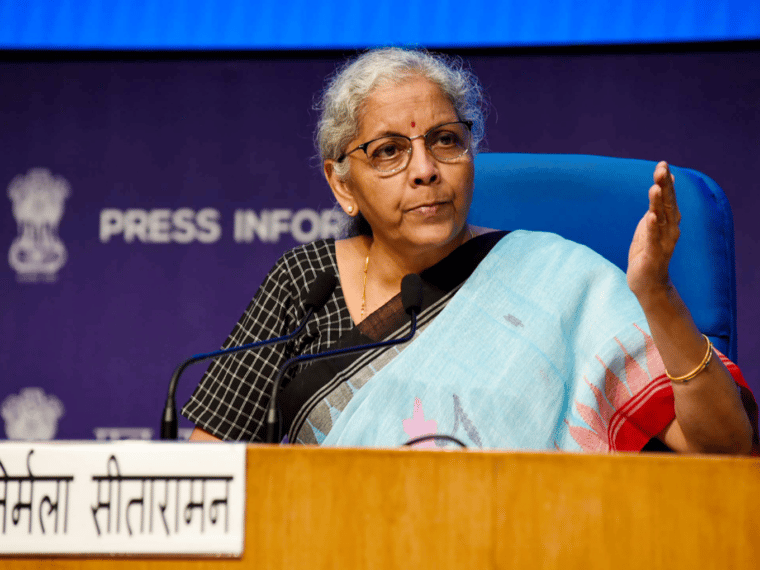

“It was informed to certain members that this is not retrospective in any way because this is how the law was earlier. Law has not been amended retrospectively. These liabilities were already existing because money online games played with bets… they were already attracting by virtue of betting or gambling 28% GST,” revenue secretary Sanjay Malhotra said during a press briefing after the meeting of the GST Council on Saturday (October 7).

Earlier, Maharashtra minister Deepak Vasant Kesarkar said that many states raised the matter of retrospective imposition of the levy on online gaming platforms during the GST Council meeting on October 7, Moneycontrol reported.

As per the report, Chhattisgarh minister TS Singh Deo said that many states highlighted that the dues being demanded from some online gaming platforms are more than their turnover.

Earlier in the day, Delhi’s finance minister Atishi also called for withdrawing the 28% GST mandate for online gaming companies, saying the tax can jeopardise the entire startup ecosystem and may lead to significant job losses.

This comes close on the heels of tax authorities dishing out exorbitant GST notices to online gaming companies, demanding dues in excess of INR 50,000 Cr. Earlier this week, the Directorate General of Goods and Services Tax Intelligence (DGGI), Mumbai Zone issued an INR 28,000 Cr notice to gaming unicorn Dream11. Prior to that, tax authorities also handed out an INR 21,000 Cr notice to Games24x7’s parent entity.

It is pertinent to mention that online gaming platforms paid 18% GST on the total platform fee earlier as there was no regulatory clarity on the matter. On the other hand, betting and gambling attracted 28% GST. Under the revised GST rate, which came into effect on October 1, all real money gaming platforms will have to pay 28% GST on full face value of the bets.

There have been whispers from many quarters that the tax authorities have been sending the show cause notices by applying the GST amendment retrospectively. Many online gaming firms, including unicorn Dream11, have taken the legal route to challenge the notices.

Gaming platforms fear that the increase in GST rate would hit the top and bottom lines. Earlier, gaming giant Mobile Premier League (MPL) and web3 gaming platform Hike laid off employees following the GST Council’s decision on taxing real money gaming companies.

Meanwhile, platforms such as Quizzy, OWN, and Fantok temporarily shut their operations as they chart their next course of action. In September, Bengaluru-based Gameskraft also shelved its fantasy offering, Gamezy Fantasy.

Ad-lite browsing experience

Ad-lite browsing experience