Offshore gaming platforms not adhering to registration norms would be banned under the provisions of the IT Act

A monitoring cell under the Directorate General of GST Intelligence (DGGI) is in the offing to monitor offshore gaming companies that operate without paying taxes

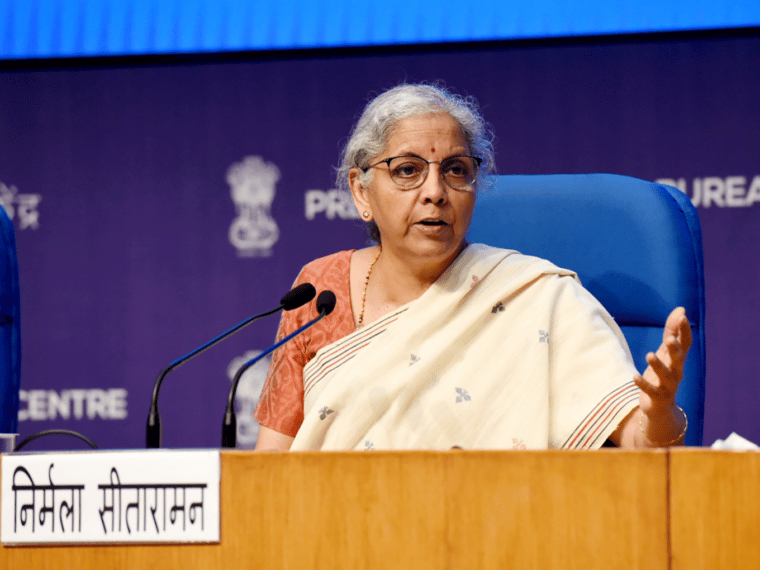

Following the GST Council meeting, FM Nirmala Sitharaman said that 28% GST levy on real-money gaming would come into effect from October 1

Following the GST Council’s decision to levy 28% GST on real-money gaming, the Centre now plans to introduce provisions mandating registration of offshore gaming platforms.

“We will introduce a specific provision in the law requiring that registration will be needed for offshore online gaming. It will be a simple process,” revenue secretary Sanjay Malhotra said while addressing the media after the 51st meeting of the GST Council on Wednesday (August 2).

The companies flouting the prospective norms would be banned under the provisions of the IT Act, Malhotra added.

The official also said that a monitoring cell under the Directorate General of GST Intelligence (DGGI) is in the offing to monitor such companies that operate without paying taxes.

However, the All India Gaming Federation (AIGF) appeared to be unmoved, saying the government’s previous efforts to block offshore gaming platforms have been ineffective till now.

Earlier, finance minister Nirmala Sitharaman said that the 28% GST on real-money gaming would be implemented from October 1 and it would be open to review six months after its implementation.

Commenting on the GST Council’s decisions, Sudipta Bhattacharjee, partner at Khaitan & Co, said, “Investors in this sector may continue to be concerned given the ‘blow hot, blow cold’ approach towards online gaming as a sector where on the one hand, the sector is lauded and encouraged through ‘light touch’ regulations by the MeitY and on the other hand punitive taxation is reaffirmed to be imposed under GST.”

Industry stakeholders also noted that companies looking to move base abroad would come under the ambit of the GST levy due to the new registration mandate for offshore companies.

“Even shifting of base outside India would not help to escape the levy, as the GST Council has decided to bring in GST registration requirements for such offshore companies for the purpose of discharging GST in India,” Saket Patawari, executive director at financing advisory firm Nexdigm, was quoted as saying.

Addressing the media after the meeting of the GST Council, Sitharaman also said that the GST Act would be amended to make provision for the 28% GST levy. The legislation would be taken up during the ongoing Monsoon Session of the Parliament.

The finance minister said that states raised different concerns and questions over the move to impose 28% GST on real-money gaming. While Delhi sought a review of the levy, Sikkim and Goa asked to reconsider the decision to levy GST on gross gaming revenue (GGR).

Meanwhile, Tamil Nadu’s finance minister wanted to know if the tax regime pertaining to online gaming would nullify the ban in the state on online gaming, Sitharaman said.

She added that several states, including Maharashtra, Gujarat, Uttar Pradesh and Himachal Pradesh, sought the implementation of 28% tax at the earliest as they felt that too much time had been spent on debating the matter.

Much has been brewing in the Indian online gaming space ever since the GST Council, last month, decided to levy 28% GST on online real-money gaming on full face value.

The Council’s move has received sharp criticism from industry bodies and startups, with many even writing to the Centre to nudge the former to reconsider the proposal. However, as things stand now, the GST Council has decided to stick to its guns. It remains to be seen what effect the decision has on India’s gaming industry, which has produced unicorns like Dream11 and MPL.

Ad-lite browsing experience

Ad-lite browsing experience