Groww had 6.63 Mn active investors at the end of September 2023 as against Zerodha’s 6.48 Mn

Groww founder Lalit Keshre said the digital public infrastructure built over the last few years in the country enabled its growth

Nextbillion Technology, which operates fintech unicorn Groww, reported a 10.73X year-on-year rise in profit after tax at INR 73 Cr in FY23

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Fintech unicorn Groww has raced past Zerodha in terms of active investors at the end of September 2023.

As per National Stock Exchange (NSE) data, Groww had 6.63 Mn active investors at the end of September 2023 as against Zerodha’s 6.48 Mn.

As per the data, the active traders in the country stood at 32.56 Mn at the end of September 2023. Within this, Groww’s market share stood at 20.35%, closely followed by Zerodha, at 19.9%. These two firms were followed by AngelOne, Upstox, and ICICI Securities.

At the end of September, India had approximately 129.7 Mn demat accounts. Surprisingly, NSE data reveals that out of this substantial number, only 33.4 Mn individuals actively engage in trading on the exchange at least once a year.

Commenting on the development, Lalit Keshre, founder of Groww, said on X. “Firstly and most importantly, we are grateful to all our customers who trusted a young company – our focus will always be to provide you the best experience. Secondly, we are grateful for the digital public infrastructure (DPI) built over the last few years that enabled our growth.”

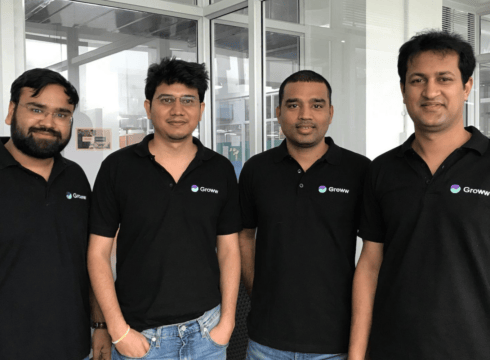

Founded in 2017 by the ‘Flipkart cartel’ comprising Harsh Jain, Lalit Keshre, Neeraj Singh, and Ishan Bansal, Groww is a wealthtech startup that enables its users to invest in stocks, exchange-traded funds (ETFs), and IPOs.

Zerodha and Groww have been at the forefront of a transformative wave in the Indian brokerage industry. While Zerodha is often recognised as a trailblazer in the Indian brokerage sector, six-year old Groww has emerged as its strong rival.

Some of Groww’s gains in active clients can be attributed to the fact that it does not charge for account opening or annual maintenance. It is also known for its youth-orienred marketing campaigns, whereas Zerodha is not very aggressive in terms of marketing activities.

In a recent blog post, Zerodha said it continues to be the only broker in the country that charges an account opening fee (INR 200) and hinted that the company has no plans to stop this.

Nextbillion Technology, which operates fintech unicorn Groww, reported a 10.73X year-on-year (YoY) rise in profit after tax (PAT) at INR 73 Cr in the financial year 2022-23 (FY23). In contrast, the company logged a PAT of INR 6.8 Cr in FY22, as per information shared with credit rating agency ICRA.

Last month, Zerodha said it recorded a total income of INR 6,875 Cr during the financial year 2022-23 (FY23), an increase of 38% from INR 4,964 Cr in the previous fiscal year. Its net profit stood at INR 2,907 Cr in FY23 as against INR 2,094.3 Cr in FY22.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.