SUMMARY

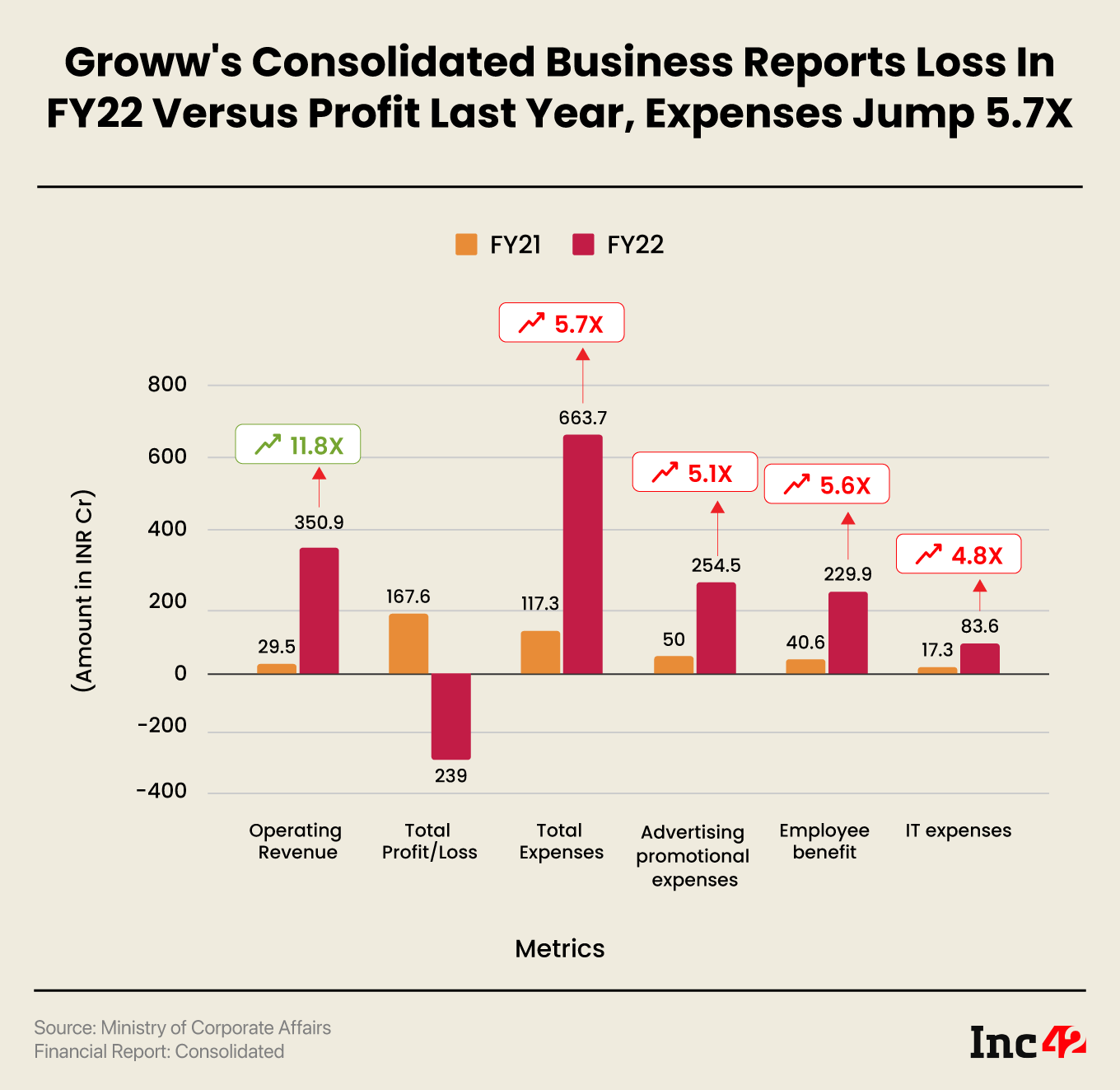

The investech unicorn had reported a profit of INR 167.6 Cr in the financial year 2020-21

Billionbrains Garage Ventures, the parent entity of Groww, slipped in the red despite an 11.8X jump in operating revenue to INR 350.9 Cr in FY22

Groww’s total expenses surged over 465% to INR 663.7 Cr, with advertising and promotional expenses accounting for INR 254.5 Cr

Fintech unicorn Groww reported a consolidated loss of INR 239 Cr in the financial year 2021-22 (FY22), as against a profit of INR 167.6 Cr in the prior fiscal year, on the back of a sharp rise in its expenses.

As per the filings of Billionbrains Garage Ventures Private Limited, the parent entity of Groww, with the Ministry of Corporate Affairs, the investech platform reported a loss despite an 11.8X jump in operating revenue to INR 350.9 Cr in FY22 from INR 29.5 Cr in the previous year.

As a financial services platform, Groww earns majority of its revenue from the sale of services, which is recognised based on contracts with customers. The sources for its revenue include income from tech platform services and from services rendered as a broker. Groww offers direct plans for mutual funds and enables users to invest via its mobile app and website.

Groww earned INR 325.8 Cr as fees and commission income in FY22 as against INR 12.9 Cr in FY21. On the other hand, its income from tech platform and support charges declined to INR 2.4 Cr from INR 14.5 Cr in FY21.

Meanwhile, Groww earned INR 22.7 Cr from interest income on fixed deposits with banks earmarked with stock exchange, a jump of almost 11% year-on-year (YoY).

Billionbrains Garage Ventures runs Nextbillion Technology, Neobillion Fintech, Billionblock Finserv, and Groww Services as its subsidiaries in India.

Groww’s total revenue increased 50.6% YoY to INR 427.2 Cr in FY22. Its other income including interest earned on fixed deposits and current investments saw 70% YoY decline to INR 76.3 Cr in FY22.

On the expenditure side, Groww’s total expenses surged over 465% to INR 663.7 Cr in the reporting period from INR 117.3 Cr in FY21.

Advertising and promotional expenses accounted for 38% of the total expenses at INR 254.5 Cr as against INR 50 Cr in FY21.

Groww is known for its aggressive youth-oriented advertising campaigns that encourage millennials to invest in stock markets using its app.

On the other hand, employee benefit expenses grew over 466% to INR 229.9 Cr in FY22 from INR 40.6 Cr in the previous fiscal year. The startup spent INR 109.5 Cr on salaries and wages in FY22, registering a 211% YoY rise, while its employee share based payments during the year stood at INR 112.5 Cr.

The jump in expenses was in line with the startup’s announcements post its fundraises. Groww raised two rounds of funding in FY22. The first was its Series D funding round of $83 Mn in April 2021, which was led by Tiger Global, at a unicorn valuation. The next was in October 2021, in which it raised $251 Mn at a valuation of $3 Bn.

While announcing the fundraises, Groww said it planned to expand its reach to the under-penetrated geographies in India, strengthen the team, scale tech infrastructure, and add more financial products and services to its platform. Spreading financial education and awareness was also a part of the growth plans.

In fact, Groww’s IT expenses surged 383% to INR 83.6 Cr in FY22 from INR 17.3 Cr in FY21.

On the other hand, miscellaneous expenses, including transaction and other related charges and foreign exchange losses, grew to INR 77.3 Cr in FY22 from INR 4 Cr in the previous year.

As per a recent report by Motilal Oswal on top discount brokers in India, Groww, Zerodha and Upstox occupy the top three spots in terms of number of active clients.

Founded in 2017 by ex-Flipkart employees Harsh Jain, Lalit Keshre, Neeraj Singh, and Ishan Bansal, Groww currently has 5 Mn active clients. Its active clients increased 31.5% between FY21 and FY22. The startup recently made a strategic investment in fintech SaaS startup Digio.

Zerodha, Groww’s biggest competitor, reported an 87% YoY jump in its net profit to INR 2,094 Cr in FY22.

Ad-lite browsing experience

Ad-lite browsing experience