The micro-fund will invest between $200K and $1 Mn in 15-20 pre-seed startups in a period of 10 years. It will have a final closure by quarter three (Q3), 2023

The fund will target about 10% ownership in the invested startups, preferring to lead the fundraising rounds or co-lead them with other specialised funds

Grayscale Ventures invested in SaaS-based startup Olvy and billing software provider for pharma retailers Localwell

Singapore-based Grayscale Ventures has made the first closure at $10 Mn of its $20 Mn micro-fund. The fund targets AI, vertical SaaS and DevInfra-based (development infrastructure) startups.

The micro-fund will invest between $200K and $1 Mn in 15-20 pre-seed startups in a period of four years. It will have a final closure by quarter three (Q3), 2023.

The fund will target about 10% ownership in the invested startups, preferring to lead the fundraising rounds or co-lead them with other specialised funds.

“We come from Dev and Product backgrounds, so we tend to understand what technical founders are building better than most generalist investors. Our portfolio founders find value in working with us as we support them in figuring out their product-market-fit and opening up market access in the US and APAC,” the Grayscale Ventures said in a statement.

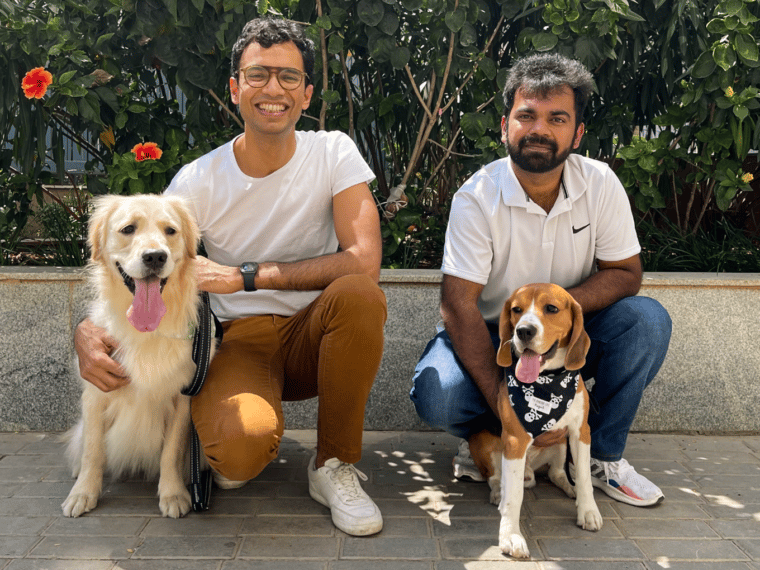

Grayscale Ventures, which was founded by Nikhil Kapur and Siddharth Verma, has limited partners (LPs) from Japan, SEA, the US and India. These LPs are operators and founders of Slack, Zendesk, Hasura, GlobalWay, Nexus, STRIVE, Apollo Munich and UOB, among others.

Both founders previously worked with STRIVE, where they backed several pre-seed funding rounds in India. Hasura, Classplus, 100ms, Reshamandi, and Testsigma are some of these Indian startups.

Meanwhile, during its stint at STRIVE, the two founders led secondary sales, merger & acquisition (M&As) opportunities in portfolio companies such as Hasura, SuperK, and PopXO.

So far, Grayscale has invested in SaaS-based startup Olvy and billing software provider for pharma retailers Localwell.

The fund announcement has come at a time when Indian startups are grappling with low funding investments. However, on the flip side, investment companies have come up with VC and PE funds to support the startup fraternity with funding.

This month, VC firm PeerCapital completed the first closure of its maiden fund at $37.5 Mn.

While in January, Dallas Venture Capital announced the first closure of INR 350 Cr fund and Sanjay Mehta-led fund infused INR 1.25 Cr in 25 startups as part of its eighth cohort.

________________________________________________________________________________________________

Update| 27th February, 4.48 PM

The story has been updated to change commitment period of the fund

Ad-lite browsing experience

Ad-lite browsing experience