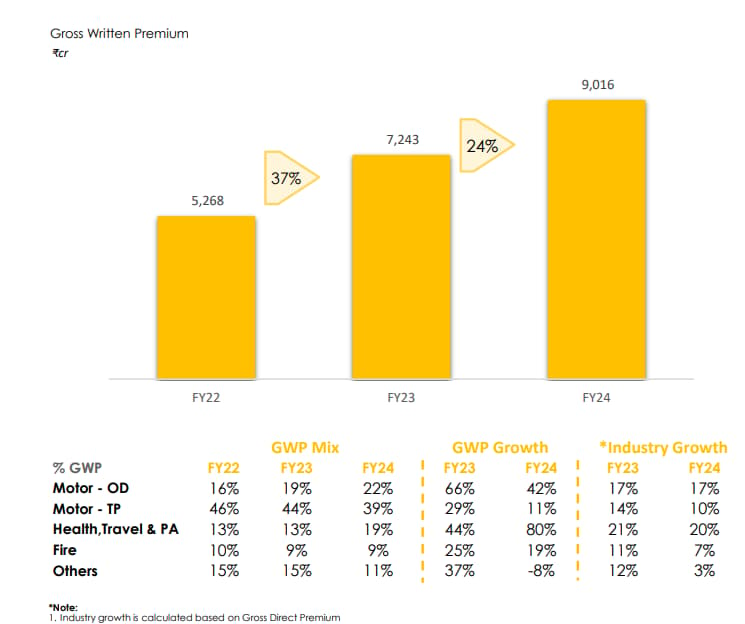

Go Digit’s total gross written premium (GWP) increased 24.5% YoY to INR 9,016 Cr in FY24

Its net earned premium stood at INR 7,096 Cr in the reported fiscal as against INR 5,164 Cr in FY23

The company's assets under management stood at INR 15,764 Cr as of March 31, 2024

Recently-listed insurtech startup Go Digit posted over a 400% jump in its profit after tax (PAT) to INR 182 Cr in the financial year 2023-24 (FY24) from INR 36 Cr in the previous fiscal year.

Led by sharp growth in health, travel, and personal accident premiums, Go Digit’s total gross written premium (GWP) increased 24.5% to INR 9,016 Cr from INR 7,243 Cr in FY23.

Third-party motor insurance premiums continued to be the biggest contributor to the startup’s GWP at 39%, followed by own damage motor insurance premiums at 22%. Health, travel, and personal accident premiums together contributed 19% to the total GWP in FY24.

Go Digit’s net earned premium stood at INR 7,096 Cr in the reported fiscal as against INR 5,164 Cr in FY23.

Including net earned premium, income from investments, and other income heads, the startup’s total income stood at INR 8,443 Cr in FY24 compared to INR 5,780 Cr in the previous year.

The company said its premium retention ratio for FY24 stood at 85.8% compared to 81.6% in the year before.

Go Digit’s assets under management stood at INR 15,764 Cr as of March 31, 2024 compared to INR 12,668 Cr a year ago.

Meanwhile, in the March quarter (Q4) of FY24, the company’s PAT more than doubled year-on-year to INR 53 Cr. GWP also increased 19.5% YoY to INR 2,336 Cr in Q4.

Founded in 2017 by Kamesh Goyal, Go Digit offers insurance policies across verticals like health, motor vehicle, travel, and property. Backed by marquee investors Fairfax, Peak XV Partners, A91 Partners, Virat Kohli and Anushka Sharma, the startup got listed on the Indian bourses in May this year.

The company made a lacklustre debut on the stock exchanges, listing at a premium of 3-5% to the issue price. Several analysts attributed the lack of investors’ interest in its IPO to its premium valuation over other major market players and the lack of differentiation.

Zooming Into Expenses

Go Digit’s total expenses increased over 36% to INR 7,958.5 Cr in FY24 from INR 5,846.5 Cr the year before, with the company spending the biggest amount in claims paid.

Claims Paid: The company paid INR 3,338 Cr towards insurance claims in FY24, which jumped from INR 1,734 Cr a year ago.

Employee Cost: Go Digit spent INR 270 Cr in employee remuneration and welfare expenses in FY24, which increased from INR 224.5 Cr a year before.

Ad Expenses: Spending towards branding, advertisement, and publicity declined over 70% YoY to INR 322 Cr during the year under review.

As of March 31, 2024, Go Digit’s total customer base stood at 4.7 Cr. In FY24, the company sold 1.1 Cr policies.

Ahead of its FY24 earnings announcement, shares of Go Digit ended Tuesday’s (June 11) trading session 1.7% lower at INR 338.35 on the BSE. Its shares have gained 20.4% since its listing.

Ad-lite browsing experience

Ad-lite browsing experience