SUMMARY

The panel said that Kishore Biyani-led Future Retail is bound by agreements which are at the centre of the dispute with Amazon

The order comes just days after the Mumbai-bench of the NCLT allowed Reliance Retail to hold a meeting of its shareholders and creditors seeking their approval for the $3.4 Bn deal

The arbitration panel had last year put the asset sale of Future Retail to Reliance Retail Ventures on hold

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

In a setback for Future Retail, the Singapore International Arbitration Centre (SIAC) has declined Future’s plea seeking exclusion from the dispute with ecommerce giant Amazon and ruled that it is a “proper party” to the ongoing arbitration proceedings over Future Group’s proposed sale of its retail assets to Reliance Retail.

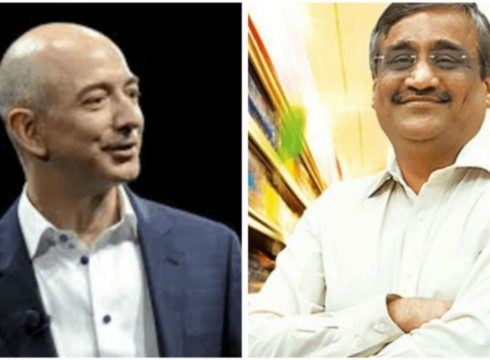

According to a Reuters report, the panel in its order on Wednesday said that Kishore Biyani-led Future Retail is bound by agreements which are at the centre of the dispute with Amazon.

The panel also observed that it has jurisdiction over Future Retail in the arbitration dispute.

It also noted that there are three agreements at the centre of the dispute and they “must be read” together the report said.

The order comes just a day after Mumbai-bench of the National Company Law Tribunal (NCLT) allowed Reliance Retail to hold a meeting of its shareholders and creditors seeking their approval for the $3.4 Bn deal. The bench also rejected the objections raised by Amazon.

Similarly, on October 28, 2021 the tribunal had allowed Future Retail to hold a meeting of its shareholders and creditors seeking their approval to sell its retail assets to the RIL arm.

Amazon and Future Group have been in a legal battle since 2020.

Amazon acquired a 49% stake in Future Coupons for INR 1,500 Cr in 2019, and the latter owns 7.3% shares in Future Retail. Through this transaction, Amazon had also managed to acquire around a 3.58% stake in Future Group.

In the following year, Future Group entered into an asset sale deal worth $3.4 Bn with Mukesh Ambani-led RIL for selling its retail, wholesale, logistics and warehousing assets to Reliance Retail.

This deal was the beginning of an extensive battle between Amazon and Future Retail.

Last year, Amazon sent a legal notice to Future stating breach of agreement, which received a favourable ruling in the Singapore International Arbitration Centre (SIAC).

The arbitration panel had last year put the asset sale of Future Retail to Reliance Retail Ventures on hold.

While Future Group moved to Delhi HC alleging interference by Amazon with its deal with RIL, Delhi HC passed a ruling favouring Amazon. This skirmish led to SIAC forming an arbitration tribunal to relook into the case (in January 2021), and a status quo was ordered on the deal by HC.

Following this, Delhi HC lifted the status quo, Amazon moved to SC challenging the ruling. This torpedoed into SC re-levying the restraint on the RIL and Future Group deal.

The court directed Kishore Biyani to attach all his properties as part of Amazon’s plea for enforcement of the emergency award.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.