Indian startups cumulatively raised $316.4 Mn across 23 deals between April 29- March 4

PharmEasy's $216.2 Mn funding was the lone mega funding round of the week

Seed funding plummeted 64% to $12.3 Mn this week from last week's $33.9 Mn

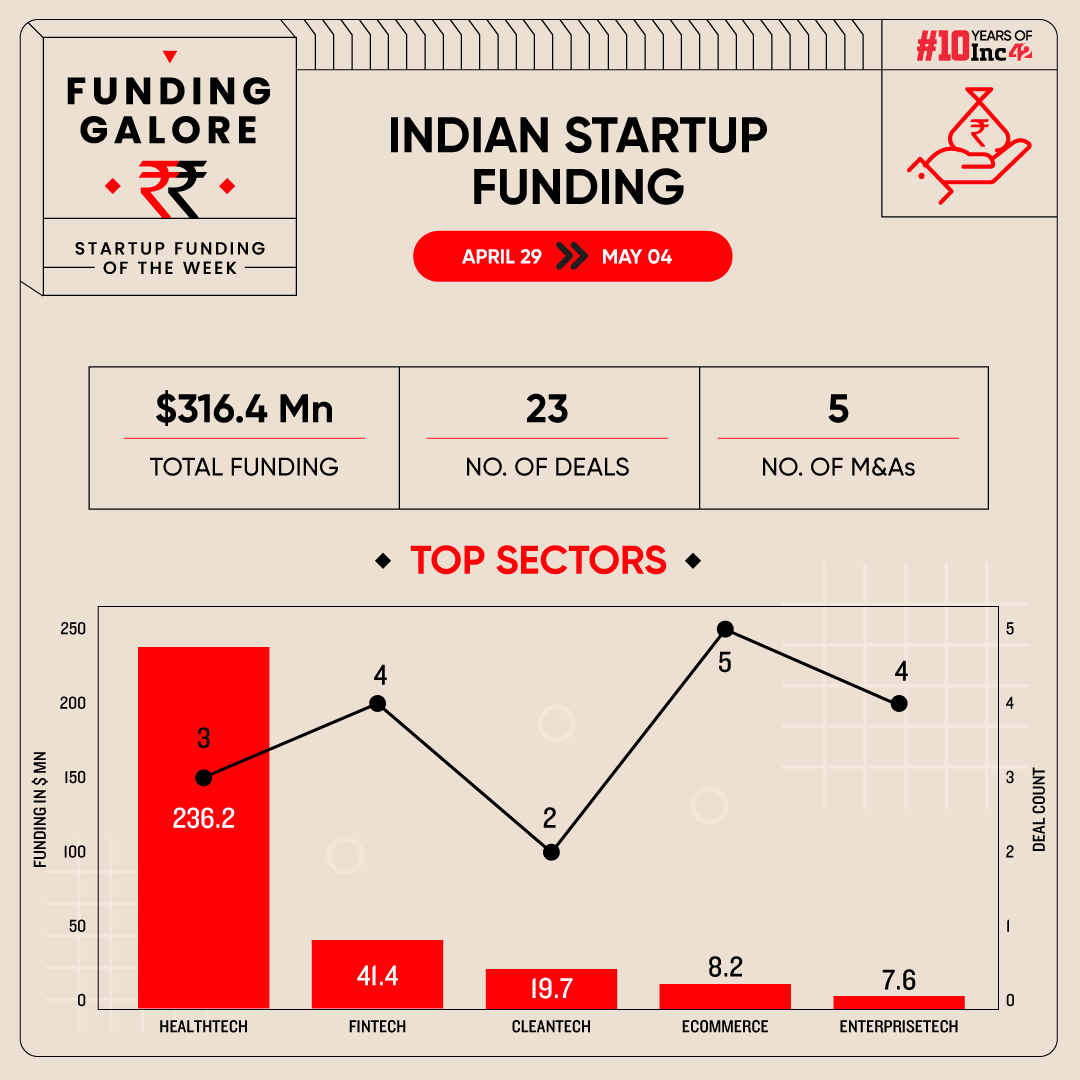

After a significant drop in the capital raised by Indian startups in the last week of April, funding picked up in the world’s third-largest startup ecosystem in the first week of May. Between April 29 and May 4, Indian startups cumulatively raised $316.4 Mn across 23 deals, up 83.3% from last week’s $172.6 Mn secured across 21 deals.

Funding Galore: Indian Startup Funding Of The Week [Apr 29 – May 4]

Date

Name

Sector

Subsector

Business Model

Funding Round Size

Funding Round Type

Investors

Lead Investor

30 Apr 2024

Pharmeasy

Healthtech

Online Pharmacy

B2B-B2C

$216.2 Mn

–

MEMG Family Office, Prosus, 360 One,Temasek

–

3 May 2024

Kinara Capital

Fintech

Lendingtech

B2B

$24.4 Mn

Debt

Impact Investment Exchange, BlueOrchard Microfinance Fund

Impact Investment Exchange, BlueOrchard Microfinance Fund

29 Apr 2024

Portea Medical

Healthtech

Home Healthcare

B2B

$20 Mn

Pre-IPO

–

–

30 Apr 2024

Charge Zone

Cleantech

Electric Vehicles

B2B-B2C

$19 Mn

–

British International Investment

British International Investment

2 May 2024

Infinity Fincorp

Fintech

Lendingtech

B2C

$8 Mn

–

Archerman Capital

Archerman Capital

29 Apr 2024

BRISKPE

Fintech

Payments

B2B

$5 Mn

Seed

PayU

PayU

2 Apr 2024

Go DESi

Ecommerce

D2C

B2C

$4.9 Mn

–

Aavishkaar Capital, Rukam Capital, Roots Ventures, DSG Consumer

Aavishkaar Capital

2 Apr 2024

Dexif

Fintech

Investment Tech

B2B

$4 Mn

Seed

RTP Global

RTP Global

29 Apr 2024

Assert AI

Enterprisetech

Horizontal SaaS

B2B

$4 Mn

Series A

Ramesh Hariharan, Prashant Purker, Arya.ag

Ramesh Hariharan, Prashant Purker, Arya.ag

2 Apr 2024

Plotline

Enterprisetech

Horizontal SaaS

B2B

$2.6 Mn

Seed

Elevation Capital

Elevation Capital

2 May 2024

DaMENSCH

Ecommerce

D2C

B2C

$2.5 Mn

Series B

Matrix Partners, Saama Capital, Whiteboard Capital, A91 Emerging Fund

–

2 Apr 2024

Fresh From Farm

Agritech

Market Linkange

B2B

$2 Mn

pre-Series A

Inflection Point Ventures, Ashish Kacholia

Inflection Point Ventures, Ashish Kacholia

2 May 2024

TalkEsport

Media & Entertainment

Digital Media

B2C

$1 Mn

pre-Series A

Saswat Ventures

Saswat Ventures

1 May 2024

Reelo

Enterprisetech

Horizontal SaaS

B2B

$1 Mn

–

Gokul Rajaram

Gokul Rajaram

30 Apr 2024

Kyari

Ecommerce

D2C

B2C

$780K

pre-Series A

Gwalior Pathways, Airen Holdings, Amit Kumat, Rajesh Patel, Sawan Laddha, We founder circle, IVY League Ventures, JITO

Gwalior Pathways, Airen Holdings

30 Apr 2024

PointO

Cleantech

Electric Vehicles

B2B

$743K

Seed

Equirus InnovateX Fund

Equirus InnovateX Fund

2 May 2024

EXFAQ Systems

Deeptech

IoT & Hardware

B2B-B2C

$288K

–

Ketan Patel

Ketan Patel

30 Apr 2024

vHub.ai

Enterprisetech

Horizontal SaaS

B2B

–

Seed

Z21 Ventures, Startup India Seed Fund Scheme

Z21 Ventures, Startup India Seed Fund Scheme

1 May 2024

neuro42

Healthtech

IoT & Hardware

B2B-B2C

–

–

Karna D Shinde

Karna D Shinde

1 May 2024

ellementry

Ecommerce

D2C

B2C

–

–

She Capital

She Capital

1 May 2024

Perceptyne

Deeptech

Robotics Process Automation (RPA)

B2B

–

Pre-Seed

Venture Catalysts, Tarun Mehta, Swapnil Jain, Pawan Chandana, Bharat Daka T-Hub, Z21 Ventures, Naveen Varma Alluri, Satya Prakash B, Aditya Damani

Venture Catalysts

2 May 2024

Culture Circle

Ecommerce

B2C Ecommerce

B2C

–

Pre-Seed

IIMA Ventures

IIMA Ventures

3 May 2024

ShipEase

Logistics

Ecommerce Logistics

B2B

–

–

JITO Incubation and Innovation Foundation, COGNIPHY.US, Ministry of Electronics and Information Technology (MEITY)

–

Source: Inc42

*Part of a larger round

Note: Only disclosed funding rounds have been included

Key Startup Funding Highlights Of The Week

- Digital pharmacy PharmEasy bagged $216.2 Mn as part of its rights issue at a 90% valuation cut compared to its peak valuation of $5.6 Bn in October 2021. This was the lone mega deal for the week as well as the biggest cheque secured by a startup.

- Buoyed by PharmEasy’s mega funding, healthtech knocked off fintech to become the most funded sector this week. Healthtech startups raised $236.2 Mn across three deals this week.

- Ecommerce maintained its streak of securing the most number of deals. Startups in the space netted $8.2 Mn across five deals this week.

- Z21 Ventures and JITO Incubation and Innovation Foundation (JIIF) were the most active investors for the week, backing two startups apiece.

- Despite the positive upturn in the funding trends overall, seed funding dropped significantly this week. Startups at this stage were able to bag only $12.3 Mn this week, down 64% from last week’s $33.9 Mn.

Startup Acquisitions This Week

- Momspresso founders Vishal Gupta and Prashant Sinha’s new venture Pravis has picked up a stake in adtech gaming platform StreamO. The growth marketing firm will leverage StreamO’s 300 Mn subscribers to target GenZ communities.

- Non-banking finance company (NBFC) UGRO Capital has initiated the acquisition process of lending tech startup MyShubhLife in a mix of equity (64%) and cash (36%) at an enterprise value of INR 45 Cr.

- SaaS major Freshworks announced the acquisition of Delaware Corporation’s Device42 for $230 Mn. The purchase price would be paid in the form of $215 Mn of cash and an equity rollover of $15 Mn.

- Chennai-based SaaS metering and pricing platform Togai is in the process of getting acquired by California-based Zuora. The subscription management software company is looking to enhance its monetisation with the Togai’s acquisition

- PB Fintech, the parent company of insurtech platform Policybazaar, is set to acquire 100% stake in UAE-based Genesis Group. It will also be divesting stakes in two subsidiaries, Visit Health Private Limited and Visit Internet Services Private Limited

Other Major Developments Of The Week

- BharatPe’s ex-COO Druv Dhanraj Bahl has rolled out his maiden venture capital (VC) fund, Eternal Capital, with a target corpus of $14.3 Mn. The fund is looking to back 40 early stage startups over the next three years.

- Venture debt firm Stride Ventures announced the final closure of its Stride Ventures India Fund III at $165 Mn. The firm will look to back startups across consumer brands, financial services and cleantech sectors

- VC firm IvyCap Ventures marked the final close of its third fund at $251 Mn. The fund will invest in 25 startups with an average ticket size of INR 30-50 Cr.

- Tribe Capital is looking to invest $75 Mn in Shiprocket through its newly-launched special purpose vehicle (SPV). The transaction is expected to be completed in a few weeks.

- Digital consulting company Brillio is looking to expand its India footprint with an investment of $240 Mn over the next five years.

- Investment firm Oister Global has floated an INR 440 Cr fund, Oister India Pinnacle Fund (OIPF), to fuel emerging technology-led innovations and various sunrise sectors in the country.

- Thyrocare founder Arokiaswamy Velumani has joined hands with Young Entrepreneurs Association (YEA) and Magnifiq Capital Trust to invest up to INR 50 Cr in Indian startups.

- Healthtech unicorn Innovaccer is in talks with health major Kaiser Permanente to raise a funding in the range of $200 Mn-$250 Mn in a mix of primary and secondary funding.

- Anthill Ventures is looking to launch a hybrid fund targeting consumer experiences, wellness and entertainment startups. It will raise $100 Mn for a hybrid private credit and equity fund.

- UGRO Capital’s board approved raising INR 1,332.66 Cr through compulsorily convertible debentures (CCDs) and warrants.

- Gold loan startup Rupeek has initiated funding discussions with Claypond Capital and Axis Bank. The startup is looking to raise an undisclosed amount of funding at a substantially reduced valuation of $200-$250 Mn from its 2022 valuation of $600 Mn.

- Private equity (PE) firm ChrysCapital closed its $700 Mn ‘Continuation Fund’. The fund was anchored by US-based HarbourVest Partners and European funds LGT Capital Partners and Pantheon Ventures.

Ad-lite browsing experience

Ad-lite browsing experience