SUMMARY

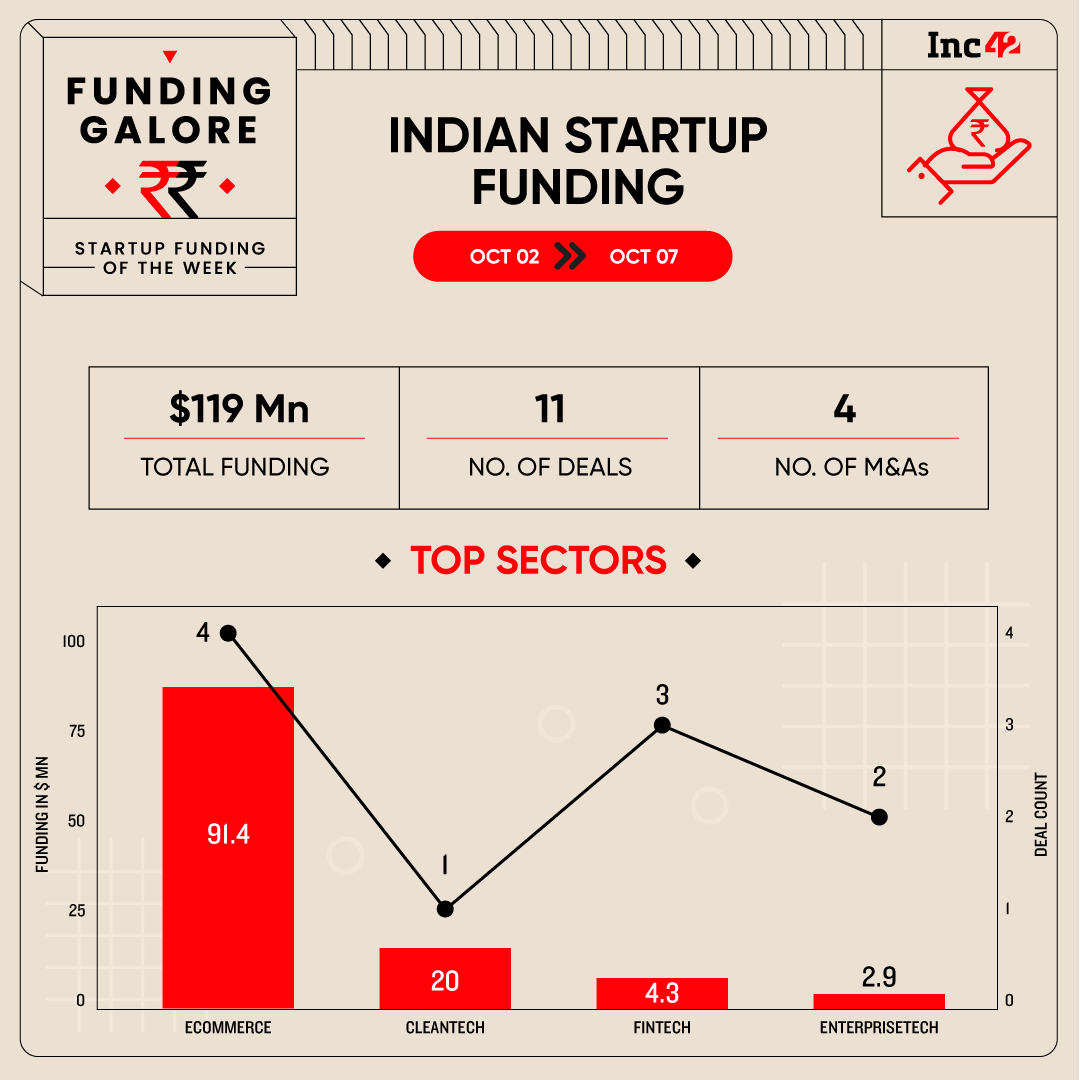

Indian startups raised $119 Mn across 11 funding deals, marking a 38% week-on-week decrease

After receiving an RBI approval, fintech unicorn slice will be merging with North East Small Finance Bank (NESFB)

Fuelled by Bizongo and Mensa Brands’ fundraise, the ecommerce sector emerged as the most funded sector this week, securing $91.4 Mn across four deals

The month of October got off to a sluggish start in terms of funding for the Indian startup ecosystem. During the first week of the month, Indian startups have secured $119 Mn across 11 deals, marking a 38% decrease to the previous week when the ecosystem collectively bagged $194 Mn across 34 deals.

Funding Galore: Indian Startup Funding Of The Week [Oct 2 – Oct 7]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 4 Oct 2023 | Bizongo | Ecommerce | B2B Ecommerce | B2B | $50 Mn | Series E | Schroder Adveq, IFC, Chiratae Ventures, B Capital, British International Investment | Schroder Adveq |

| 5 Oct 2023 | Mensa Brands | Ecommerce | Roll Ups | B2C | $40 Mn | Debt | EvolutionX Debt Capital | |

| 5 Oct 2023 | Bolt. Earth | Cleantech | Electric Vehicle | B2B-B2C | $20 Mn | Series B | Union Square Ventures, Prime Venture Partners, ITIGO Funds | |

| 4 Oct 2023 | DPDzero | Fintech | Fintech SaaS | B2B | $3.25 Mn | Seed | Blume Ventures, India Quotient, Sunil Gulati, Nikhil Kumar | Blume Ventures, India Quotient |

| 4 Oct 2023 | ClearFeed | Enterprisetech | Horizontal SaaS | B2B | $2.7 Mn | Seed | Peak XV’s Surge, 8VC | Peak XV’s Surge |

| 3 Oct 2023 | The Cube Club | Ecommerce | D2C | B2C | $1.1 Mn | Seed | Harsh Jain, Salagaocar Family Office, Siddharth Ladsariya, Rajeev Sahney | |

| 3 Oct 2023 | Roopya | Fintech | Fintech SaaS | B2B | $601K | Seed | 100X.VC | |

| 4 Oct 2023 | Altitude | Fintech | Investment Tech | B2C | $500K | Seed | – | |

| 5 Oct 2023 | Answer Genomics | Healthtech | Fitness & Wellness | B2C | $500K | Pre-series A | IPV | IPV |

| 5 Oct 2023 | Dressfolk | Ecommerce | D2C | B2C | $397K | Seed | All-in Capital, Sidhant Keshwani, Sidesh Chauhan, Riju Jhunjhunwala | All-in Capital |

| 4 Oct 2023 | YouVah | Enterprisetech | Horizontal SaaS | B2B | $210K | Seed | CIIE. CO |

Key Startup Funding Highlights Of The Week

- B2B vendor management startup Bizongo raised $50 Mn in a Series E funding led by Schroder Adveq, making it the biggest funding deal of the week.

- Fuelled by Mensa Brands & Bizongo’s fundraise, the ecommerce sector emerged as the most funded sector this week, raising $91.4 Mn. The sector also secured the most number of deals i.e. 4, making it the funded sector overall.

- Seed funding activity saw a marginal dip this week with $8.75 Mn in infusion across 7 deals. Last week, $9 Mn was raised in a seed funding across 17 deals.

Startup Acquisitions This Week

- Listed caller identification app Truecaller acquired Bengaluru-based TrustCheckr, to help businesses verify customer information and detect the risk of fraud based on phone numbers.

- This week, Inc42 exclusively reported that gaming unicorn Dream11’s acquisition of fantasy cricket platform Sixer for an undisclosed amount.

- Nazara Technologies’ NODWIN Gaming acquired a 100% stake in PublishME for $2 Mn.

- After receiving an RBI approval fintech unicorn slice will be merging with North East Small Finance Bank (NESFB).

Other Major Developments From This Week

- GVFL, formerly known as Gujarat Venture Finance Limited, has launched an accelerator programme – Xcelerate Program, in partnership with Marwari Catalysts for seed stage startups. The programme, will provide mentorship and investment in the range of INR 75 Lakh to INR 2.5 Cr

- Bengaluru-based car rental startup Zoomcar is eyeing to list on the American stock exchange Nasdaq in the ongoing quarter through a special purpose acquisition company (SPAC) deal.

- Chairman of Manial Group – Ranjan Pai is reportedly in talks to make a major investment in the beauty ecommerce unicorn Purplle.

- Everest Fleet has given 18.8X and 19X exits to its early backers – Rockstud Capital and Artha Venture Fund respectively after securing investment from Uber and Paragon Ventures