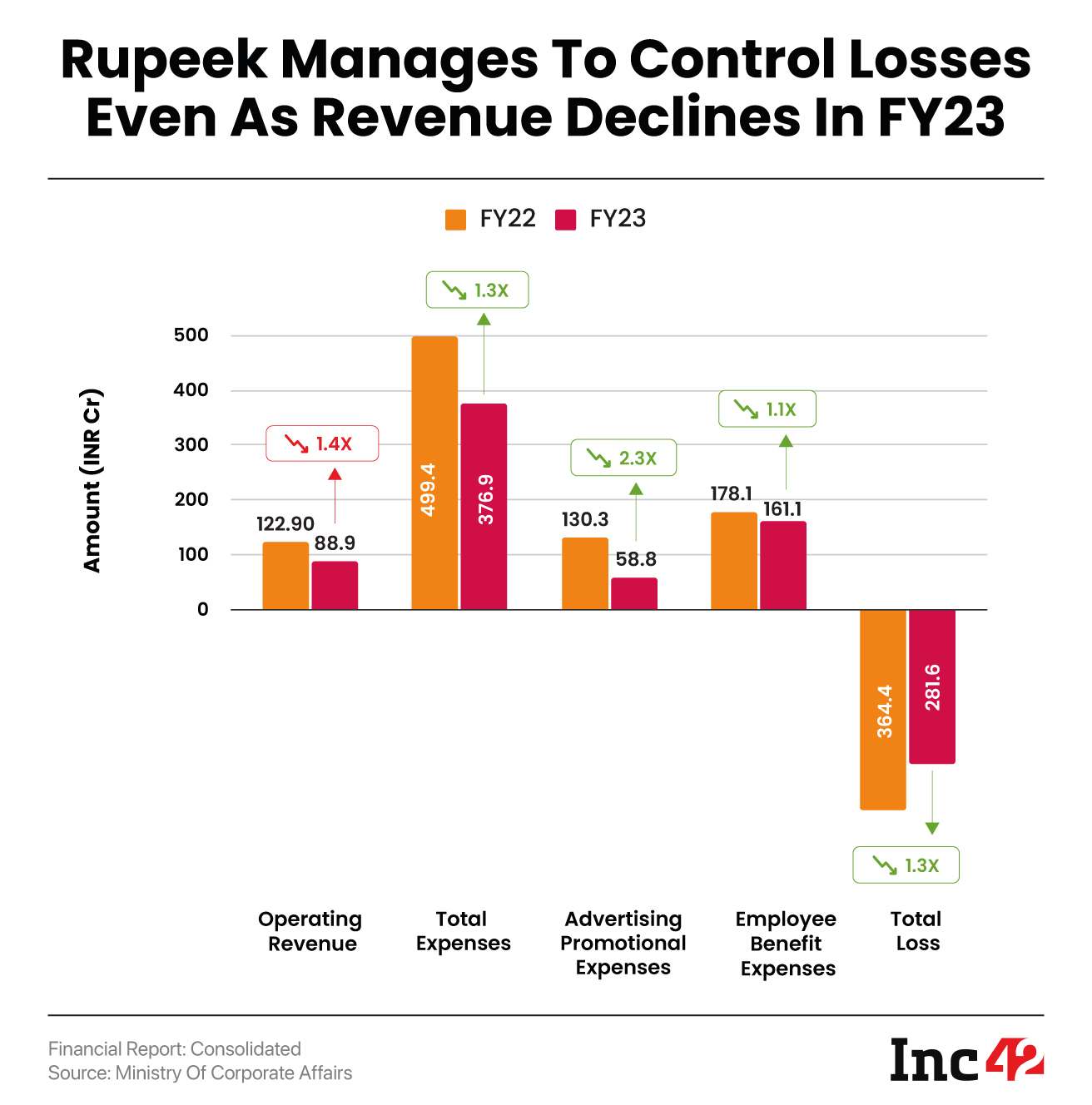

The gold loan startup’s revenue from operations slumped 27.7% to INR 88.9 Cr from INR 122.9 Cr in FY22

Rupeek managed to bring down its total expenses by one-fourth to INR 376.9 Cr in FY23 from INR 499.4 Cr in the previous fiscal year

On a unit economics level, the startup spent INR 4.2 to earn every INR 1 in revenue from operations

Gold loan startup rupeek

The Peak XV Partners-backed startup had posted a net loss of INR 364.4 Cr in FY22 on a total revenue of INR 132.4 Cr.

Rupeek’s total revenue fell 26.5% year-on-year (YoY) to INR 97.2 Cr during the year under review. Revenue from operations also slumped 27.7% to INR 88.9 Cr in FY23 from INR 122.9 Cr in FY22.

Founded in 2015 by Sumit Maniyar and Ashwin Soni, Rupeek provides instant gold loans at doorstep and through bank branches. The startup earns a majority of its revenue from the sale of services, which it recognises in two parts – commission income and income from lending business.

Rupeek earned INR 40.8 Cr in commission and INR 48.1 Cr as income from its lending business in FY23.

The startup currently provides its services in over 60 cities and more than 5,000 locations. including Bengaluru, Ahmedabad, Hyderabad, Jaipur, Delhi, Kolkata, Chennai, Surat, and Coimbatore.

Rupeek’s Cost Control Measures

Rupeek managed to bring down its total expenses by one-fourth to INR 376.9 Cr in FY23 from INR 499.4 Cr in the previous fiscal year.

Employee benefit costs continued to account for the biggest chunk of expenses, but declined to INR 161.1 Cr in FY23 from INR 178.1 Cr in the prior year. This was in line with the company’s restructuring measures as part of which it laid off over 250 employees in two rounds in FY23.

In June 2022, Rupeek fired around 200 people. Later, Inc42 exclusively reported about another round of layoff in which the startup let go over 50 employees in September last year.

Rupeek spent INR 125.6 Cr on salaries and wages in FY23 as against INR 145.4 Cr in the previous year. However, the startup’s employee share-based payment (equity settled) increased to INR 25.3 Cr in the year under review from INR 18.1 Cr in FY22.

Meanwhile, advertising promotional expenses more than halved to INR 58.8 Cr in FY23 from INR 130.3 Cr in the previous fiscal.

However, Rupeek’s subscription membership fees jumped 21% YoY to INR 11.3 Cr. Its depreciation, depletion, and amortisation expenses also shot up 69% YoY to INR 46.8 Cr in FY23.

On a unit economics level, the startup spent INR 4.2 to earn every INR 1 from operations.

Besides Peak XV, Rupeek is also backed by marquee investors including Lightbox, GGV Capital, Accel, and Bertelsmann.

Inc42 reported last year that the startup was planning to raise around $16 Mn in a fresh round of funding from Accel, Peak XV, and others.

Ad-lite browsing experience

Ad-lite browsing experience