Founded in 2022 by Sheetal Jain, Mahesh Kumar Barate, and Hari Ambati, LeRemitt helps businesses, especially MSMEs, to streamline the overseas transaction

The freshly raised funds will be used for hiring, global expansion, product development, and exploring strategic partnerships

LeRemitt aims to enable seamless cross-border money transfers, ensuring recipients have instant access to their funds

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Fintech startup LeRemitt has raised $1.25 Mn in a seed funding led by Axilor Ventures. Venture capital firm Capital A as well as angel investors including Ram Govindarajan, founder of Wiz Freight and Sumit Agarwal, founder of Vyapar also participated in the round.

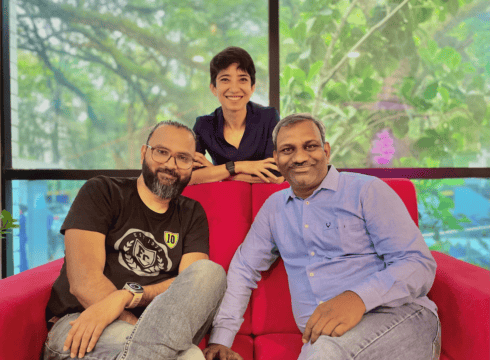

Founded in 2022 by Sheetal Jain, Mahesh Kumar Barate, and Hari Ambati, LeRemitt helps businesses, especially MSMEs, to streamline overseas transactions.

The funds will be used for hiring, global expansion, product development, and exploring strategic partnerships.

Commenting on the fundraise, cofounder Barate said, “As our world becomes more interconnected, there is a growing demand for efficient and secure cross-border solutions. Traditional remittance methods are burdened with high costs, slow processing times, and limited accessibility, creating significant challenges.”

As per Barate, such obstacles particularly impact MSMEs, as small businesses often lack the resources to navigate complex financial systems, leading to time-consuming operational hurdles.

To address the gaps, LeRemitt aims to enable seamless cross-border money transfers, ensuring recipients have instant access to their funds. The startup claims to use advanced encryption and authentication protocols to ensure security, safeguarding customer funds.

Ankit Kedia of Capital A said, “The international remittance market is currently dominated by traditional banks and institutions that rely on legacy processes that are slow and costly, especially for MSMEs. The need of the hour is to build digitally driven, fast, accurate, compliant, and user-friendly remittance mechanisms that can ensure swift funds transfer at costs that encourage startups and the MSME sector players to expand their coverage overseas.”

The funding comes at a time when Indian startups have been experiencing a prolonged funding winter. According to Inc42’s ‘Indian Tech Startup Funding Report H1 2023’ report, total funding declined 78.5% year-on-year (YoY) to $580.18 Mn in June 2023. Even seed funding witnessed a decline as early stage startups raised $112.23 Mn in the month, a decline of 8.3% year-on-year.

However, the fintech sector stands tall in weathering the funding crunch. There are plenty of such startups introducing new services and fetching funding. For instance, fintech unicorn Razorpay launched MoneySaver Export Account, focussing on Indian exporters, which could be a direct competitor to LeRemitt.

Further, according to State Of Indian Fintech Report Q1 2023 by Inc42, the Indian fintech sector is estimated to rise to $2.1 Tn by 2030. Between 2021 and H1 2023 alone, the industry has bagged $14.8 Bn in investment.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.