Increasing premiumisation and advertisements will result in improvement in margins of ecommerce companies this festive season, Redseer said

The festive season this year will see highest-ever participation from D2C brands, while the share of mobile and electronics in total GMV is expected to decline as other categories pick up

Amid the likes of Flipkart and Amazon using AI to improve user experience, Redseer said new-age technologies like generative AI will drive strong growth momentum

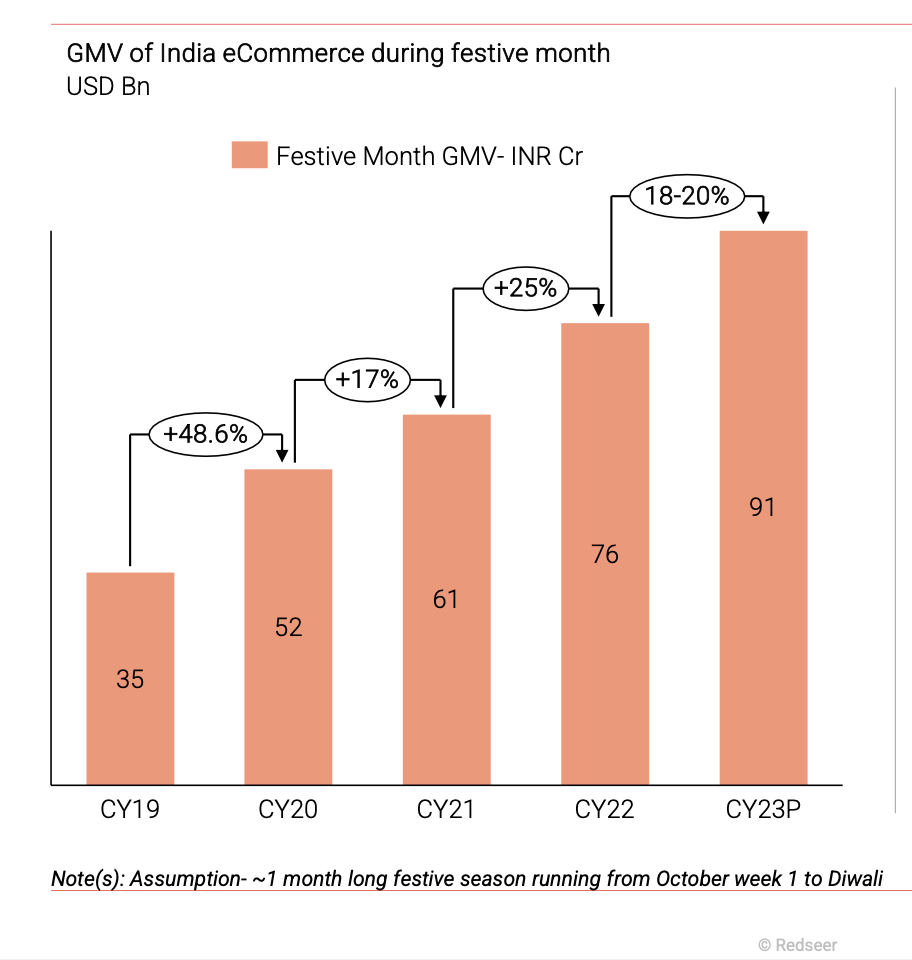

Buoyed by the strong growth of the Indian economy and the rise in private consumption, the gross merchandise value (GMV) of the country’s ecommerce sector is expected to grow 18-20% to INR 90,000 Cr during the festive season this year from INR 76,000 Cr last year, as per consulting firm Redseer.

This year’s festive season sale would mark the 10th consecutive ecommerce sale, which would see giants like Amazon and Flipkart competing with the likes of SoftBank-backed Meesho, Tata Digital’s super app Neu, D2C brands, among others.

Nearly 140 Mn shoppers are expected to make purchases during the festive season sale this year, Redseer said in a report.

In what would be music to the ears for ecommerce companies, Redseer said increasing premiumisation and advertisements will improve the margins of these companies.

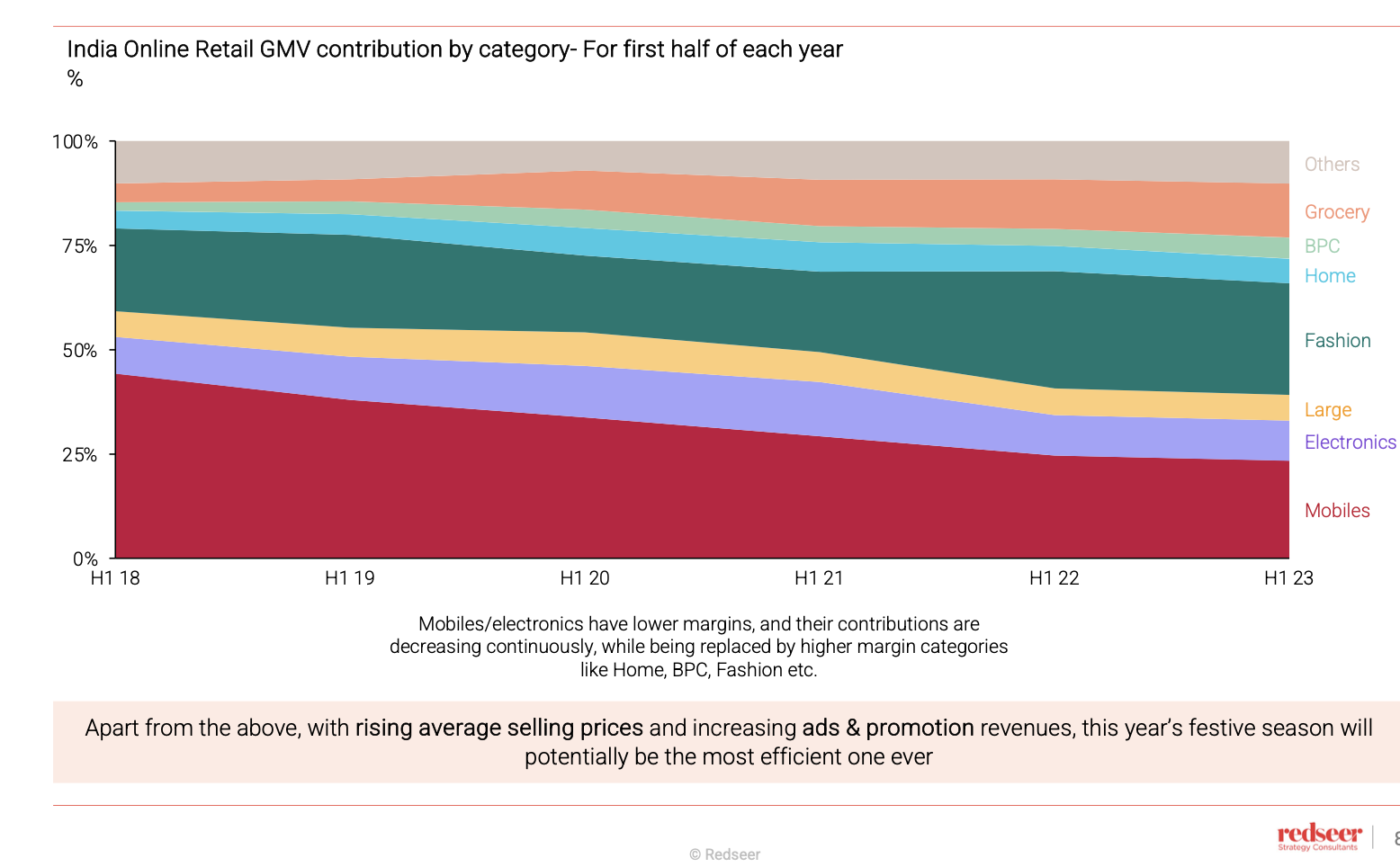

“… this year’s festive season will see increasing contributions from higher margin categories like beauty & personal care (BPC), home & general merchandise, fashion etc. Also, there is persistent premiumisation leading to rising average selling prices (ASP) and increasing ads & promotion revenues (which) will possibly make this year’s festive season the most efficient from a margin perspective,” the consulting firm said.

Share Of Electronics In GMV To Decline

The mobile, electronics and large appliances category has historically accounted for more than 50% of the overall gross merchandise value (GMV) during India’s ecommerce festive sales period. However, Redseer expects its share to go down this year.

To be sure, mobile phones led during last year’s festive season sales, with 56,000 units sold every hour on ecommerce platforms. While mobile phones had a 41% share in the total GMV during the first week, the fashion segment’s share stood at a meagre 20%.

“Over the last several quarters, we are seeing enhanced GMV contributions from categories beyond electronics. While electronics sell a lot in the festive period, looking at the bigger picture and comparing the festive sale periods over the last several years, there is a clear trend of category diversification,” said Mrigank Gutgutia, partner at Redseer.

Calling this trend positive for the ecommerce ecosystem, Gutgutia said it shows the willingness of consumers to purchase multiple categories online and more brands coming to cater to their needs.

“Continuing with this trend, we expect increasing GMV contributions from non-electronics categories like fashion, BPC, home and general merchandise and more this festive period,” Gutgutia added.

The report also highlighted that large corporations have doubled down on acquisitions in the ecommerce space, which has intensified the competition in high-margin categories like fashion.

Notably, the likes of Reliance, the Tata Group, and the Aditya Birla Group have announced various acquisitions in the fashion and beauty categories this year to bolster their online channel growth and compete with Walmart-backed Flipkart, Amazon and Meesho.

D2C Brands To Shine

The festive season sales this year will see the highest-ever participation from direct-to-consumer (D2C) brands.

Going beyond this festive season, the D2C brands are expected to outpace etailers and retailers in growth in the coming years. Redseer expects the revenue of D2C brands to grow 40% during the 2023-2027 period, 1.6X and 3.6X higher than the growth of the broader etailing and retail market, respectively.

Interestingly, Redseer said metro cities drove the ecommerce growth in the country during the last few quarters amid a slowdown in spending due to tight liquidity conditions. However, it expects Tier-I, II and beyond cities to bounce back, which will result in robust demand from across city tiers during the festive season.

Ecommerce’s Exponential Growth & AI

With increasing internet penetration and access to smartphones, the ecommerce industry in the country has grown by leaps and bounds over the past few years. Highlighting this, Redseer said the GMV of the industry stood at INR 27,000 Cr in the year 2014, when the first ecommerce festive sales took place. However, the GMV is expected to surge 19.6X to INR 5,25,000 Cr in 2023.

“The Indian etailing (industry) has increasingly become the litmus test for consumer demand in India. The 10th festive season sale period is even more significant this year considering the recent slowdown in consumption and the almost 3 years of external shocks on the economy,” the report said.

Over the years, the festive season sale has emerged as a big event for ecommerce companies as demand shoots up from across the country. To meet the high demand during the period, the likes of Amazon and Flipkart have already begun preparations for the festive season sale this year.

Amid the generative AI boom, ecommerce companies are also using the technology to improve the experience of sellers and customers. While Flipkart has launched an AI-powered catalogue designer to help sellers create a convincing catalogue of their products, Amazon has added new AI capabilities to help sellers create better product descriptions, titles and listing details.

Commenting on this, Redseer said, “… new-age technology solutions like generative AI being more widely adopted in multiple use-cases during the sale period will also lead to better and novel consumer experiences and drive stronger growth momentum.”

Ad-lite browsing experience

Ad-lite browsing experience