If your business model relies on the assumption that once a customer gets in, it’s very difficult for them to get out; we don’t like it – SEBI Chief on ‘Abhimanyu Complex’ in fintech startups

Buch said that if a business model includes financial inclusion as a key stack, SEBI will be very supportive

When it comes to financial services, anonymity is not something that a regulator is ever going to permit – SEBI Chief on crypto

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

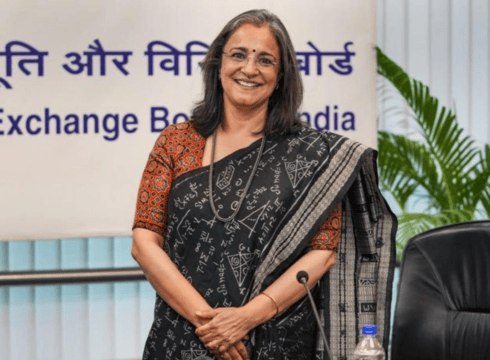

Madhabi Puri Buch, the chairperson of India’s securities and exchange board (SEBI) warned fintech companies against placing barriers when a user decides to exit their ecosystem.

Calling the business model the ‘Abhimanyu Complex’ at the Global Fintech Fest in Mumbai on Wednesday (September 21), Buch said, “If your business model relies on the assumption that once a customer gets in, it’s very difficult for them to get out; we don’t like it.”

She added that such business models will find it hard to find favour with SEBI. “A person that has an ease of entry, has a right to ease of exit,” said Buch, adding that the regulator does not want any ‘Abhimanyus’ in the market.

She added that if a business model includes financial inclusion, then SEBI will be more than happy to help. “If your business model facilitates financial inclusion, then to that extent that you have those within your fold, the regulator is bound to be very supportive. It will be a sustainable business model,” said Buch.

The SEBI chief also said any business model that relies on a black box and that cannot be audited or validated will not be permitted.

“If your business model is going to rely on a black box, which is not open to sunlight for disinfecting; if it is not capable of being validated and audited and your claims cannot be audited and validated, it cannot be permitted,” said Buch.

Speaking more on fintech business models, Buch added that infrastructure for innovation will be a ‘public good’, stating that India has not only a stated objective but implemented evidence to suggest the same.

Citing the example of Aadhaar, National Health Stack, UPI and Account Aggregator system, the SEBI chief said that the ‘rails’ will be a public good and private innovation has to build on top of those rails.

“If somebody again has a business model where their presumption is that they are going to own the infrastructure, you are setting yourself up for a rude shock subsequently,” Buch said.

Buch also spoke on crypto and its insistence on anonymity, stating that SEBI will never allow anonymity in financial services. However, the SEBI chief said that the regulator will facilitate an ecosystem for cryptos, digital currencies and tokens ‘in due course’.

“You need to understand that on social media it’s [anonymity] quite alright. But in the fintech world, when it comes to financial services, anonymity is not something that a regulator is ever going to permit,” said Buch, adding that any business models which offer anonymity as a key selling point are ‘not going to last’.

At the same event, Buch stated that the regulator plans to narrow the regulatory gap in the startup space.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.