The seed and private round of INR 11 Cr saw participation from Old Fashion Research, Nothing Research, Tenzor capital, among others as well as Solana’s Tamar Menteshashvili, Ankr’s Ryan Fang and Marco Robustelli, and Persistence’s Tushar Aggarwal

Strip Finance is building an NFT-as-a-collateral borrowing and lending marketplace on Binance Smart Chain

The funds will be used for product development, user acquisition and expansion into other growth avenues, cofounder Yash Jejani tells Inc42

Non-fungible tokens (NFTs) are fast changing the landscape of art and entertainment by making it easier than ever for fans to support their favourite creators and for artists to mint and trade unique, collectible pieces.

Amid the rising adoption of NFTs, to enhance the liquidity of the marketplaces, Hyderabad-based Strip Finance is building liquidity easing solutions intending to launch a collateralised NFT lending and borrowing platform on Binance Smart Chain.

The startup has previously raised INR 3.5 Cr, bringing the current seed and private round at a close at INR 11 Cr from Old Fashion Research, Nothing Research, Tenzor Capital, Exnetwork Capital, Valhalla Capital, Block0, Shima Capital, Lancer Capital, MEXC Global Exchange, Kryptos Research, The Newfield Fund, ZBS Capital, J10M Capital.

The round also saw participation from angel investors including Solana’s Tamar Menteshashvili, Ankr’s Ryan Fang and Marco Robustelli, and Persistence’s Tushar Aggarwal, PVPL’s Aditya Nagarsheth, and Frontier’s Palash Jain.

Founded in 2021 by Varun Satyam, Yuvraj Chhibber and Yash Jejani, Strip Finance’s advisory board also consists of Siddharth Menon (COO of WazirX), Jaynti Kanani (CEO of Polygon), Tamar Menteshashvili and Yida Gao (GP at Shima Capital).

Strip Finance will use the funds for product development, user acquisition and expansion into other growth avenues, Jejani told Inc42.

Talking about how the startup’s lending marketplace works, the company said that by using Strip Finance, NFT collectors can get stablecoins without selling off their NFTs. It allows them to attain liquidity and leverage the value of holdings to mint more NFTs and still have ownership of their prized assets.

For the lenders, it allows them to earn interest on the platform and have a chance to acquire defaulted NFTs at discount prices.

They can propose an interest rate and Lifetime Value (LTV), which when accepted by the borrower transfers the NFT to an escrow. If the instalments are paid in the stipulated time, the borrower gets the NFT back. In case of defaults, the ownership rights are transferred to the lender.

“Collateralisation is a natural progression for any asset class, and NFTs will certainly be the most desired assets in the upcoming time,” said Jejani. “Trades worth billions of dollars in the NFT markets have created a liquidity challenge. For the overall system to become robust, there is a need for a platform like ours that brings capital efficiency and unlocks tremendous value.”

What Are NFTs?

NFTs are unique files on a blockchain whose ownership is traceable on the Ethereum blockchain. The concept shot into prominence after the first NFT artwork auction in March was won by an Indian-origin crypto entrepreneur Vignesh Sundaresan (aka Metakovan) who paid $69.3 Mn for a digital collage of 5,000 images by artist Mike Winkelmann (aka Beeple) titled “Everydays: The First 5000 Days”.

Talking about the NFT Marketplaces (a place where users can buy and sell NFTs) during The Crypto Summit hosted by Inc42, Melvin Thambi, an NFT artist and cofounder of NFTMalayali, stated that the NFT phenomenon has helped him connect with other artists around the world much faster than Facebook-owned Instagram that only resulted in likes.

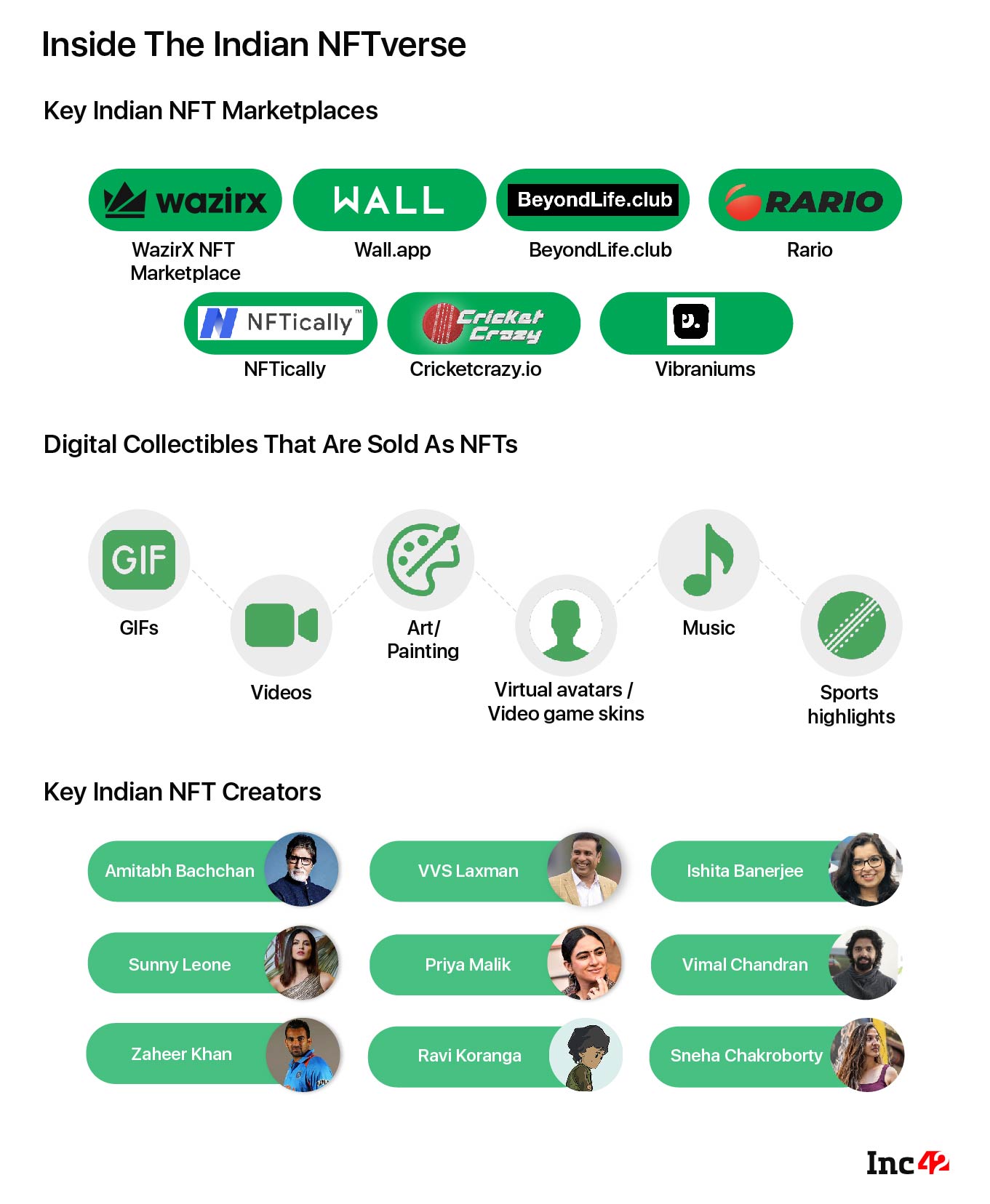

Currently, the NFT ecosystem is home to marketplaces such as WazirX, Wall.app, BeyondLife.Club, Rario, NFTically, among others.

NFTs are slowly gaining the attention of the masses, with celebrities like Amitabh Bachchan and Sunny Leone entering the fray, and the increased interest calls for a deep dive and better insights for all stakeholders — artists, startups, investors or individuals.

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech