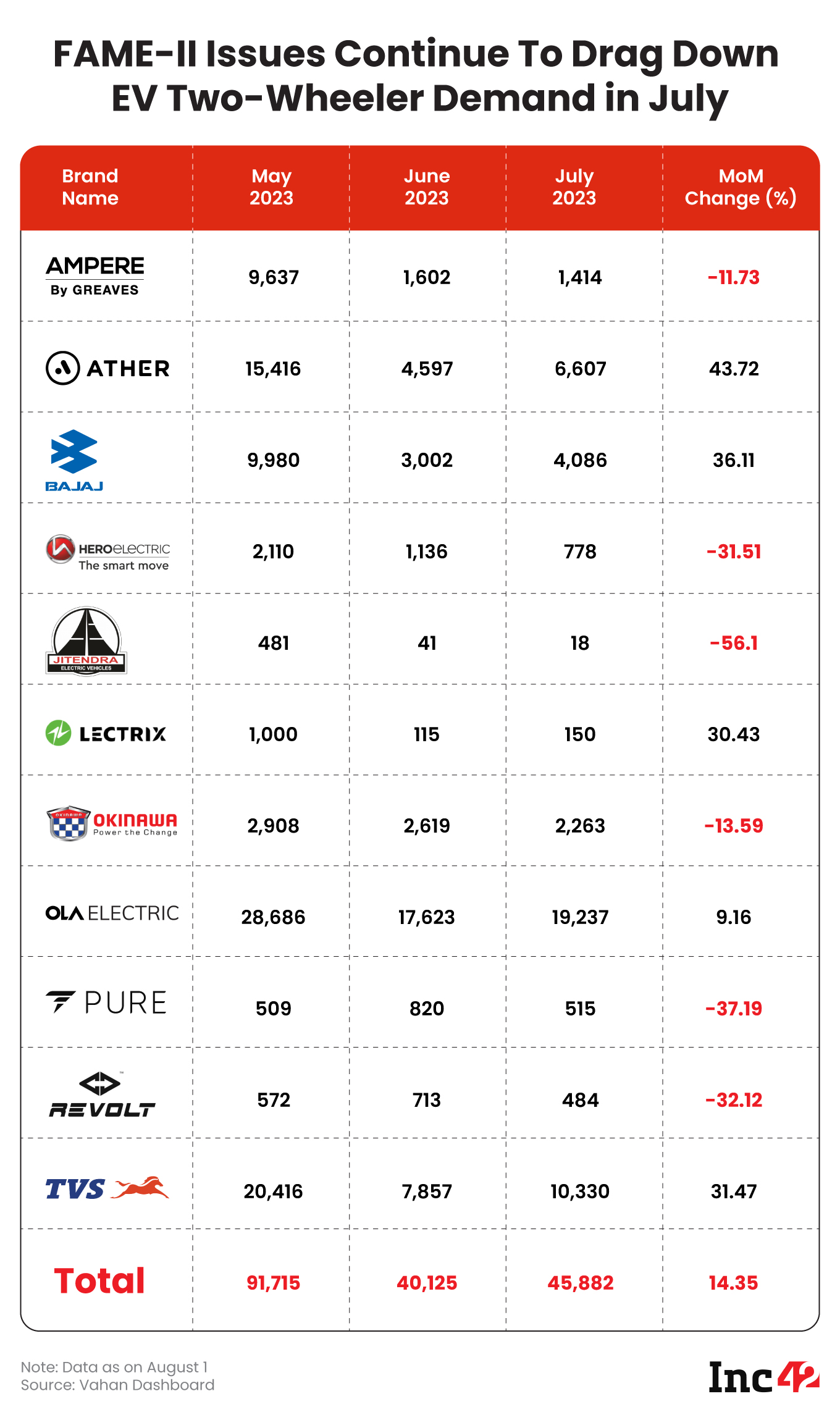

Ola Electric retained its top spot with 19,237 registrations in July. On a month-on-month basis, it was a 9% jump from 17,623 units registered in June

TVS Motor continued to maintain its second position with 10,330 units of vehicle registrations in July, up 31.5% MoM

Demand for Ather Energy escooters also spiked more than 43% MoM to 6,607 last month but was down 57% from 15,416 units registered in May

Sales of most electric two-wheeler startups continued to remain under pressure in July, still recovering from the impact of FAME-II issues and the changes in government subsidies under the scheme.

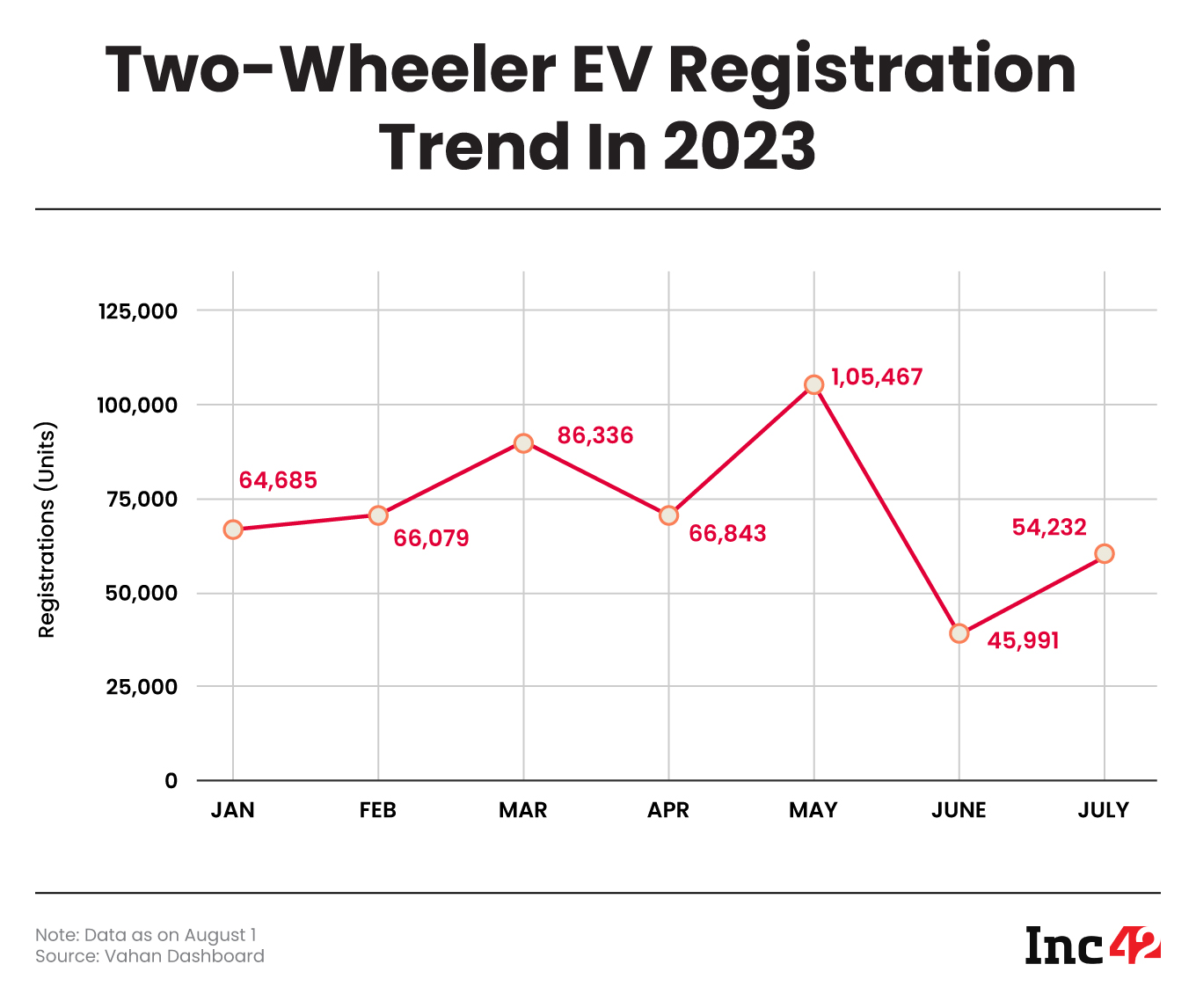

Though total EV registrations in the two-wheeler category rose to 54,232 units in July from 45,991 units in June, as per Vahan data on August 1, the number of registrations in July was lower than in each of the months during the January-May 2023 period.

Ola Electric retained its top spot with 19,237 registrations in July. On a month-on-month (MoM) basis, it was a 9% jump from 17,623 units registered in June. Despite this, Ola Electric’s July demand was almost at the January 2023 level.

Moving on, Ola Electric now holds an almost 35% share in the electric two-wheeler market with the dwindling market traction for the escooters of Okinawa Autotech, Hero Electric, and Ampere Vehicle, who were giving serious competition to the Bhavish Aggarwal-led EV major.

Ola Electric will soon start delivering its more affordable escooter, Ola S1 Air, which is expected to catalyse its sales.

“With our revolutionary yet affordable S1 Air receiving an overwhelming response, we are well-positioned to accelerate India’s EV penetration by driving mass market adoption in the scooter segment. The highly versatile and accessible S1 Air is the perfect answer to ICE scooters, and with its unmatched TCO (Total Cost of Ownership),” said Ankush Aggarwal, chief business officer, Ola, in a statement on its July sales.

After Ola Electric, TVS Motor maintained its second position with 10,330 units of vehicle registrations in July, up 31.5% MoM. However, the number was still 49% below its record vehicle registration of 20,416 units in May.

Demand for Ather Energy escooters recovered more than 43% MoM to 6,607 in the last month but was down 57% from 15,416 units of record vehicle registrations witnessed in May.

In a statement, the Bengaluru-based EV startup said it sold 7,858 units in July 2023.

“Post the FAME-II subsidy revision in June, the EV industry saw a dip, but we already see it bouncing back. With the festive season on the anvil, the volumes are expected to grow faster. In line with this growth, we are seeing our volumes also growing and we are now gearing up for the festive season,” said Ravneet Singh Phokela, chief business officer, Ather Energy.

Ather Energy has also started taking pre-booking of its upcoming scooter, 450S, which is expected to be launched on August 11.

Bajaj Auto’s vehicle registrations, too, rose 36% to 4,086 units last month, making it the fourth-biggest market player in the Indian electric two-wheeler space.

Meanwhile, vehicle registrations of most other players, including Okinawa, Ampere, Hero Electric, Pure EV, and Jitendra EV, have continued to stagger. While Hero Electric’s vehicle registration tanked 31.5% MoM to 778 units in July, Okinawa’s registration volume slipped 13.4% MoM to 2,263 units.

It is pertinent to note that more than a dozen electric two-wheeler players have recently been probed by the government and many of them have been given an embargo on future sales of vehicles for alleged misappropriation of the FAME-II subsidies. They have also been slapped with penalties. Meanwhile, these manufacturers have also passed on crores of rupees as subsidies to customers but are yet to receive them as incentives from the government.

Adding to their troubles, the central government has also slashed the incentives allocated for electric two-wheelers under the FAME-II scheme to 15% of ex-factory price from the earlier 40% and cut the demand incentive to INR 10,000/kWh from INR 15,000/kWh earlier.

This has made several EV players, including Ola Electric, Ather Energy, Matter, and AMO Mobility, increase their vehicle prices from June this year.

Electric two-wheeler registrations crossed the 1 Lakh mark for the first time in May this year. Total EV registration across categories stood at 1.15 Lakh units in July as against 1.02 Lakh units in June and 1.58 Lakh units in May.

Ad-lite browsing experience

Ad-lite browsing experience