Cofounder and CEO Nishant Pitti sold over 24.65 Cr shares of EaseMyTrip, effectively reducing his stake by half from June 2024

Shares of EaseMyTrip hit its 20% lower circuit and nosedived to INR 32.78 apiece on the BSE today

Founded in 2008, EaseMyTrip began its journey as an online travel agency but has since diversified its business to foray into insurtech and electric bus manufacturing

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Update | September 25, 08:07 PM

Online travel aggregator (OTA) EaseMyTrip cofounder and CEO Nishant Pitti offloaded 24.65 Cr shares of the startup via multiple block deals for INR 920 Cr.

As per the NSE data, Pitti sold 16.91 Cr shares for INR 37.22 apiece and another 6.73 Cr shares for INR 37.42 per share. The cofounder sold another 1 Cr shares for INR 38.28 apiece.

With this, Pitti’s stake in the travel tech startup has declined to slightly above 14% from over 28% at the end of the June quarter. He held 49.84 Cr shares of the OTA at the end of the June quarter this year.

Additionally, the stake of the promoter and promoter group now stands at a little over 50% post the execution of these block deals.

Original Story | September 25, 5:02 PM

Shares of EaseMyTrip hit its 20% lower circuit and nosedived to INR 32.78 apiece on the BSE in early trading hours on Tuesday (September 25) after a 2.6% stake in the company changed hands via a block deal estimated at INR 176.5 Cr.

The stock crashed after cofounder and CEO Nishant Pitti sold over 4.6 Cr shares of EaseMyTrip at a floor price of INR 38 apiece, a discount of over 7% from the previous close, Moneycontrol reported.

Earlier, it was reported that Nishant would offload a 8.5% stake in EaseMyTrip. As per the shareholding data available on the BSE, he held a 28.1% stake in the company as of the quarter ended June.

EaseMyTrip shares have been witnessing huge selling pressure for some time. The stock has plummeted over 14% over the last month and tanked over 21% over the past six months.

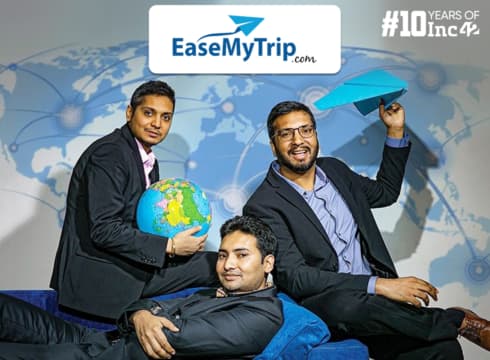

Founded in 2008 by Nishant Pitti, Rikant Pitti and Prashant Pitti, EaseMyTrip began its journey as an online travel agency but has since diversified its business to foray into insurtech and electric bus manufacturing.

After reporting a net loss of INR 15 Cr in Q4 FY24, the listed online travel aggregator returned to the black in Q1 FY25 and posted a net profit of INR 33.9 Cr.

Earlier this month, EaseMyTrip set up a new subsidiary, Easy Green Mobility, to manufacture ebuses. Easy Green Mobility plans to build a plant with a capacity of producing 4,000-5,000 ebuses in the initial phase. The production capacity will be ramped up going forward.

Recently, it also jumped on the ONDC bandwagon and rolled out a marketplace called ScanMyTrip to offer travel services on the government-backed network. To tap the market opportunity in the medical tourism sector, EaseMyTrip announced that it will buy stakes in two companies for INR 90 Cr.

Shares of EaseMyTrip made some recovery later in the day today but still ended 16.4% lower at INR 34.3 apiece on the BSE. The startup’s market capitalisation stood at INR 6,078.1 Cr (about $727 Mn).

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.