Gurugram-based Indifi has raised INR 145 Cr in a round led by CDC Group

Accel Group, Omidyar Network, Fair Finance Fund and Elevar Equity also participated

The new-age lending platform provides credit to small and medium enterprises (SME)

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Gurugram-based B2B lender Indifi Technologies has raised INR 145 Cr ($21 Mn) in its Series C funding round, led by the CDC Group. The company also has additional investors like Accel India, Omidyar Network, Fair Finance Fund and Elevar Equity.

According to an ET report, Indifi has raised INR 100 Cr from CDC group, INR 23 Cr from Accel Group, and INR 10 Cr each by Omidyar Network and Fair Finance Fund. The company aims to utilise the funds to modernise and expand the existing business into new areas of business, develop infrastructure, capital expenditure, repay debts and general corporate expenditure to meet objectives.

Indifi, founded by Alok Mittal and Siddharth Mahanot in 2015, is a new-age lending platform for small and medium enterprises (SME). It raised its first round from Accel Partners and Elevar Equity. The company has digitised the lending process for these small scale businesses. In 2016, the company ended its Series B round of investment after Omidyar Network, a philanthropic investment firm, invested $10 Mn in the company.

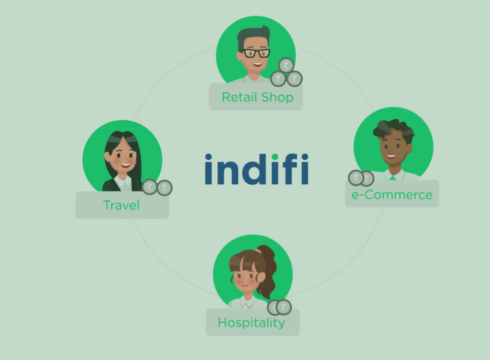

Indifi provides term loan, line of credit, invoice discounting, and merchant cash advance services customised for the companies in travel, e-commerce, retail, restaurants and hotels. The company has also partnered with Swiggy in 2017 to provide loans for its partner restaurants.

Digital lending is considered the fastest-growing segment in India’s fintech industry. According to DataLabs by Inc42, the top three fintech sub-sectors include payments tech, insurance tech and lending tech. The three combined account for 85.7 % of the total $6.97 invested in the Indian startup ecosystem. Even the BCG report predicts that digital lending industry will touch $1 Tn in the next five years.

Over the last few months, startups in the lending business have raised funding. Mumbai-based three lending startups: ‘Happy’ received $20 Mn to explore the scope of Artificial Intelligence, ‘InCred’ managed to raise INR 600 Cr in Series A from a Dutch development finance institution FMO, and ‘CreditVidya’ secured $3 million from Bharat Innovation Fund.

Other such startups include Gujarat-based LendingKart, which managed to INR 80 Cr Debt Capital, New Delhi-based CashSuvidha, which received $2.3 Mn in debt funding, and Bengaluru-based Zest Money, which secured $20 Mn in Series B funding round.

Update: August 7, 2019 | 9:07 AM

Indifi officially announced its Series C funding round of INR 145 Cr led by CDC Group. Existing investors including Accel, Elevar Equity, Omidyar Networks and Flourish Ventures also participated in the round. The company plans to use the funds to diversify into new verticals, develop technology and data infrastructure for future growth, and expand our service offerings to our customers.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.