The crypto ecosystem is left wondering whether India will impose a blanket ban on cryptocurrencies

This past week has been buzzing with the potential ban on cryptos in India which has taken the entire crypto ecosystem by shock.

Investors, exchanges and startups are now left debating whether the Indian government will indeed completely ban all cryptos, which has sent prices crashing, resulting in losses for many Indians.

Before we go into the potential ramifications for the crypto industry, here are two other stories that also caught our attention

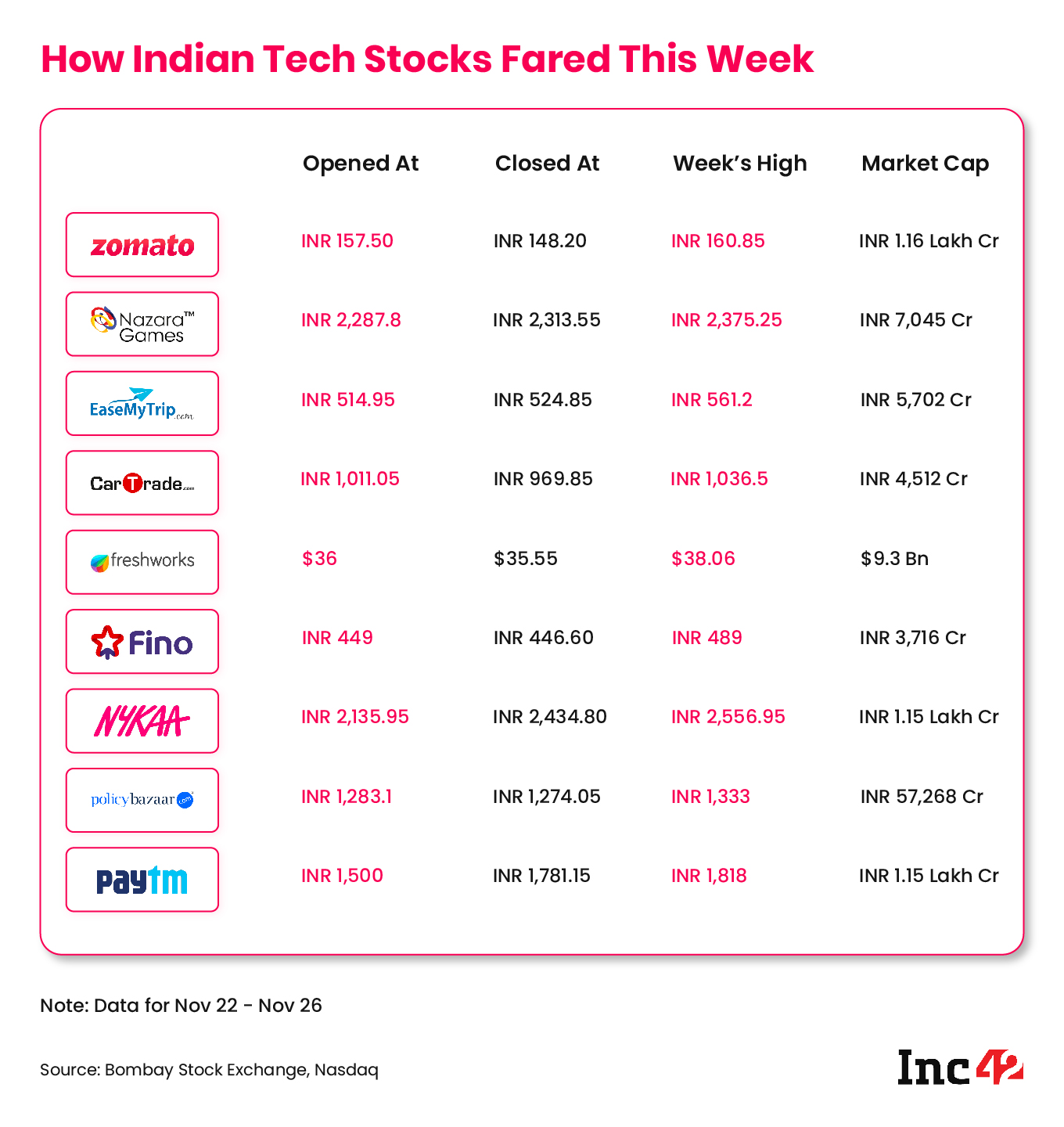

- ?Paytm Stock Climbs! Paytm saw a stock price bump and reported 63.6% higher quarterly revenue this past week, but its net losses widened by 8.42%

- ✋MobiKwik IPO On Hold: As investors pull out with concerns about the fintech startup, MobiKwik’s public listing has been pushed back indefinitely

?Crypto In Murky Waters

If the year began with a massive boom for the crypto industry, it’s looking like it might end in a bust.

The Indian government has listed the so-called crypto bill — officially named “The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021″ — for the upcoming winter session in the parliament.

While the contents of the bill are not yet privy to the public, reports indicate it seeks to ban all private cryptocurrencies while allowing a few exceptions in terms of the usage of the underlying technology or blockchain.

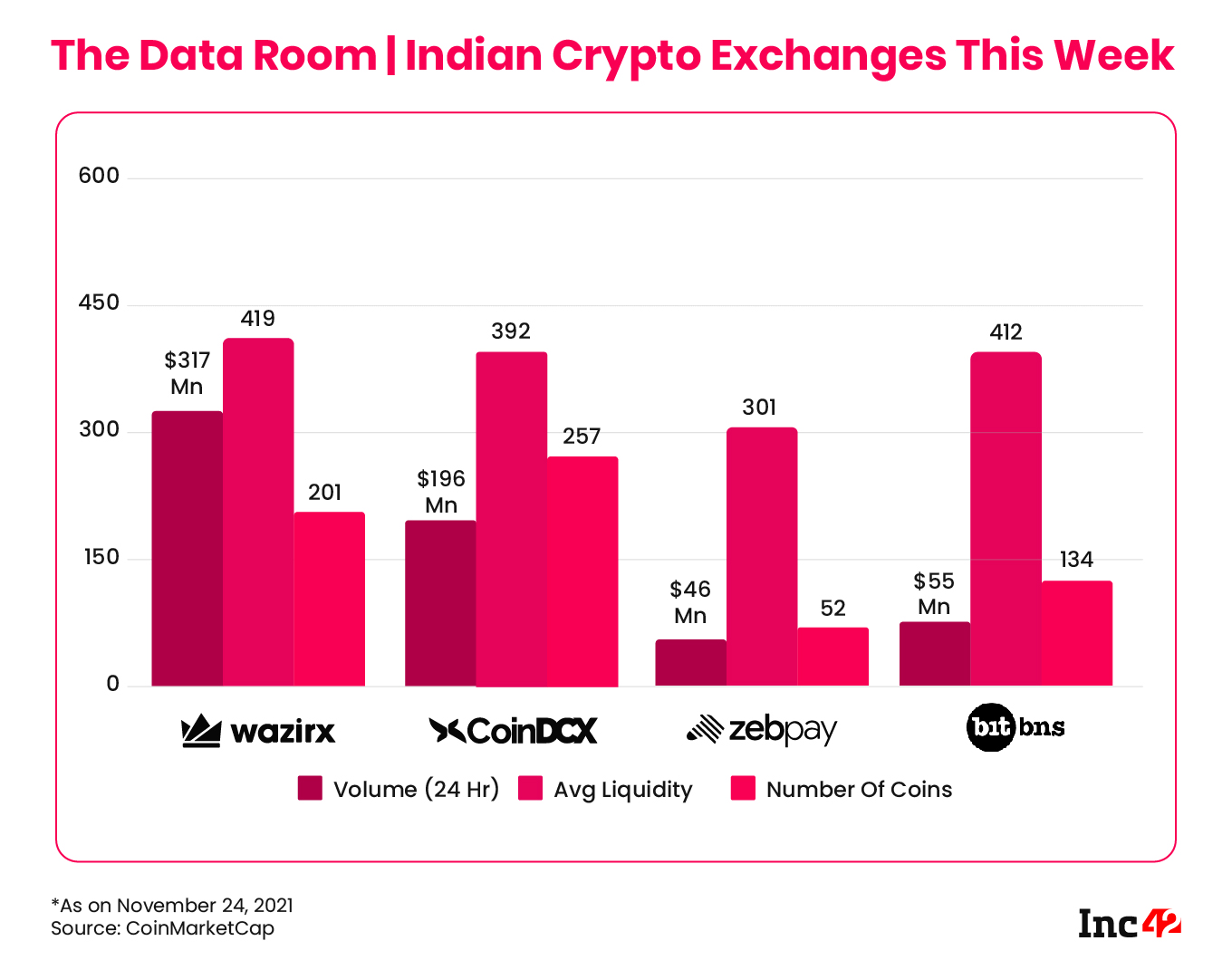

?Crypto Investors Sweat: Binance-owned crypto exchange WazirX crashed after the news broke, as investors overloaded its servers looking to cash out before the prices went on a tumble. Bitcoin saw an immediate dip of $1,500, but other cryptos did not suffer a stiff fall. At the moment, though fear lingers and there could be other dips to come.

As per estimates, crypto investments in India have crossed the INR 6 Lakh Cr mark, but fear over a potential ban has left many investors uncertain, some of whom have invested many lakhs in crypto assets.

?Will India Ban Crypto? There’s no answer to this question yet. Although the bill’s description sounds as ominous as before, there’s no clarity on whether the government will completely ban crypto. The draft and the final bill that is tabled could have significant differences.

Many like Ashish Singhal, founder and CEO of crypto unicorn CoinSwitch Kuber, are hopeful. Others urged investors to remain calm. “Our discussions (with the government) in the past few weeks indicate a broad agreement on ensuring that customers are protected, the stability of the (crypto) financial system is reinforced and India is able to take advantage of the crypto technology revolution,” Singhal said, echoing the voices of the Indian crypto industry.

?️Mixed Messages: However, finance secretary TV Somanathan said that the cryptocurrency will never be accepted as legal tender in India. And then there have been reports that the government will only target the use of cryptocurrency in hawala, foreign exchange violations and terror funding. It’s all very uncertain, at the moment.

In response to the potential blockade on crypto investing and trading, the Blockchain and Crypto Assets Council (BACC) said that any blanket ban will only serve to encourage non-state players and lead to higher unlawful usage of cryptocurrencies.

Indian Startups’ IPO Corner

- ?RateGain, Tracxn Get The Green Light: RateGain and Tracxn have received SEBI approval for their respective IPOs.

- ⬇ Pharmeasy’s Unlisted Shares Fall: Pharmeasy declined by almost 15% in the past one week, as both domestic and global stock markets are highly volatile.

- Paytm’s share price showed signs of growth, giving investors some confidence of a bounce back in the medium term.

- Nykaa stock price continued to rally and the company’s market cap is now the same as Paytm and Zomato.

- News of the latest Omicron variant of Covid-19 has resulted in a big stock market crash in the US. However, no massive decline was seen in the Indian stock markets.

Indian Startup Funding Counter

Indian Startup Funding Counter

?Two More Unicorns! Automobile marketplace Spinny and real estate tech platform NoBroker turned unicorns to take the total number of unicorns in 2021 to 38.

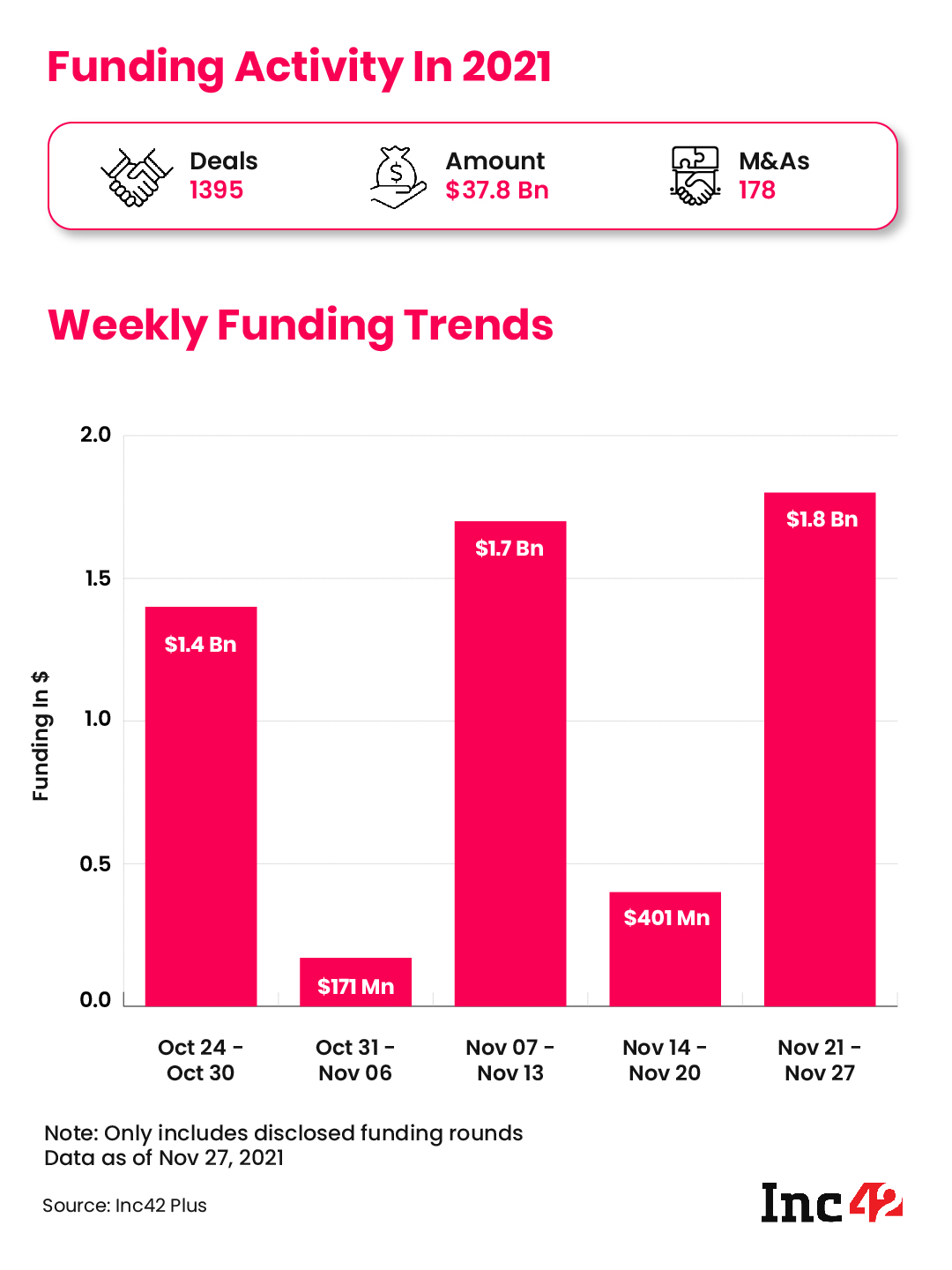

?Funding Bounce Back The overall startup funding this week touched $1.8 Bn dominated by Dream Sports’ mammoth $840 Mn round.

What’s In Store At The D2C Summit

It’s almost here. Just a few more days to go and just in time, here’s a quick look at the agenda for the second edition of The D2C Summit.

We have fireside chats with luminaries like Thrasio founder and CEO Carlos Cashman, masterclasses with investors and experts on everything that matters in the D2C and online selling world, and panel discussions on beauty, fashion and more featuring India’s D2C leaders.

Join 100+ speakers — the likes of Wellversed investor and brand ambassador Yuvraj Singh, Hector Beverages’ Neeraj Kakkar, Manish Chowdhary of WOW Skin Science, Malika Datt Sadani of The Moms Co. — and 100+ brands in groundbreaking talks on December 3 and 4, 2021. Register now if you aren’t one of the 5,000+ people who have signed up!

Top Stories

Finally, here’s a look at the other major stories and developments from the week that went by:

-

- ?India, An Internet Nation: India’s consumer internet and digital economy took the great leap in 2021 across sectors. Here’s to the world’s largest open internet market.

- ? Amazon Vs Future Saga Goes On… Amazon has written to Future Group’s independent directors alleging a fund diversion of $1.5 Bn, which it claims should have been paid to debtors instead

- ?Skyroot Takes Off! After its solid propulsion rocket engine test, the startup is now the first in India to develop a cryogenic rocket

- ?WhatsApp Pay Gets A Boost! The NPCI has allowed WhatsApp to add up to 40 Mn users, up from 20 Mn, to its payments service in India

- ✈️UPI Hops Over To UAE: NPCI is set to roll out UPI in the United Arab Emirates in early 2022 as it looks to expand cross-border UPI use-cases

- ? RBI Raises Loan App Alarm! An RBI report claims up to 600 of the available 1,100 digital lending apps on app stores are predatory, data insensitive and illegal.

- ?️Fashion Brands In The Spotlight: India’s D2C fashion brands play the omnichannel game to become a major challenger for big name brands and unorganised fashion.

That’s all for this week. See you at The D2C Summit and then next Sunday.

Till next week,

Team Inc42

Indian Startup Funding Counter

Indian Startup Funding Counter

Ad-lite browsing experience

Ad-lite browsing experience