RBI governor Shaktikanta Das said that while crypto supporters call it an ‘asset’ or a ‘financial product’, there is no underlying value

If you want to allow gambling, treat it as gambling and lay down the gambling rules. But it [crypto] is not a financial product: Das

Last month, Das warned that the next financial crisis would be triggered by private cryptocurrencies, citing the FTX collapse

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

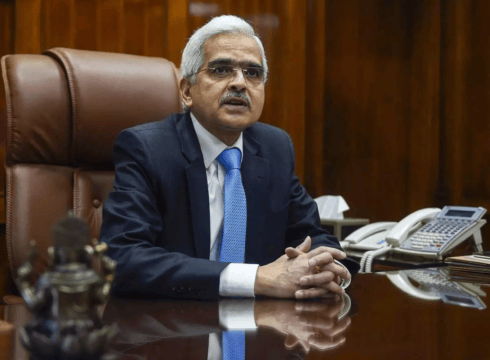

Reserve Bank of India (RBI) governor Shaktikanta Das reiterated the federal bank’s stance on cryptocurrencies by stating that they were equivalent to gambling, addressing a media event on Friday (January 13).

“Every asset, every financial product has to have some underlying (value) but in the case of crypto, there is no underlying value. So anything without any underlying, whose value is dependent entirely on make-believe, is nothing but 100% speculation or to put it very bluntly, it is gambling,” said the RBI governor.

At the same event, he added that while crypto supporters call it an ‘asset’ or a ‘financial product’, there is no underlying value. “Since we don’t allow gambling in our country, and if you want to allow gambling, treat it as gambling and lay down the gambling rules. But crypto is not a financial product,” he said.

This is not the first time the RBI governor has come out strongly against cryptos and their continued usage in India. Last year, there were several instances where various senior RBI officials spoke out against crypto, along with other government officials and union ministers.

Last month, Das warned that the next financial crisis would be triggered by private cryptocurrencies, citing the FTX collapse that shook the global crypto industry.

“After the FTX episode, (I) don’t think we need to say anything more on crypto,” the governor said, adding that the market cap of cryptocurrencies has fallen to $140 Bn, with $40 Bn wiped out in a year.

However, while the RBI keeps reiterating its apparent hostile stance on cryptocurrencies, the government has not done anything against it. On the other hand, the government has also not brought sufficient regulations to the industry, apart from the crypto tax introduced a year ago.

The government also has not shied away from voicing its concerns on global forums and lobbying for global crypto regulations.

Union Finance Minister Nirmala Sitharaman has spoken on several global forums about government concerns, including terror financing and money laundering, calling for worldwide regulations. India can’t do much about cryptos due to their inherently decentralised and international nature.

On its part, the reserve bank has launched the e-Rupee, India’s answer to the central bank digital currency (CBDC). Speaking at the same event, Das said that CBDCs are the future of money and their adoption could help save on logistics and printing costs.

Earlier this month, Das said that CBDCs could also be an area of cooperation within South Asian economies in the future.

“Rupee settlement of cross-border trade and central bank digital currency, where the RBI has already started moving forward, can also be areas of greater cooperation in the future,” Das said during his keynote address at a conference organised by the International Monetary Fund (IMF) in New Delhi on January 6.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.