As per a complaint filed with the Lokpal and CVC, Ramesh Abhishek allegedly favoured 16 companies, including troubled fintech major Paytm, during his stint as a public servant

In a post-retirement affidavit filed with the Lokpal, Abhishek said he earned over INR 2.7 Cr as professional consultancy fees within 15 months after his retirement

Abhishek also serves as an independent director on the board of Paytm Payments Bank, which is facing the ire of the Reserve Bank of India for “persistent non-compliance”

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

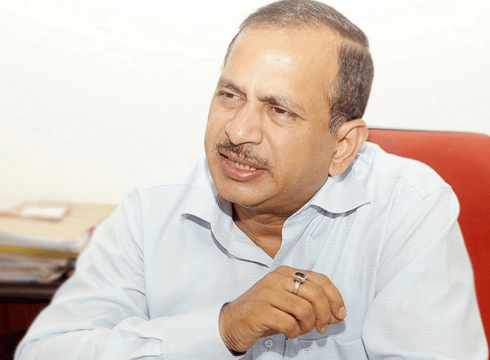

The Central Bureau of Investigation (CBI) on Tuesday (February 20) reportedly raided the residential premises of former bureaucrat Ramesh Abhishek.

Prior to his retirement in 2019, Abhishek served as the secretary of the erstwhile Department of Industrial Policy and Promotion (DIPP). The DIPP was responsible for the implementation of the Centre’s Startup India initiative. Later, the DIPP was renamed as the Department for Promotion of Industry and Internal Trade (DPIIT).

Businessworld reported, citing sources, that the raids were conducted in connection with a disproportionate assets case.

As per the report, the Lokpal and the Central Vigilance Commission (CVC) were earlier tipped off by a complainant who alleged that Abhishek favoured 16 companies, including troubled fintech major Paytm, during his stint as a public servant.

Interestingly, Abhishek also serves as an independent director on the board of Paytm Payments Bank, which is facing the ire of the Reserve Bank of India (RBI) for “persistent non-compliance”. He was appointed to the payments bank’s board in December 2021, along with ex-SBI executive Manju Agarwal and banker Shinjini Kumar.

Earlier this month, both Agarwal and Kumar resigned from Paytm Payments Bank’s board.

Meanwhile, the Businessworld report said that in a post-retirement affidavit filed with the Lokpal, Abhishek said he earned over INR 2.7 Cr as professional consultancy fees within 15 months after his retirement.

The aforementioned 16 companies now feature as Abhishek’s clients, as per the report.

The connection with Paytm Payments Bank is expected to ruffle some feathers at the troubled fintech startup.

The development comes on the same day as Paytm hit upper circuit for the third consecutive trading session. Paytm’s shares have been on a downward spiral ever since the RBI cracked its whip on the company and banned it from undertaking deposits or credit transactions, or top-ups in any of its customer accounts.

The central bank also barred the payments bank from offering other banking services, such as UPI facility and fund transfers, after February 29, 2024. Eventually, it extended the timeline for certain prohibitions to March 15.

Reacting to the extension, shares of the company closed Tuesday’s trading session 5% higher at INR 376.45 on the BSE.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.