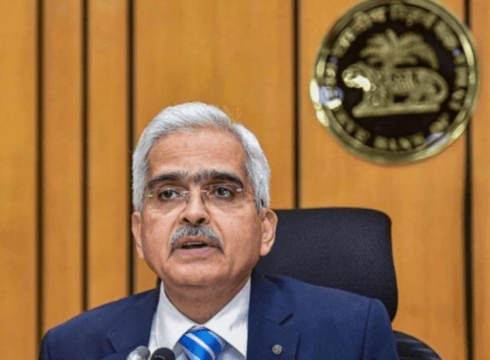

RBI Governor Shaktikanta Das said that the central bank is piloting the CBDC very carefully and cautiously due to concerns around cloning

The governor also called on the South Asian countries to focus on making the policy environment more rewarding for startups

Earlier, Das said that the next financial crisis would take place due to private cryptocurrencies

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday (January 6) said that central bank digital currencies (CBDCs) can emerge as an area of greater cooperation among South Asian economies in the future.

“Rupee settlement of cross-border trade and central bank digital currency, where the RBI has already started moving forward, can also be areas of greater cooperation in the future,” Das said during his keynote address at a conference organised by the International Monetary Fund (IMF) in New Delhi.

The governor also said that the central bank is piloting the digital rupee ‘very carefully and cautiously’ due to concerns such as cloning, which can be ‘very risky’.

Das also said that the central banks of South Asian economies are cooperating across areas such as digital financial inclusion and reducing the cost of cross-border remittances by linking with the UPI system.

Lauding the startup ecosystem, the RBI governor said that fintech, ecommerce, edtech, healthtech and foodtech are the new-age growth propellers and highlighted the need for reliable digital payments.

He also called on South Asian countries to focus on making the policy environment for scientific research and startups more rewarding.

Das’ statement comes more than two months after the RBI commenced the first pilot of wholesale segment-targeted digital rupee. Later, the central bank also rolled out the retail pilot of the digital currency.

The RBI has so far identified nine banks – State Bank of India, ICICI Bank, Yes Bank, IDFC First Bank, Bank of Baroda, Union Bank of India, HDFC Bank, and Kotak Mahindra Bank – for the wholesale pilot run.

The trial run will enable the central bank to test the architecture and robustness of the much awaited project. While there are only two use cases, the conclusions from the trial can see the central bank add a host of features and use cases during its full-fledged launch.

The central bank has thrown its weight behind the CBDC project as it looks to crackdown on private cryptocurrencies and provide an alternative for Indian users. The central bank’s top brass has been vocal about its opposition to private cryptocurrencies, with Das previously saying that the next financial crisis would take place due to cryptocurrencies.

India is also pushing for global regulations for crypto assets. It has been pursuing various options at the global level to regulate or explore the possibility of banning unbacked crypto assets.

The Indian crypto industry has been under the spotlight over the last few months due to the raids by the Enforcement Directorate at the offices of major crypto exchanges.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.