In his new role, Pulyani will be responsible for product development and innovation along with developing strategic growth initiatives for Cashfree

Prior to that, Pulyani served as the product leader at Mumbai-based fintech startup Jupiter

Recently, Cashfree appointed former Razorpay’s SVP Harsh Gupta as the chief revenue officer (CRO)

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

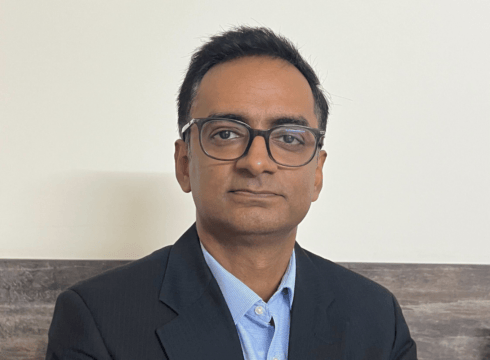

Fintech startup Cashfree Payments has roped in former PhonePe executive Nitin Pulyani as its product head and senior vice president (SVP).

In his new role, Pulyani will be responsible for product development and innovation along with developing strategic growth initiatives for Cashfree, the company said in a statement.

Prior to that, Pulyani served as the product leader at Mumbai-based fintech startup Jupiter. He also worked as the director of product management at PhonePe from 2018-2022.

Pulyani brings over two decades of experience in product development and management. His portfolio also includes companies like NeoGrowth and Ola.

“As the Indian digital economy continues to expand, I see tremendous potential to leverage Cashfree’s years of research and innovation in the fintech space to drive growth and scalability for businesses,” said Pulyani.

The development comes at the heart of Cashfree appointing former Razorpay’s SVP Harsh Gupta as the chief revenue officer (CRO).

As per the release, these appointments align with Cashfree’s market expansion strategy.

Founded by Akash Sinha and Reeju Datta in 2015, Cashfree operates a full-stack digital payments solution platform. It claims to assist more than 6 Lakh businesses with payment collections, vendor payouts, instant loan disbursements and e-commerce refunds.

Cashfree counts companies like Cred, BigBasket, Zomato, Ixigo, Acko, Zoomcar, and Delhivery among its key customers.

In July, the Bengaluru-based company became the first entity to receive the Payment Aggregator Cross Border (PA-CB) licence, after the Reserve Bank of India (RBI) released guidelines to regulate entities facilitating cross-border payments.

This licence enables the startup to process cross-border online transactions for the import and export of goods and services.

In March, Cashfree rolled out ‘Embedded Payments’, a payment solution enabling software platforms to facilitate direct payments between their businesses and users.

The company saw its net loss widen by 46X to INR 133.1 Cr in FY23 from INR 2.9 Cr in the previous year, hurt by a sharp jump in its employee costs.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.