US-based lenders’ representative Glas Trust has said the BYJU'S resolution professional's decision to remove it from the creditors' committee is "unlawful"

It alleged that IRP Pankaj Srivastava is "secretly plotting" to reject the US-based lenders' $1.35 Bn claim against BYJU'S

Glas Trust has moved the Bengaluru bench of the NCLT seeking Srivastava’s removal as the IRP, citing his alleged failure to comply with current bankruptcy rules

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

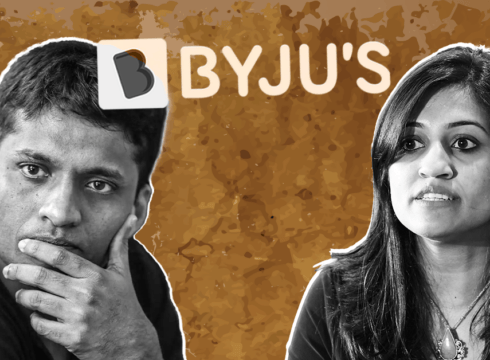

Hours after the insolvency resolution professional of BYJU’S ousted US-based lenders’ representative Glas Trust from its committee of creditors, the latter has said the move is “unlawful” — alleging that Pankaj Srivastava is “secretly plotting” to reject its $1.35 Bn claims against the troubled edtech startup.

Reports surfaced yesterday (September 3) that Srivastava, the interim resolution professional of BYJU’S, unseated Glas Trust from the creditors’ committee.

The decision came after Srivastava reportedly concluded that Glas Trust did not represent the minimum 51% of US-based lenders that extended the $1.2 Bn term loan B to BYJU’S.

However, the lenders have described Srivastava’s actions as “fraudulent” and “illegitimate”.

“Pankaj Srivastava’s actions are unprecedented and entirely illegitimate as no interim resolution professional in the history of the Insolvency and Bankruptcy Code of India has ever attempted to unlawfully strip financial creditors of claims of this magnitude amounting to more than US$1.35 billion without any legitimate reason and in doing so securing his appointment as the permanent resolution professional,” the steering committee of lenders said.

According to the lenders, Srivastava had previously confirmed that the claim filed by Glas Trust on their behalf amounting to INR 11,432.98 Cr (about $1.35 Bn) had been verified and admitted and that Glas Trust was “undoubtedly” a member of the CoC.

However, Srivastava abruptly cut off all communication to the lenders on August 27 and ignored all efforts to reach him to check-in on the status of the insolvency process, Glas Trust alleged.

The lenders further alleged that Srivastava “misled and blindsided” Glas Trust and lenders by moving the first CoC meeting 9 hours earlier without giving any notice.

Meanwhile, Glas Trust has moved the Bengaluru bench of the NCLT seeking Srivastava’s removal as the IRP, alleging he failed to comply with current bankruptcy rules. The matter is due for hearing today (September 4).

At the heart of this dispute is the $1.2 Bn debt raised by BYJU’S in 2021. However, amid mounting losses and a cash crunch, the company suspended payments and filed a suit against its creditors.

On the other hand, its US lenders have accused the company’s founder and CEO Byju Raveendran of diverting more than $500 Mn from the TLB corpus. The creditors have even filed a bankruptcy case against the company’s American arm, BYJU’S Alpha, in the US.

In an effort to recover the funds, Glas Trust moved the Supreme Court to quash an INR 158 Cr settlement between the edtech firm and the Board of Control for Cricket in India (BCCI) in connection with the edtech’s insolvency proceedings. Last month, the SC revived the insolvency proceedings against BYJU’S.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.