BDO’s exit comes just more than a year after Deloitte, the company’s previous auditor, stepped down citing problems with BYJU’S financial reporting

In its resignation letter, BDO highlighted several troubling issues, including delays in financial reporting, lack of support from the management and concerns over recovering outstanding dues from a Dubai-based entity

BDO also pointed to other challenges facing BYJU’S, such as ongoing litigation, liquidation proceedings initiated by creditors, and allegations of mismanagement by minority shareholders

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

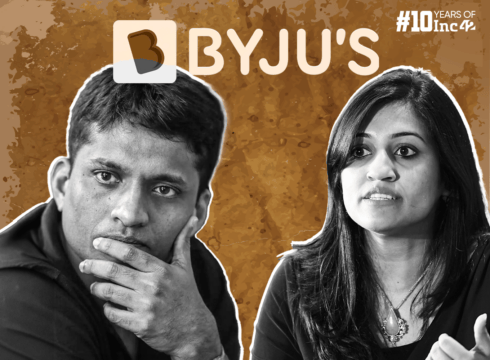

In another setback to BYJU’S, the embattled edtech major’s second auditor BDO (MSKA & Associates) has resigned amid concerns over “financial” and “governance” issues.

BDO’s exit comes just more than a year after Deloitte, the company’s previous auditor, stepped down citing problems with BYJU’S financial reporting.

The board of BYJU’S initially engaged MSKA & Associates on August 2, 2023, to fill a casual vacancy that had arisen due to Deloitte’s exit. Subsequently, the firm was reappointed on December 20, 2023, as the company’s statutory auditor during the annual general meeting for a duration of five years, spanning from FY23 to FY27.

In its resignation letter, BDO highlighted several troubling issues, including delays in financial reporting, lack of support from the management and concerns over recovering outstanding dues from a Dubai-based entity.

Specifically, BDO raised doubts about the recovery of approximately INR 1,400 Cr from More Ideas General Trading LLC, a reseller based in Dubai. The transaction was reported to the Ministry of Corporate Affairs on September 2.

BDO also pointed to other challenges facing BYJU’S, such as ongoing litigation, liquidation proceedings initiated by creditors, and allegations of mismanagement by minority shareholders.

Furthermore, BDO stated that BYJU’S failed to provide crucial information, including notices for extraordinary general meetings (EGMs) and insolvency proceedings, to its audit team.

Following resignation, the edtech startup released an official statement saying, “BYJU’S has complied with every request made by BDO, except those that would require crossing ethical and legal boundaries. The real reason for BDO’s resignation is BYJU’S firm refusal to backdate its reports, while BDO went to the extent of recommending a firm that could facilitate such an illegal activity.”

“Multiple call recordings exist, where BDO representatives explicitly suggest backdating these documents, which BYJU’S refused to do. BYJU’S strongly believes that this is the main reason for their resignation,” the statement added.

This comes amid BYJU’S facing a heap of legal challenges, which include a recent Supreme Court ruling to recommence insolvency proceedings against the startup.

BYJU’S entered insolvency proceedings on July 16, 2024, due to a legal dispute with the Board of Control for Cricket in India (BCCI). This led to the appointment of an Insolvency Resolution Professional (IRP) and the suspension of the company’s Board.

The following day, on July 17, BDO emailed the suspended board requesting clarification on historical transactions with a Middle Eastern partner. In the same email, BDO threatened to resign if the clarifications were not provided within 45 days.

BDO eventually resigned after the 45-day window expired, citing the suspended board’s failure to provide the requested clarifications. However, surprisingly, the BDO failed to appreciate that for most of that 45-day period, the IRP was in control of BYJU’S and only the IRP could provide the answers they were seeking.

During a Committee of Creditors meeting on September 3, 2024, the IRP reported attempts to contact BDO for clarification but received no response, raising concerns about BDO’s communication practices.

Regarding the Middle Eastern transactions, BYJU’S clarified that a forensic audit was arranged and supervised by BDO before the insolvency proceedings. The audit could not be completed due to the insolvency initiation, but a prior audit had cleared these transactions.

A BDO senior partner has also confirmed on video that after conducting thorough due diligence, they have found no evidence of fraud or malpractice in our international transactions, the company added in the statement.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.