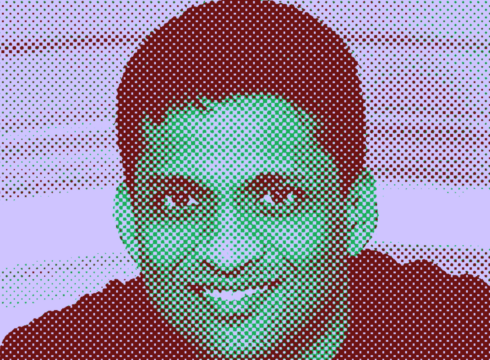

As per recently released Forbes Billionaire Index 2024, the embattled edtech major’s founder and CEO’s net worth plummeted to zero in 2024, pushing him out of the coveted list

Byju Raveendran’s net worth stood at INR 17,545 Cr ($2.1 Bn) last year

The edtech major has been grappling with fires on multiple fronts including multiple legal cases, a looming debt crisis, mass layoffs, funding crunch and a public standoff with investors

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Byju Raveendran, founder and CEO of embattled edtech major BYJU’S, has a dramatic fall from grace, with his net worth plummeting from INR 17,545 Cr ($2.1 Bn) to zero, according to the recently released Forbes Billionaire Index 2024.

The fall from grace coincides with a slew of issues that have erupted at the edtech major in the past one year. Once the country’s most valued startup at $22 Bn, BYJU’S has grabbed news headlines for all the wrong reasons in the recent past with the turmoil at the company now pushing Raveendran out of the coveted list of world’s “richest’.

Founded in 2011 by Raveendran, along with his wife Divya Gokulnath, the edtech startup quickly rose to fame on the back of pandemic-era growth and raked in millions of dollars in VC funding.

With schools shut, the company launched a slew of offerings, catering to students from primary school to UPSC aspirants. Flush with capital, it also undertook a host of big-ticket acquisitions and even took a term loan B (TLB) anticipating the pandemic boom to continue.

However, things went south as the FOMO-era of 2021 took a backseat amid the early onset of funding winter in 2022. Wary investors tightened their purse strings as interest rates began to rise and market volatility became the norm.

As schools reopened and macroeconomic pressures began to appear, things went on a downward spiral for the edtech unicorn. As capital became scarce during the funding winter starting 2022, acquisitions of past years only added to the company’s losses without yielding any positive returns.

Making matters worse was opacity in the functioning of the company. BYJU’S regularly delayed its financial results inviting the ire of investors and other shareholders. It released its financial results for the year ending March 2022 (FY22) after a gap of two years, posting a cumulative loss of over $1 Bn.

As a result, the company began mass layoffs in 2022 as part of a restructuring exercise to streamline operations. It has fired more than 5,000 employees since 2022 and has delayed the salary of its workforce already twice this year.

On top of that, the company is also fighting a legal battle with its creditors over a $1.2 Bn TLB, hitting the brand image of the startup, which was once the poster boy of the Indian startup ecosystem. Besides, it also has a dozen legal cases, including insolvency proceedings, filed before various courts across the country.

It is also fighting pitched public battles with its investors that earlier this year convened an extraordinary general meeting (EGM) to oust Raveendran and his kin (wife and brother Riju Ravindran), who dominate the company’s board.

Additionally, the edtech giant is also under the scanner of Enforcement Directorate (ED) over alleged foreign exchange violations involving a sum of INR 9,362 Cr.

Such has been the situation that Raveendran has had to reportedly pledge two houses to pay the salaries of the edtech major’s employees while the NCLT has barred it from accessing the proceeds of the recent $200 Mn rights issue till further notice.

The issues have contributed to Byju Raveendran’s fall from grace. Once a high flying name in the startup ecosystem, his net worth now, as per Forbes, stands at zero. As much goes on at the company, all eyes are now on whether he is able to weather the storm and steer BYJU’S’ sinking ship through choppy waters.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.