Raveendran told the teachers working with the edtech startup that he has managed to borrow some funds to make a "small payment by this weekend" to them

Raveendran also asserted confidence in winning the case that the company is currently facing in the Supreme Court, filed by its US-based lenders Glas Trust

He also acknowledged the fact that BYJU’S hasn’t paid its teachers for the past three months but promised to pay more than their “fair share” once he regains control of the company

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

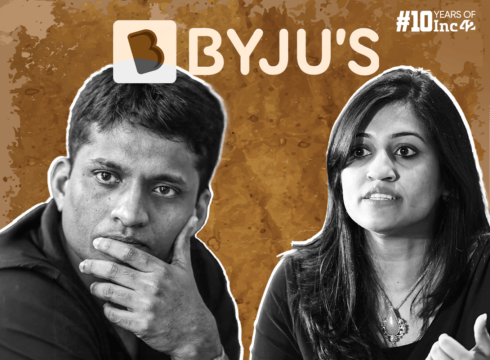

Amid the ongoing insolvency proceedings, BYJU’S founder and CEO Byju Raveendran told the teachers working with the edtech startup that he has managed to borrow some funds to make a “small payment by this weekend” to them.

In an email addressed to the teachers, Raveendran said that BYJU’S employees will get paid once the founders regain control of the company’s finances. He acknowledged that the company hasn’t paid the teachers for the past three months but promised to pay more than their “fair share” once he regains control of the company.

Inc42 has accessed the email sent by the founder.

Raveendran also asserted confidence in winning the case that the company is currently facing in the Supreme Court, filed by its US-based lenders Glas Trust.

“Right now, there are many legal battles underway. US-based lenders have filed a flimsy case, staking a claim on our India assets. But they have no entitlement to these assets, as per the agreement we signed with them. The so-called trust that represents them in India has no legal standing. It does not represent the majority of these lenders,” he said in the mail.

This is the second email written to Raveendran to employees in the past month. Since his last email, the company’s battle with Glas Trust has intensified in the Supreme Court.

Glas Trust moved the Supreme Court against a ruling by National Company Law Appellate Tribunal (NCLAT) that had stayed the insolvency proceedings against the embattled edtech giant.

Following this, the Supreme Court revived the insolvency proceedings. The consortium of the edtech’s term loan B (TLB) lenders has claimed dues to the tune of INR 11,432 Cr ($1.36 Bn). Besides, BYJU’S wholly owned subsidiary and coaching chain Aakash Educational Services Ltd (AESL) has filed a claim of INR 1,404 Cr ($167 Mn).

“This process has been challenged by us in the court of law because we believe in this company, we believe in our mission, and most importantly, we believe in you. We know that BYJU’S is not just a business model,” Raveendran said in the mail.

In his previous mail, Raveendran said that the lenders which Glas Trust represents are not the company’s original lenders, who had signed an agreement to get repaid in November 2026. He said they are “aggressive foreign distress funds” who are using “unlawful” ways to force the company to pay back the $1.2 Bn within 16 months of distribution.

Meanwhile, Glas Trust was also disqualified from the Committee of Creditors (CoC) by the insolvency resolution professional, Pankaj Srivastava, after its first meeting on September 3.

After the ouster, the lenders labelled Srivastava’s actions as unprecedented and entirely illegitimate. The lenders have also challenged their removal from BYJU’S CoC at the SC. Besides, Glas Trust is also seeking the removal of Srivastava.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.