Public capital in the funds capped at 20%, to be managed by private fund managers

Blended finance mixes public capital with market-based funds to mobilise additional commercial funding toward sustainable development

FM also proposes setting up a fund routed through NABARD under a co-investment model to finance startups in the agritech space

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

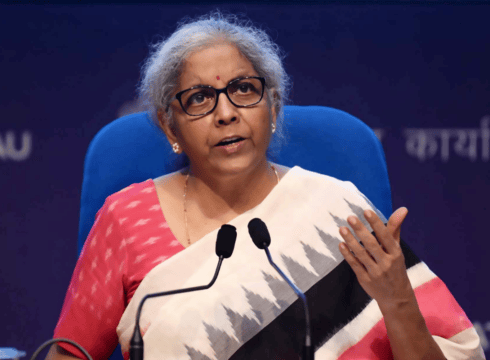

In her big Budget speech today, Finance Minister Nirmala Sitharaman announced the setting up of thematic funds for blended finance in the ‘sunrise’ sectors of deeptech, agritech and climate action.

The Government’s share in the funding will be limited to just 20% and these funds will be managed by private fund managers.

She said that, “For encouraging important sunrise sectors such as climate action, deeptech, digital economy, pharma and agritech, the government will promote thematic funds for blended finance with the government share being limited to 20% and the funds being managed by private fund managers.”

Blended finance mixes public capital with market based funds to essentially mobilise additional commercial funding towards sustainable development.

This is expected to be modelled after government backed funds set up by National Investment and Infrastructure Fund and Small Industries Development Bank of India.

Sitharaman also pointed out that so far government-backed NIIF and SIDBI Fund of Funds have provided scale capital that has created a multiplier effect.

The move is expected to spur private equity and venture capital funding in Indian startups. The initiative is expected to be joined by major players which, in turn, will ensure more capital earmarked for startups in these ‘sunrise; sectors.

The FM also made a slew of announcements for the agritech sector as well. In her speech, she proposed the setting up of a fund routed through NABARD (National Bank for Agriculture and Rural Development) under a co-investment model to finance startups in the agritech space.

She said, “This is to finance startups for agriculture and rural enterprise, relevant for farm produce value chain. The activities for these startups will include, inter alia, support for FPOs, machinery for farmers on rental basis at farm level, and technology including IT-based support.”

In addition, FM called for facilitating the deployment of “Kisan Drones” in agriculture for crop assessment and spraying insecticides. She also called for leveraging ‘Drone Shakti’ through varied applications and for Drone-as-a-Service (Dr-aaS).

This comes amid a big bump in funding for the agritech sector as the space has grown by leaps and bounds in the past couple of years. An Inc42 report estimates that India is home to over 1000+ agritech startups. Add to that, agritech startups raised close to $684 Mn across 47 deals in 2021. The sector is led by biggies like DeHaat, Ninjacart, Agrowave, BharatAgri, BigHaat, Bijak, Gramophone, Krishify and CropIn.

The deeptech space too has been performing well. 2020 saw over 14% of all investments in tech startups flow to the deeptech space. According to Inc42 data, around $1.6 Bn has been poured into deeptech sector since 2014. The Indian deeptech space is led by startups like Agnikul, Bugworks, KBCols Sciences, among others.

An Ernst & Young study estimates the Indian agritech market to grow to $24 Bn by 2025. The sector has been propelled by ever increasing internet penetration in the country and a transition from conventional business models to agritech-led innovative business models.

The new announcements in the Budget will go a long way in ensuring that these startups have more corpus funds. The initiatives will also push VC funds to invest more cash in these ‘sunrise’ sectors. This will lead to greater legroom for Indian startups and propel them towards growth.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.