Bounce’s financial results for FY22 clearly show the impact of the pandemic, as its operating revenue saw a marginal 0.05% YoY rise at INR 15 Cr

Led by the decline in employee benefit expenses due to layoffs, Bounce’s total expenses fell nearly 23% YoY to INR 276.8 Cr in FY22

Bounce started its journey as a bike rental services platform, but now also sells escooters to retail customers

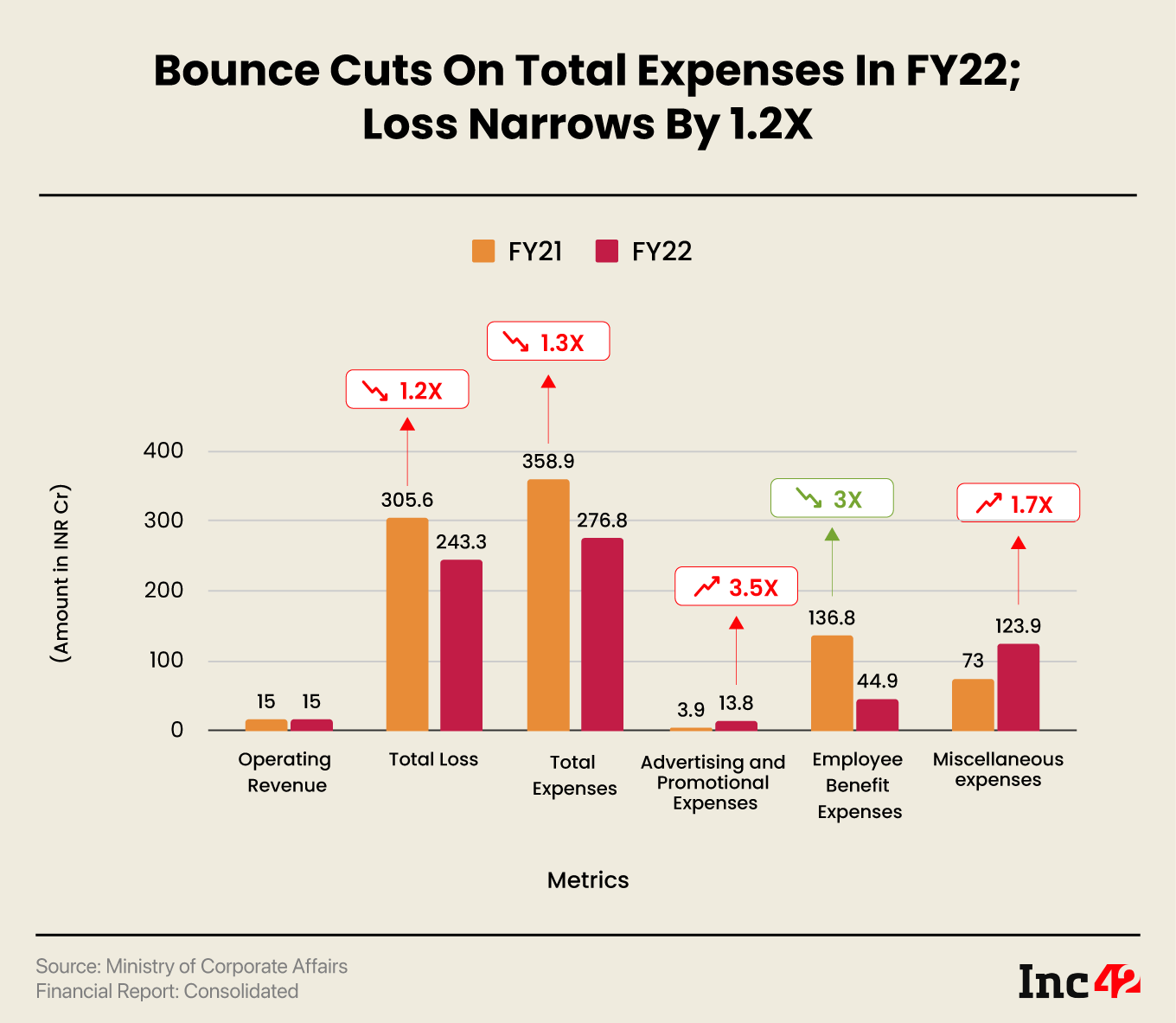

Bike rental and electric vehicle (EV) startup Bounce reported over a 20% year-on-year (YoY) decline in net loss to INR 243.3 Cr in the financial year 2021-22 (FY22) as the startup significantly cut down its expenses to offset the decline in its top line during the year.

Bounce’s net loss stood at INR 305.6 Cr in the previous fiscal year.

Bounce, founded in 2014, started its journey as a bike rental services platform. However, it entered the EV space in 2022 after its scooter rental business took a big hit during the Covid-19 pandemic. Bounce now manufactures and sells electric scooters – Bounce Infinity. It provides escooter rental services as well as competes with the likes of Ola Electric, Ather Energy, Pure EV, Okinawa Autotech, and other two-wheeler EV manufacturers.

The startup’s financial results for FY22 clearly show the impact of the pandemic, as its operating revenue saw a marginal 0.05% YoY rise at INR 15 Cr. Of this, it generated a revenue of INR 14.3 Cr from renting of motor vehicles as against INR 14.5 Cr in FY21.

The startup did not recognise any income from sale of products in FY22.

Meanwhile, Bounce’s total income declined over 37% to INR 33.5 Cr during the year under review from INR 53.3 Cr in FY21 due to a sharp fall in some of its other non-operating income, which includes unwinding of discount on security deposits, concession in rent due to the pandemic, and more.

In respect of certain leased office premises, the lessors provided certain rent concessions in the form of rent waiver. This was recognised in other income amounting to INR 80.3 Lakh in FY22 as against INR 82.4 Lakh in FY21, Bounce said in its regulatory filings with the Ministry of Corporate Affairs.

In order to cut its loss, Bounce also laid off employees during the year. In its second round of layoffs in February 2021, the startup laid off about 40%-60% of its workforce.

In line with the restructuring efforts, Bounce’s employee benefit expenses declined nearly one-third to INR 44.9 Cr in FY22 from INR 136.8 Cr in FY21.

The startup’s depreciation, depletion, and amortisation expense also fell 32.6% YoY to INR 61.2 Cr in FY22.

However, Bounce spent 3.5X more towards advertising and promotional expenses during the period. Promotional expenses shot up to INR 13.8 Cr in FY22 from INR 3.9 Cr in FY21. It must be noted that Bounce roped in Bollywood actor Hrithik Roshan for its Bounce Infinity commercials in December 2021.

Meanwhile, miscellaneous expenses also surged 1.7X YoY to INR 123.9 Cr in FY22. While the company did not disclose the expenses included in the miscellaneous bucket in FY22, its FY21 miscellaneous expenses included the cost of helmets, payment gateway charges, subcontractor charges, provision for bad and doubtful debts, among others.

Overall, Bounce saw nearly 23% in total expenses to INR 276.8 Cr in FY22 from INR 358.9 Cr in the previous fiscal year.

While Bounce evidently faced a significant challenge due to the pandemic and funding winter, the startup has reportedly raised $20 Mn from existing investors, including Sequoia Capital recently.

Backed by the likes of Accel Capital and B Capital, Bounce has raised a funding of over $234.2 Mn till date.

Bounce recently fired around 3%-4% of its total employees in another round of layoffs. Meanwhile, it is spending heavily on establishing experience centres for its electric scooters across the country.

The company had 37 Bounce Infinity stores in India at the end of October, and was aiming to open 75 more outlets by the end of 2022.

Ad-lite browsing experience

Ad-lite browsing experience