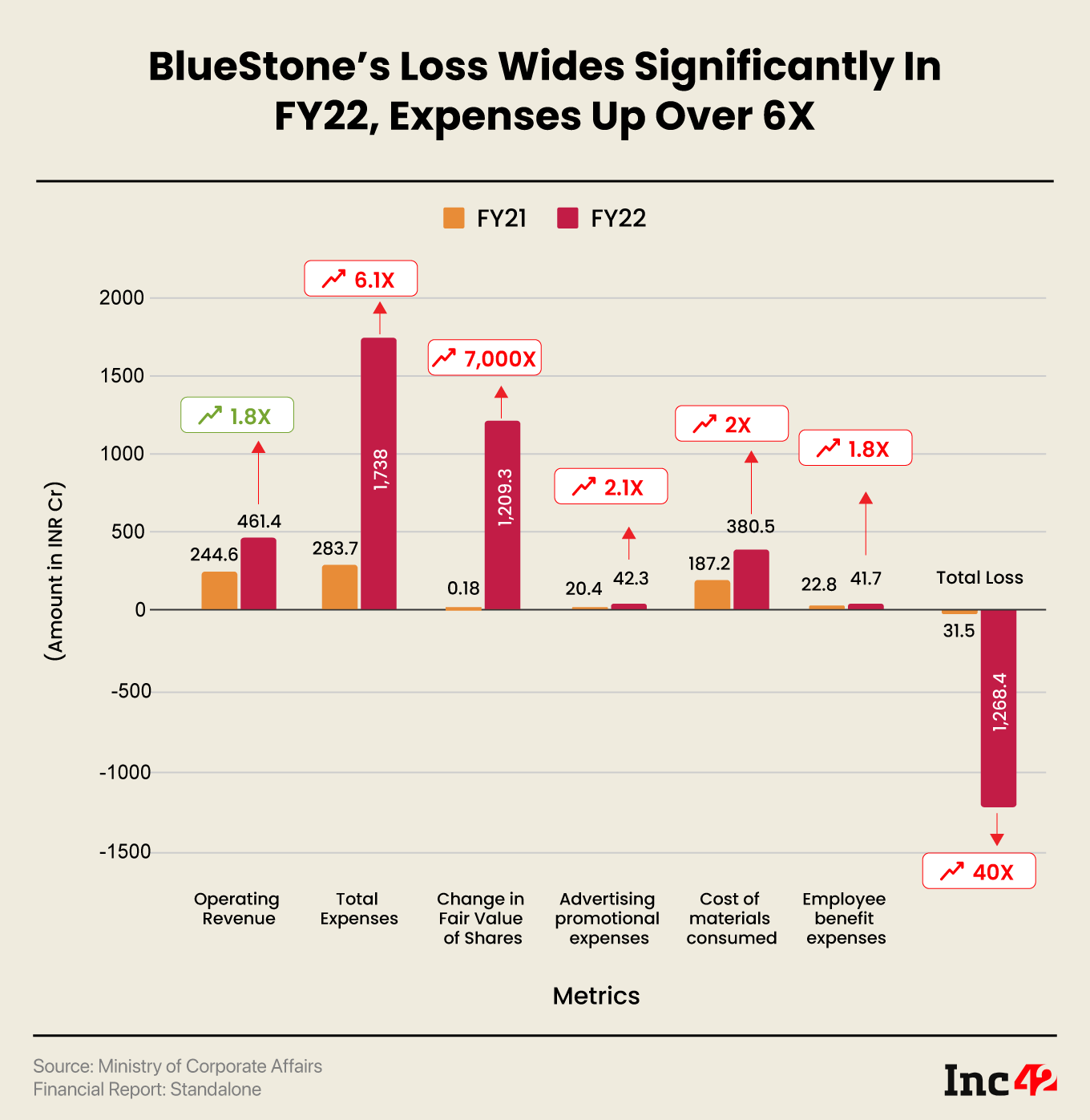

Ratan Tata-backed BlueStone’s operating revenue rose 1.8X to INR 461.4 Cr in FY22 from INR 244.6 Cr in FY21

Total expenses grew 6.1X to INR 1,738 Cr in FY22 due to a non-operating expenditure of INR 1,209.3 Cr following a change in fair value of shares due to adoption of a new accounting policy

Excluding the fair value loss on financial liabilities, the jewellery retailer’s net loss stood at INR 528.7 Cr in FY22 as against INR 31.3 Cr in FY21

Ratan Tata-backed jewellery retailer BlueStone’s net loss widened 40X to INR 1,268.4 Cr in the financial year 2021-22 (FY23) from INR 31.5 Cr reported in FY21 due to a loss on fair valuation of shares which led to a sharp rise in non-cash expenditure.

BlueStone, which designs and sells various jewellery like rings, pendants, and earrings in precious metals and fashion jewellery categories, reported a 1.8X increase in its operating revenue to INR 461.4 Cr in FY22 from INR 244.6 Cr in FY21.

Its total revenue stood at INR 476.6 Cr in FY22, registering an increase of 89% year-on-year (YoY).

The startup operates physical stores as well as an online platform for business and generates a majority of its revenue from the sale of products. BlueStone also earns revenue from gift vouchers. The amount collected on the sale of a gift voucher is recognised as a liability and transferred to revenue (sales) on redemption by the customers, as per the startup’s regulatory filing with the Ministry of Corporate Affairs.

Meanwhile, BlueStone’s total expenses grew 6.1X to INR 1,738 Cr in FY22 from INR 283.7 Cr in the prior fiscal year. In that, the startup registered a non-operating expenditure of INR 1,209.3 Cr in the year following a change in fair value of shares due to the adoption of a new accounting policy. This non-operating expenditure stood at INR 18 Lakh in FY21.

In the reporting year, BlueStone adopted Ind AS accounting standards from previous accounting standards under Indian GAAP.

Excluding the fair value loss on financial liabilities, the startup’s net loss stood at around INR 59.2 Cr in FY22 as against INR 31.3 in the prior fiscal year.

BlueStone spent INR 380.5 Cr towards the cost of materials in FY22 as against INR 187.2 Cr in FY21.

On the other hand, employee benefit expenses increased 1.8X to INR 41.7 Cr in FY22 from INR 22.8 Cr in the prior fiscal year. In that, it spent INR 35 Cr towards salaries and wages, registering an 84% increase YoY.

It must be noted that the startup has been on an expansion spree. It was planning to ramp up its manufacturing capabilities and accelerate its pan-India rollout after raising $30 Mn in a funding round led by Hero Enterprise’s Sunil Kant Munjal in March 2022.

BlueStone’s advertising promotional expenses also doubled to INR 42.3 Cr in FY22 from INR 20.4 Cr in the prior fiscal year.

As a growing new-age jewellery brand, which competes with leading brands like Tata’s Tanishq, CaratLane, and Kalyan Jewellers, along with startups like Giva and Melorra, BlueStone is known for its millennial-focus jewellery advertisements across platforms.

Besides these major expenses, BlueStone spent INR 21 Cr on commissions to other selling agents in FY22, a rise of 81% YoY.

However, its expenses towards rent declined a little over 7% YoY to INR 4.1 Cr in FY22.

Founded in 2011 by Gaurav Singh Kushwaha and Vidya Nataraj, BlueStone claims to operate over 140 retail outlets across 38 Indian cities. It claims to have created over 8,700 contemporary designs so far.

Recently, the Bengaluru-based startup promoted its Chief Operating Officer Sudeep Nagar as its cofounder.

BlueStone’s competitor Melorra reported a 73% rise in net loss to INR 106.7 Cr in FY22, while sales grew 363.6% to INR 364.4 Cr.

Ad-lite browsing experience

Ad-lite browsing experience