In a week when the broader Indian equity market remained range-bound, all new-age tech stocks ended in the red

Zomato was the worst hit among the new-age Indian tech stocks, plunging 11% during the week, followed by PB Fintech with a 9% decline

Despite Paytm reporting consistent growth in its loan disbursals, the shares of its parent One97 Communications declined 3.7% on the BSE

After seeing a sharp rebound last week, new-age Indian tech stocks were crushed this week. Shares of all the listed tech startups fell between 2% to 11% during the week when the overall Indian stock market remained range-bound.

Zomato was the biggest loser this week, with the stock plunging 11% on a weekly basis on the BSE. It was followed by PB Fintech, the parent company of Policybazaar, which declined over 9%.

Factors such as potential regulatory changes and the impending expiry of the lock-in period for pre-IPO investors continue to weigh heavily on Policybazaar shares. According to analysts, there are no signs of a reversal on the technical charts right now. However, brokerage JM Financial, in a research note this week, said that Policybazaar is well-placed to benefit from rising digital penetration and the timely foray into omnichannel insurance distribution.

Meanwhile, EaseMyTrip, MapmyIndia, Paytm, and CarTrade Technologies had a less severe fall this week compared to Zomato and Policybazaar.

Despite Paytm reporting consistent growth in its loan disbursals, the shares of its parent One97 Communications declined 3.7% on the BSE this week. On the other hand, EaseMyTrip shares fell 3.4% on a weekly basis.

Overall, the Indian stock market remained range-bound movement this week, seeing red as well as green days. India’s easing wholesale inflation, a relief rally in global markets, and decline in crude oil prices provided some relief to the domestic indices.

The benchmark indices NSE Nifty50 and BSE Sensex were down 0.7% and 0.4% this week, ending Friday’s session in the green zone at 17,185.70 and 57,919.97, respectively.

“Although markets were unable to sustain at higher levels and pared some gains, Nifty is holding well above its crucial levels,” said Siddhartha Khemka, head of retail research at Motilal Oswal.

The market is likely to remain range-bound for some time, said Amol Athawale, deputy vice president of technical research at Kotak Securities.

Now, let’s dig a little deeper into the weekly performance of some of the listed new-age tech stocks from the Indian startup ecosystem.

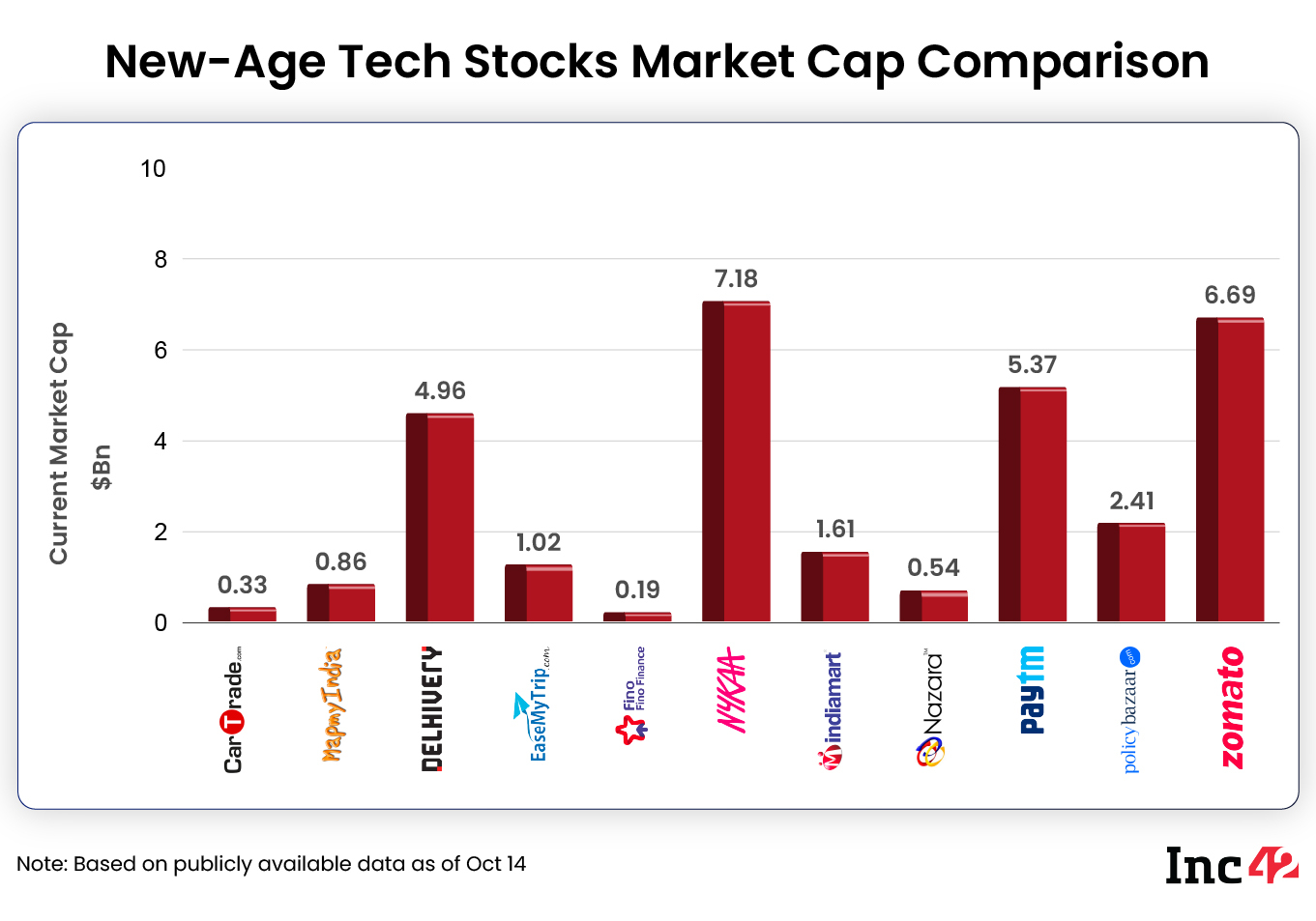

The total market capitalisation of the 11 new-age tech stocks stood at $31.2 Bn versus $32.6 Bn last week.

Zomato Biggest Loser

After a 14.55% surge in its stock price last week, Zomato was the worst hit among the new-age Indian tech stocks this week.

The shares of the food delivery startup fell in four straight sessions during the week. However, they recovered a bit on Friday, ending the week at INR 61.9 on the BSE, up about 1% from Thursday’s close.

After several major investors sold their stakes in Zomato in the last few months, there were speculations this week about another strategic investor selling its stake in the startup.

However, many analysts are upbeat about Zomato’s performance in Q2 FY23. In a recent research note, JM Financial said that the startup is likely to continue on its path to profitability, with its adjusted EBITDA loss percentage estimated to narrow by 210 basis points (bps) quarter-on-quarter (QoQ).

“We expect reported revenue to grow at 3.9% QoQ on the back of strong growth in Hyperpure (9.2% QoQ) which continues to see good traction,” said the analysts at the brokerage. “We expect food delivery to report 2.5% QoQ growth in reported revenue.”

Meanwhile, Kotak Securities’ Athawale said, “For the last couple of months, the stock has been witnessing range-bound activity. On the higher side, it is consistently taking resistance near INR 70 and on the lower side it is consistently taking support at INR 57-58. So, as long as the stock is trading in this range, we are not expecting any promising uptrend or downtrend momentum.”

If the stock closes above INR 70, there is a possibility of fresh uptrend rally till INR 75-77. On the flip side, if it reaches its support level of INR 58-60, there is a possibility of a quick short-term correction to INR 50-55 levels, he added.

Paytm Continues To Be Under Pressure

Shares of Paytm gained on Monday after the fintech startup reported strong loan disbursals in Q2. However, the stock gave up the gains and fell sharply in the next four sessions, declining 3.7% on a weekly basis. Paytm shares ended the week at INR 681.35.

In The News For:

- Paytm disbursed 9.2 Mn loans, worth a cumulative INR 7,313 Cr ($894 Mn), during July-September 2022 period. Loan disbursals grew 224% year-on-year (YoY) in Q2

- Paytm launched a travel sale for its users to offer them festive deals on travel ticket bookings using the app

Some analysts are of the opinion that the startup’s big spending on ancillary services could further hurt the stock price. However, brokerages like JP Morgan and Goldman Sachs continue to be bullish on the stock.

Paytm shares are currently trading over 65% below their listing price of INR 1,955 on the BSE.

“As long as the stock is trading below INR 730 or the 50-day simple moving average (SMA), the weak texture is likely to continue. If the stock succeeds to close above 50-day SMA, then the immediate upside for the stock would be INR 750, which is 200-day SMA. Further upside may also continue, which could leave the stock at INR 770-780,” said Athawale.

However, the stock looks weak currently and immediate support is seen at INR 660, he added.

EaseMyTrip Stocks Fail To Hold On To Gains

Shares of EaseMyTrip surged 7.48% last week after two weeks of decline. However, shares of the traveltech startup slipped into the red this week, falling 3.4% on a weekly basis.

The stock gained during the first session of the week after the startup’s board approved issuance of bonus shares in a 3:1 ratio and a stock split on Monday. However, it failed to hold on to the gains and fell sharply in the next three sessions.

The shares rose marginally from Thursday’s close to end the week at INR 388.5 on the BSE on Friday.

Before we dig deeper into the stock, let’s first check the headlines the startup made this week.

In The News For:

- EaseMyTrip’s board approved issuance of bonus shares in a 3:1 ratio and sub-division of existing equity share of face value of INR 2 each into two equity shares of face value of INR 1 each

- The traveltech company is preparing to launch Save Now Buy Later (SNBL), an investment scheme for its customers

Despite the continuing volatility in the stock price, JM Financial expects a sharp sequential and YoY increase in EaseMyTrip’s gross booking revenues in Q2 FY23, driven by the rebound in the international and domestic travel industry.

However, the brokerage also expects the startup’s EBITDA margin to narrow by 11 percentage points YoY given higher advertising and promotional expenses due to the increased competition.

On the daily chart, EaseMyTrip has formed a double top formation, quite similar to the Zomato stock, opined Kotak Securities’ Athawale. The stock is consistently taking resistance at INR 430 level, he said, adding that on the lower side, INR 360-370 is the immediate support zone for the stock.

“Currently, the stock is witnessing correction, but I think higher bottom formation is possible if the stock succeeds to trade above INR 410. If the stock trades above that level then there is a possibility of a fresh uptrend rally till INR 440-450 on the higher side,” Athawale said.

Ad-lite browsing experience

Ad-lite browsing experience