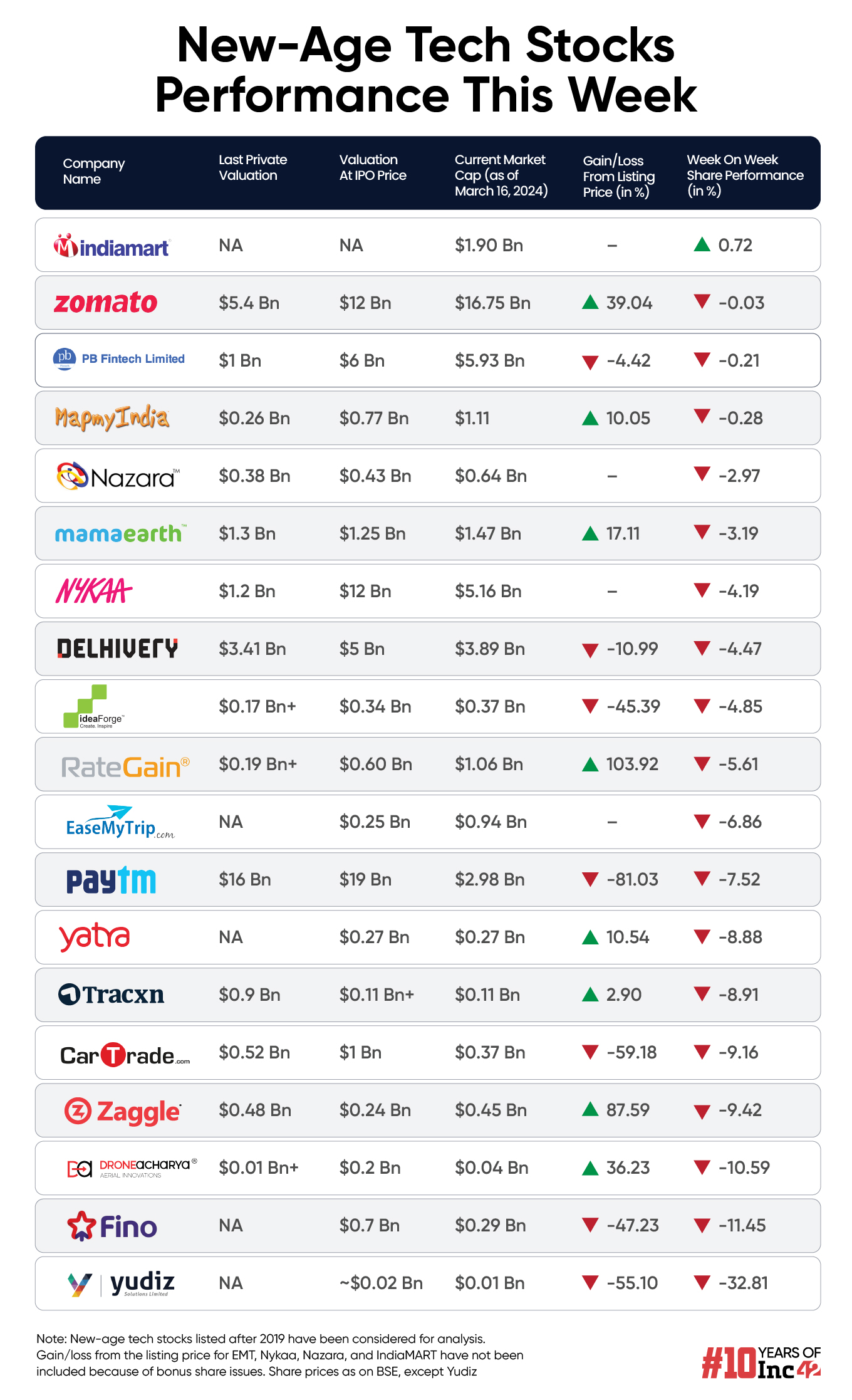

Eighteen of the 19 new-age tech stocks fell in a range of 0.03% to a massive 33% this week, with Yudiz emerging as the biggest loser

IndiaMART InterMESH was the only gainer this week, rising 0.7% on the BSE

In the broader market, Nifty50 declined 2.09% to close the week at 22,023.35, while Sensex fell 1.99% to end at 72,643.43 on Friday

Continuing the last week’s slump, Indian new-age tech stocks nosedived this week amid volatility and a major correction in the broader domestic equity market.

Eighteen of the 19 new-age tech stocks fell in a range of 0.03% to a massive 33% this week. Amid the bloodshed, IndiaMART InterMESH emerged as the only gainer this week by rising 0.7% on the BSE.

Yudiz Solutions turned out to be the biggest loser by falling 32.8%, followed by Fino Payments Bank (down 11.4%) and DroneAcharya Aerial Innovations (down 10.6%).

Besides, Zaggle and CarTrade Technologies slumped over 9% each, Tracxn Technologies and Yatra fell over 8% each, while ideaForge, Nykaa, and Delhivery declined more than 4% each this week.

Meanwhile, shares of Paytm continued to remain under pressure amid multiple new developments and fell 7.5% on the BSE.

In the broader market, the benchmark indices witnessed a volatile week, largely affected by weak global cues and concerns about rich valuations of many stocks. Nifty50 declined 2.09% to close the week at 22,023.35, while Sensex fell 1.99% to end at 72,643.43 on Friday (March 15).

Vinod Nair, head of research at Geojit Financial Services, said that unfavourable risk-reward balance of mid and small-cap stocks, fuelled by prolonged premium valuations, aggravated the downfall in the market.

“We expect bargain opportunities to persist in mid and small-cap stocks whose valuations are supported by fundamentals. In the week ahead, the global central bank’s monetary policy decision will get investors’ attention,” he said.

The US Federal Reserve, Bank of England, and Bank of Japan are set to unveil their interest rate decisions next week.

Nair said currently there is uncertainty over Fed rate cuts due to an increase in the US unemployment rate and higher-than-expected US inflation.

Overall, analysts expect the volatility to continue in the Indian equity markets in the near term.

Now, let’s deep dive into the performance of some of the new-age tech stocks this week.

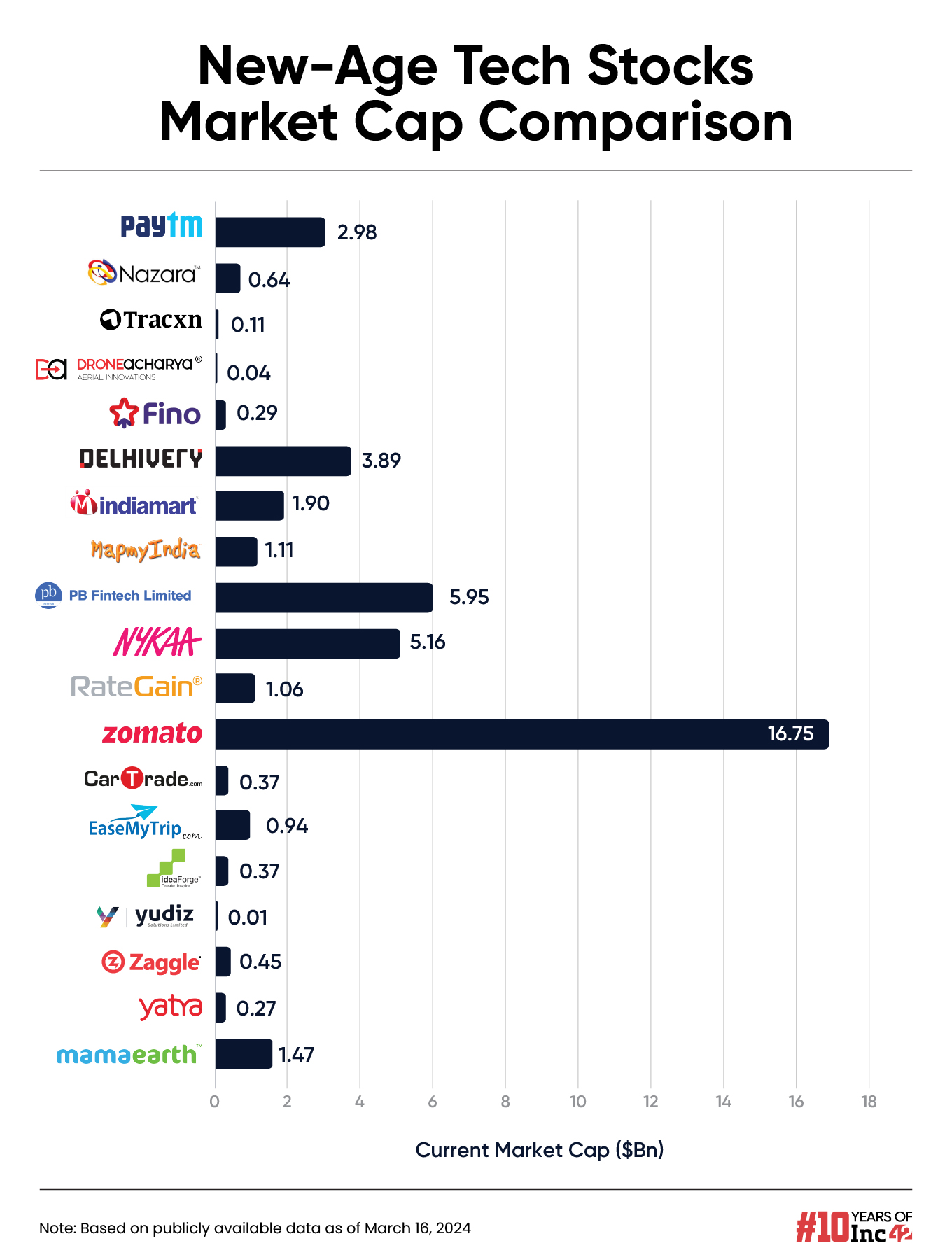

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage stood at $43.74 Bn at the end of this week as against $44.64 Bn last week and $55.49 Bn the week before.

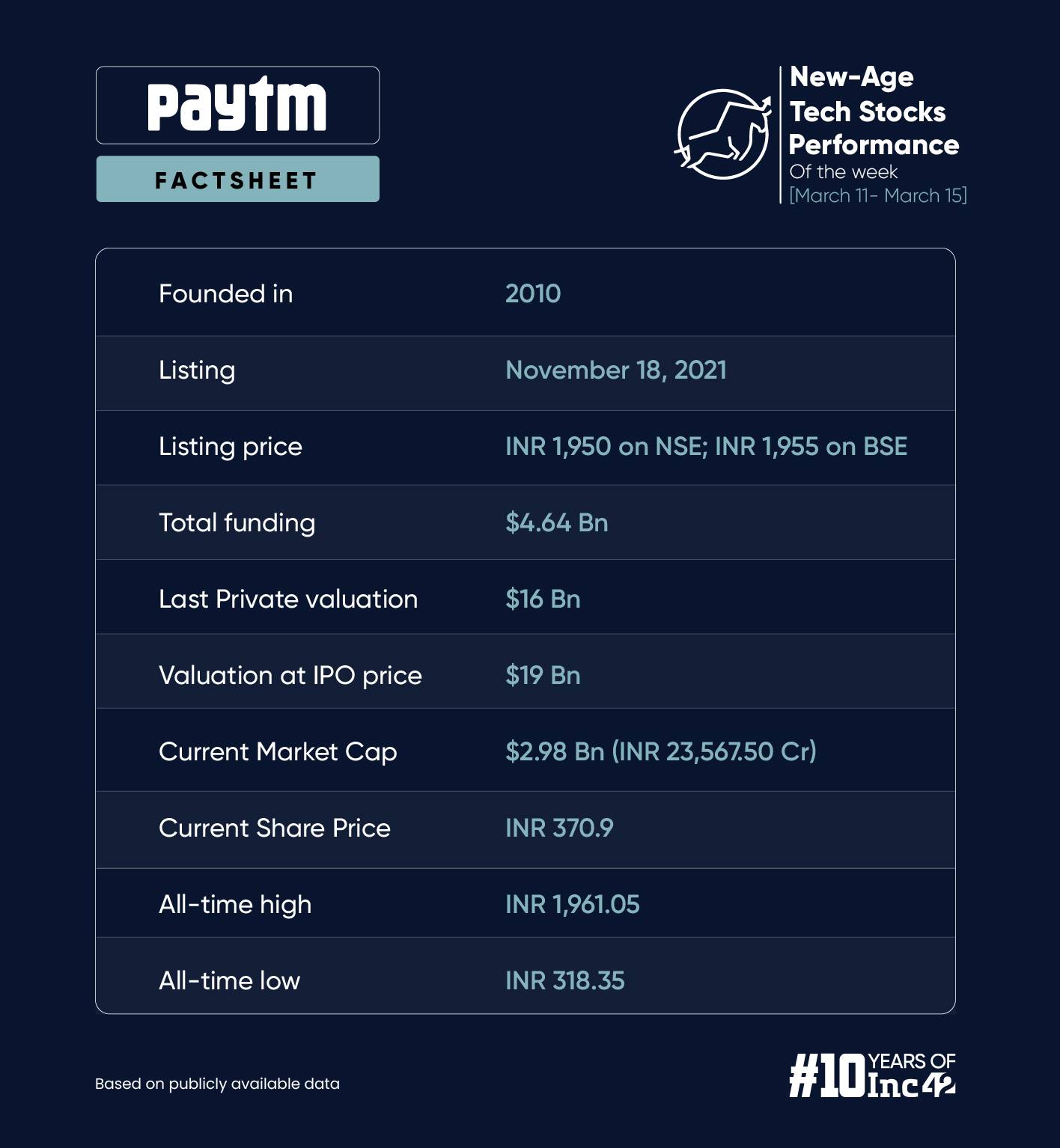

Paytm Shows No Signs Of Recovery

Shares of Paytm continued to remain volatile amid multiple developments at the fintech giant following the Reserve Bank of India’s crackdown on Paytm Payments Bank. The stock continues to face selling pressure at every major rise.

Meanwhile, the central bank’s deadline for the payments bank ended this week and the curbs are into effect now.

What’s The Update?

- Paytm secured the Third-Party Application Provider (TPAP) licence from the National Payments Corporation of India (NPCI).

- Paytm is also reportedly planning to transfer its point of sale (PoS) terminals to RBL Bank.

- Meanwhile, the National Highways Authority of India (NHAI) notified Paytm FASTag users to procure a new FASTag from another bank.

- The RBI revealed that it received 501.86 complaints per branch against Paytm Payments Bank between April 1, 2022, and March 31, 2023.

- Paytm’s parent entity One 97 Communications is likely to cut about 20% of its workforce across departments as part of its annual performance review.

Shares of Paytm sharply declined in the first three sessions of the week but gained a little in the last two trading sessions. Overall, the shares crashed 7.5% this week on the BSE.

After getting the TPAP licence from the NPCI, the stock jumped 5% to touch the upper circuit on Friday and close the week at INR 370.9 on the BSE.

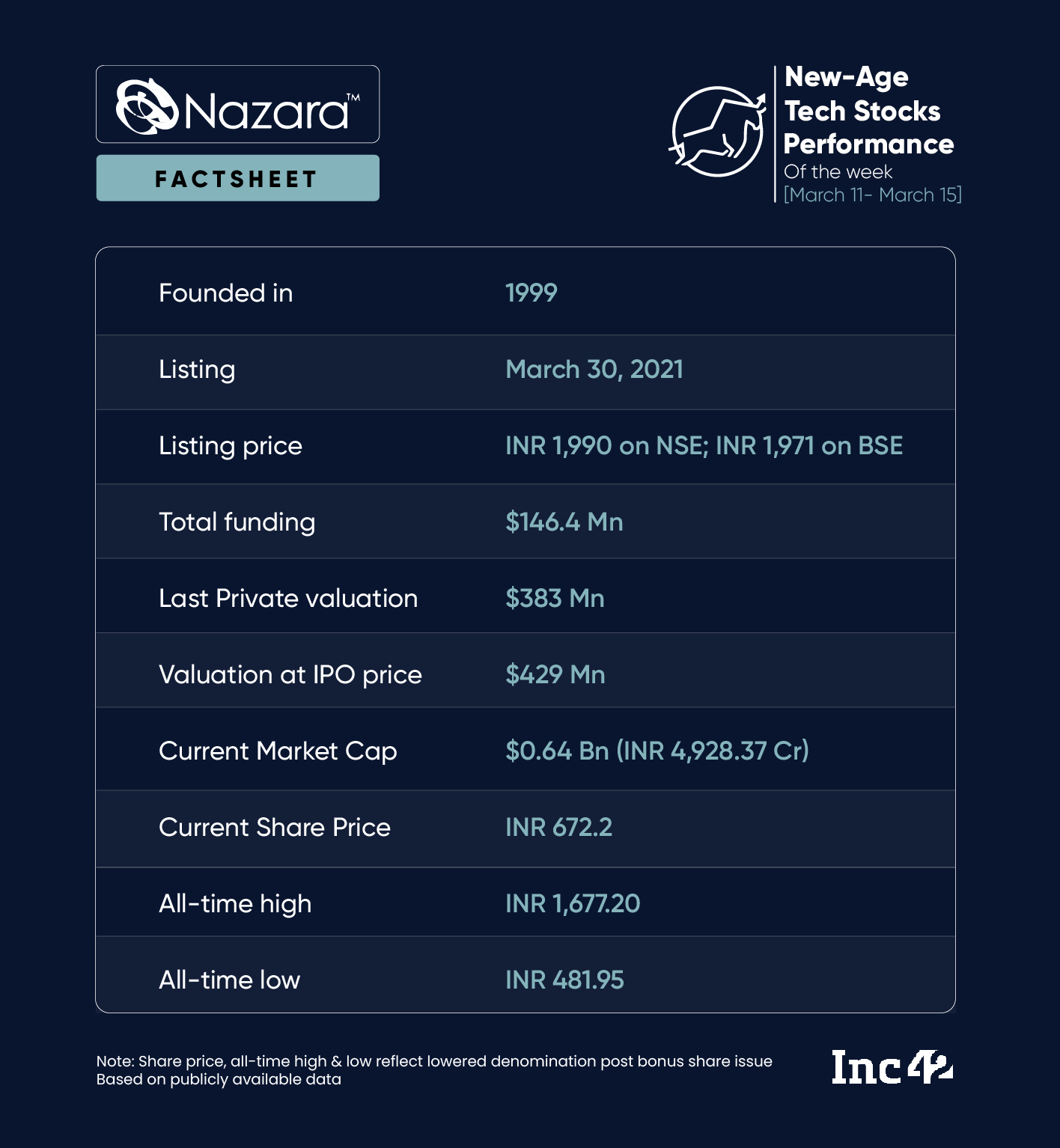

Nazara On Acquisition Mode

Gaming major Nazara Technologies said it has earmarked $100 Mn for mergers and acquisitions over the next two years in an attempt to further strengthen its global presence.

The company also said that it completed the transaction to buy a stake in influencer marketing platform Kofluence, almost a month after announcing that it received the board’s approval to acquire 10.77% stake in the company for a total consideration of up to INR 32.41 Cr.

Nazara said in its statement that it now holds 10.38% of the total equity share capital of Kofluence on a fully diluted basis.

Earlier, the company, which recently secured INR 760 Cr via a preferential allotment from investors such as Nikhil Kamath, ICICI Prudential MF, and others, told Inc42 that it was looking to use the fresh funds for organic as well as inorganic expansion.

After a significant rise last year, shares of Nazara have witnessed a massive downfall so far this year. This week, its shares slumped in the first three trading sessions but saw some improvement towards the end of the week.

Overall, the shares declined about 3% on the BSE this week. Shares of Nazara have nosedived over 30% in the last two months.

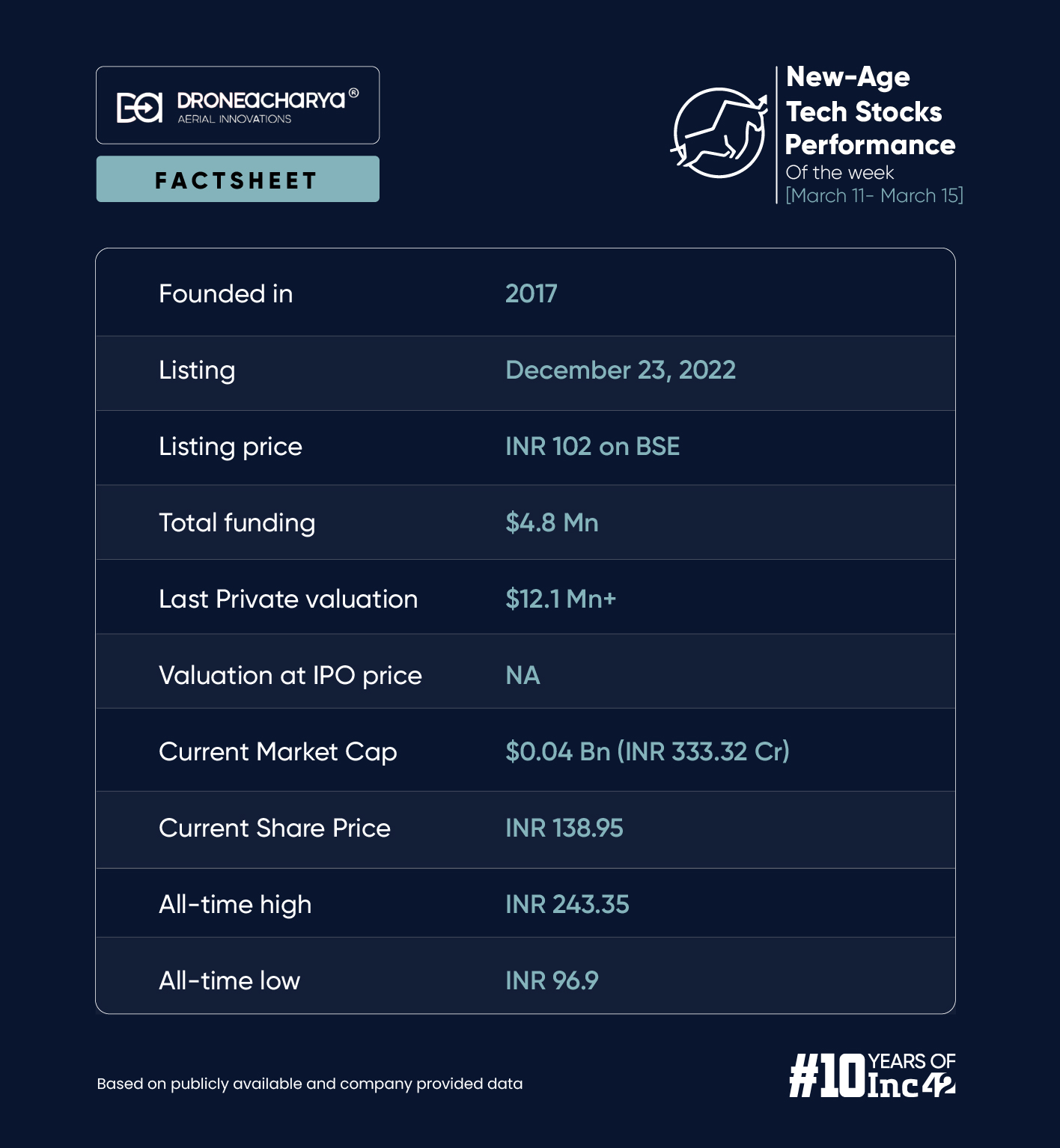

DroneAcharya Wins Major Contracts

The drone startup saw major new developments this week, including winning an order from the Adani Group for providing the Directorate General of Civil Aviation (DGCA) certified drone pilot training to the enterprise.

Besides, DroneAcharya bagged an order from Earthtree Enviro Pvt. Ltd. for the supply of the Precision Mapping System.

Enhancing its B2G collaborations further, DroneAcharya secured a contract to supply IT hardware for the Indian Army’s drone lab in Jammu and Kashmir. It also bagged the First Person View (FPV) drone pilot training contract from the Ministry of Defence, Department of Military Affairs.

The startup also said this week that it received accreditation as a DGCA-certified Medium Category Drone Pilot Training Organisation, which grants DroneAcharya legal authorisation for flying drones within the weight range of 25 kg-150 kg in crucial sectors like agricultural spraying and delivery drones.

Despite the major developments, its shares nosedived significantly in the first three trading sessions this week but gained some momentum on Thursday (March 14). Overall, the shares fell 10.6% this week on the BSE.

Ad-lite browsing experience

Ad-lite browsing experience