MeitY blocked loan apps in India over alleged links to China, impacting the likes of Prosus-backed LazyPay, Kissht, Ola’s Avail Finance, and TrueBalance

Several loan apps have faced bans on Play Store after getting blacklisted by the government since 2020

Out of INR 2,116 Cr identified as proceeds of crime by the government, INR 859.15 Cr have been attached, seized, or frozen under the PMLA

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

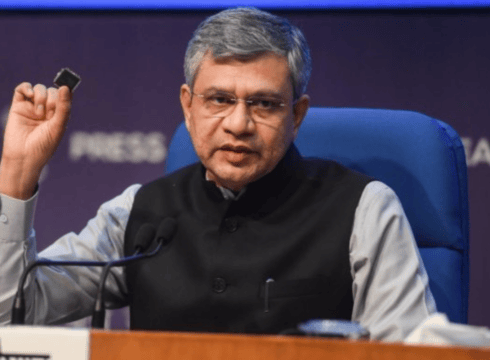

The government’s decision to ban more than 90 digital lending platforms last week is an ‘issue of national security’, Union minister Ashwini Vaishnaw said on Monday (February 13).

“It is a national security issue. I wouldn’t like to comment further on it here,” Vaishnaw told the press on the sidelines of the G20 digital economy working group meeting in Lucknow, according to a Moneycontrol report.

Starting last week, the Ministry of Electronics and Information Technology (MeitY) started blocking 138 betting and 94 loan apps in India over alleged links to China, impacting the likes of Prosus-backed LazyPay, Kissht, Ola’s Avail Finance, and TrueBalance.

Commenting on the ban last week, RBI governor Shaktikanta Das said, “We have given a list of apps which work with NBFCs to the government. On that basis, the government has taken this step.”

Within days, the MeitY revoked the ban for a few and asked internet service providers (ISPs) and Google to unblock those digital lending apps and websites, including Kissht, LazyPay, BuddyLoans, Faircent, Indiabulls Home Loans, and mPokket.

The Indian government started doubling down on its regulatory oversight of digital lending platforms last year, after receiving loads of consumer complaints – pertaining to harassment, data privacy breach, unfair business conduct, and more – against loan providers. However, since 2020 several loan apps have faced bans on Play Store after getting blacklisted by the government.

The RBI released the first set of guidelines for digital lending in August last year, which came into effect on December 1, 2022.

The government’s latest crackdown on several digital loan apps has also led to a lot of confusion and uncertainty in the fintech industry over a lack of communication, reported Inc42.

Meanwhile, the industry body Fintech Association for Consumer Empowerment (FACE) has issued a statement supporting the Centre’s actions to ban predatory lending apps with dubious antecedents.

The Finance Ministry informed the Rajya Sabha last week that the government identified around INR 2,116 Cr as proceeds of crime, as of February 7. Of these, proceeds to the tune of INR 859.15 Cr have been attached, seized, or frozen under various provisions of the Prevention of Money Laundering Act (PMLA). Besides, assets worth INR 289.28 Cr have been seized under provisions of the Foreign Exchange Management Act (FEMA).

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.