The startup is putting fresh equity worth INR 490 Cr for sale while adding another 10.5 Mn shares in an offer for sale (OFS)

The IPO will see the founder Raj P. Narayanan and the CEO Avinash Godkhindi dilute about 1.5 Mn shares of each of their holdings in the company

Zaggle saw its profit surging 54% year-on-year (YoY) from INR 19.3 Cr in FY21 to reach INR 41.92 Cr in FY22

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Mumbai-based B2B fintech startup Zaggle has filed its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for an initial public offer (IPO).

According to the draft documents, the startup is putting fresh equity worth INR 490 Cr for sale while adding another 10.5 Mn shares in an offer for sale (OFS). The total value of the offer has not been mentioned by Zaggle in its draft documents.

The DRHP filing makes Zaggle the latest fintech startup to go public, following the likes of Paytm, Policybazaar and others. The offer listing is now subject to SEBI’s approval.

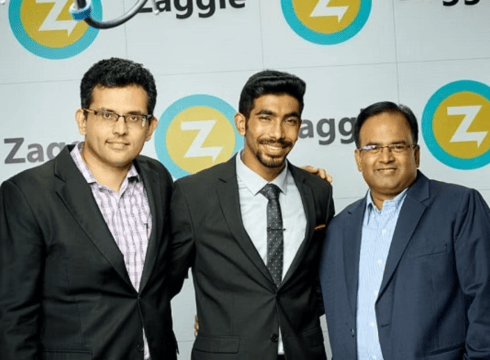

The IPO will see the founder Raj P. Narayanan and the CEO Avinash Godkhindi dilute about 1.5 Mn shares of each of their holdings in the company.

It is prudent to mention here that while the founder held 51.71% of the company, the CEO held a 9.95% stake in Zaggle. Among Zaggle’s investors, VenturEast and GKFF Ventures are also diluting their stake in the IPO. The two hold a 7.58% and 4.6% stake in Zaggle respectively.

Per the financial information provided by Zaggle in the DRHP for the IPO, its revenue from operations reached INR 371.25 Cr in FY22, up 35% from the INR 239.96 Cr it recorded in FY21. Zaggle also saw its profit surging 54% year-on-year (YoY) from INR 19.3 Cr in FY21 to reach INR 41.92 Cr in FY22.

The fintech startup, founded in 2011, saw the majority of its income coming from Program Fees, the Zaggle Propel platform revenue and Zaggle Save and other gift cards it offers. In total, these three verticals accounted for INR 354.63 Cr in FY22.

Almost 96% of Zaggle’s revenue in FY22 was from these three verticals, with SaaS fees from Zaggle Zoyer, its spend management software, making up the rest.

Incidentally, Zaggle acquired a mobile payments solution Click&Pay in 2018, intending to build an expense management and automation platform of its own. The 25-member Click&Pay team had joined Zaggle as part of the deal and the fintech startup launched the platform, Zaggle Zoyer, in 2022.

According to the startup’s website, it has issued 45 Mn prepaid cards since first launching the offering, along with around 1,750 customers and 1.7 Mn users.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.